Twenty-year-old Eric Mun didn’t want to believe it: Only one kid in the family could make it to medical school — and it wasn’t going to be him.

Mun had done everything right. He graduated high school with honors, earned a scholarship at Northwestern University and breezed through his biology courses.

He immigrated to Alabama from Korea as a toddler. From the quiet stretches of the South, he dreamed of helping patients in a pressed white coat.

But dreams don’t pay tuition. And with new borrowing limits, Mun’s family can only support one child through school.

“My parents already implied that my older brother is probably going to be the one that gets to go,” Mun said.

President Donald Trump’s sweeping “big, beautiful” tax and spending bill, signed into law earlier this month, imposes strict new caps on federal student loans, capping borrowing for professional schools at $50,000 per year. The measure particularly affects medical students, whose tuition often exceeds $300,000 over four years.

Aspiring physicians like Mun have been thrown into financial uncertainty. Many members of the medical community say the measures will send shock waves through a system already laden with economic barriers, discouraging low-income students from pursuing a medical degree.

“It might mean there are people who want to be doctors that can’t be doctors because they can’t afford it,” said Richard Anderson, president of the Illinois State Medical Society.

Before the passage of Trump’s budget bill, the Grad PLUS loan program allowed graduate students to borrow their institution’s total cost of attendance, including living expenses. The program was slashed as part of a broader overhaul to the federal student loan system.

Now, beginning July 1, 2026, most graduate students will be capped at $20,500 in federal loans per year, with a total limit of $100,000. Students in professional schools, like medical, dental or law school, will face the $50,000 annual cap and a total limit of $200,000.

Mun’s parents work at an automobile assembly plant. Throughout high school, he knew he would have to rely on scholarships and federal loans to pay his way through college.

Mun’s voice faltered. “I’m just trying to remain hopeful,” Mun said.

Also folded into the bill: the elimination of several Biden-era repayment plans, cuts to Pell Grants and limits to the Parent PLUS loans program, which allows parents of dependent undergraduates to borrow.

Proponents of the Republican-backed bill said the curbed borrowing will incentivize medical schools and other graduate programs to lower tuition. The tuition of most Chicago-area medical schools is nearly $300,000 for four years, not including cost-of-living expenses.

Northwestern University’s Feinberg School of Medicine has a $465,000 price tag after accounting for those indirect costs, according to the school’s website. Rosalind Franklin University of Medicine and Science trails closely behind at nearly $464,000.

“One of the main concerns about the Grad PLUS program is money that is going to subsidize institutions rather than extending access to students,” said Lesley Turner, an associate professor at the University of Chicago Harris School of Public Policy.

Still, many medical professionals expressed doubt that schools will adjust their costs in response to the bill. Tuition for both private and public schools has been steadily climbing for decades, up 81% from 2001 after adjusting for inflation, according to the Association of American Medical Colleges.

There’s some evidence that Grad PLUS may have contributed to those tuition hikes. A study co-authored by Turner in 2023 found that prices increased 65 cents per dollar after the program’s introduction in 2006. There was also little indication that Grad PLUS had fulfilled its intended goal of expanding access to underrepresented students.

But Turner cautioned against the abrupt reversal of the program. After accounting for inflation, the lifetime borrowing limits now placed on graduate students are lower than they were in 2005, she said. Many students may turn to private loans to cover the gap, often at higher interest rates.

More than half of medical students relied on Grad PLUS loans, according to AAMC. The median education debt for indebted medical students is around $200,000, with most repayment plans lasting 10 to 20 years. The median stipend for doctors’ first year post-MD was just $65,100 in 2024.

“I think for many reasons, it would have been reasonable to put some sort of limit on Grad PLUS loans, but I think this is a very blunt way of doing it,” Turner said.

