Millions of Americans are at risk of losing their Social Security benefits as student debt follows them into their golden years.

According to a report from the New School Schwartz Center for Economic Policy Analysis, roughly 2.2 million Americans over the age of 55 have outstanding student loans. And if your loans fall into default, your Social Security retirement benefits can be lowered.

Read more: Checking Account vs. Savings Account: Which is Best for You?

Older Americans already represent the highest proportion of student loan borrowers, at 43 percent, the report says.

The Social Security Administration currently garnishes Social Security benefits to a certain point if seniors haven’t paid back their federal loans.