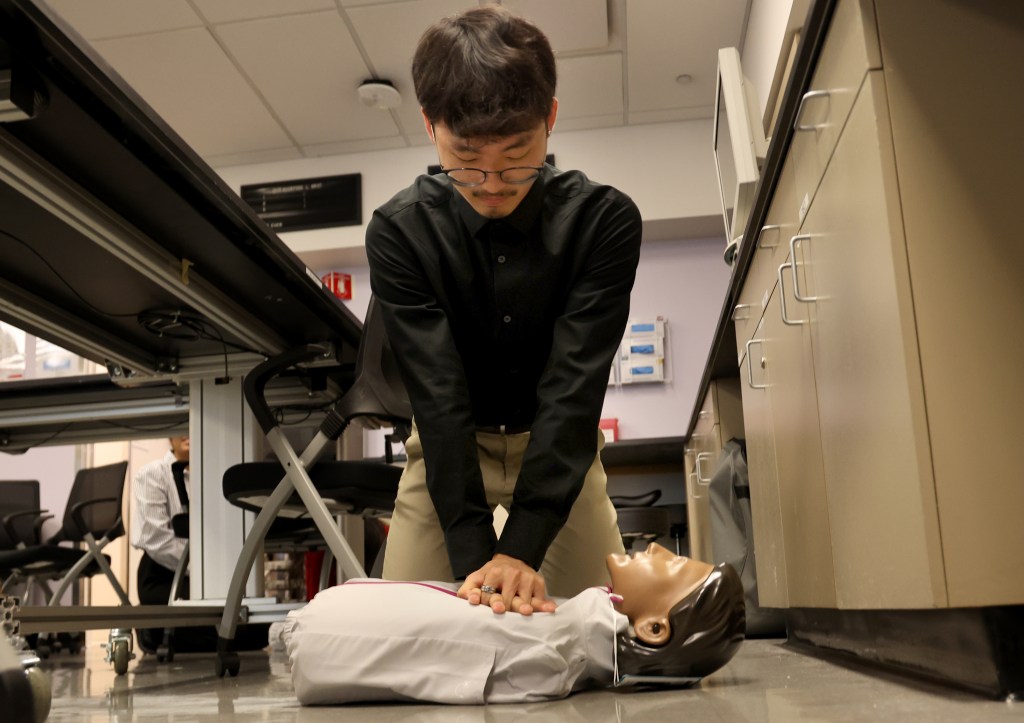

In a high-rise on Northwestern’s downtown campus last week, 20 undergraduate students and alums from local colleges gathered for the Chicago Cancer Health Equity Collaborative Fellows program. The eight-week summer intensive offers aspiring medical professionals a deep dive into cancer health disparities information and research. Participants like Mun have been left reeling after the flurry of federal cuts.

Alexis Chappel, a 28-year-old graduate of Northeastern Illinois University, watched her dad struggle with addiction growing up. She was deeply moved by the doctors who supported his recovery, and it inspired her to pursue medicine. But she has no idea how she’ll cover tuition.

“I feel like it’s in God’s hands at this point,” Chappel said. “I just felt like it’s a direct attack on Black and brown students who plan on going to medical school.”

Just 10% of medical students are Black and 12% are Latino, according to AAMC enrollment data. Socioeconomic diversity is also limited: A 2018 analysis found that 24% of students came from the wealthiest 5% of U.S. households.

Tricia Pendergrast, who graduated from Feinberg in 2023, relied entirely on Grad PLUS loans to fund her medical education. Juggling classes and clinicals, she had little money saved and no steady stream of income. Pendergrast was so strapped for cash that she enrolled in SNAP benefits — a program also cut under Trump’s budget bill.

Now an anesthesiologist at University of Michigan Health, she’s documented her concerns on TikTok for her 48,000 followers.

“It’s not going to improve representation, and it’s not going to improve access,” Pendergrast said. “It’s going to act as a deterrent for people who otherwise would be excellent physicians.”

For low-income students, the application process is already fraught with economic obstacles, Pendergrast said. Metrics like GPA and the Medical College Admissions Test, or MCAT, are heavily weighted in admissions, and may disadvantage students from underresourced schools. Many students also lack mentorships or networks to guide them through the process, she noted.

“I think the average medical student is going to be richer and whiter, and not from rural areas and not from underserved communities,” Pendergrast said.

The elimination of Grad PLUS loans comes amid a mounting nationwide physician shortage. A recent AAMC report predicted a shortfall of 86,000 physicians by 2036. Meanwhile, a significant portion of the workforce is poised to enter retirement: The U.S. population aged 65 and older is expected to grow 34.1% over the next decade.

The shortage is particularly concentrated in primary care. In practice, that means longer waiting times for patients, and an increased caseload on physicians, who may already suffer from burnout.

“If the goal is truly to make America healthy again, then we need to have a strong physician workforce … We should be coming up with ideas to make it more accessible for people who want to be doctors as opposed to hindering that,” Anderson said.

Sophia Tully, co-president of the Minority Association of Pre-Med Students at Northwestern, said she and her peers have struggled to reconcile with a system that often feels stacked against them. The 21-year-old plans on taking an extra gap year before medical school in an effort to save money.

Tully summed up the environment on campus: “For lack of a better word, people are panicking.”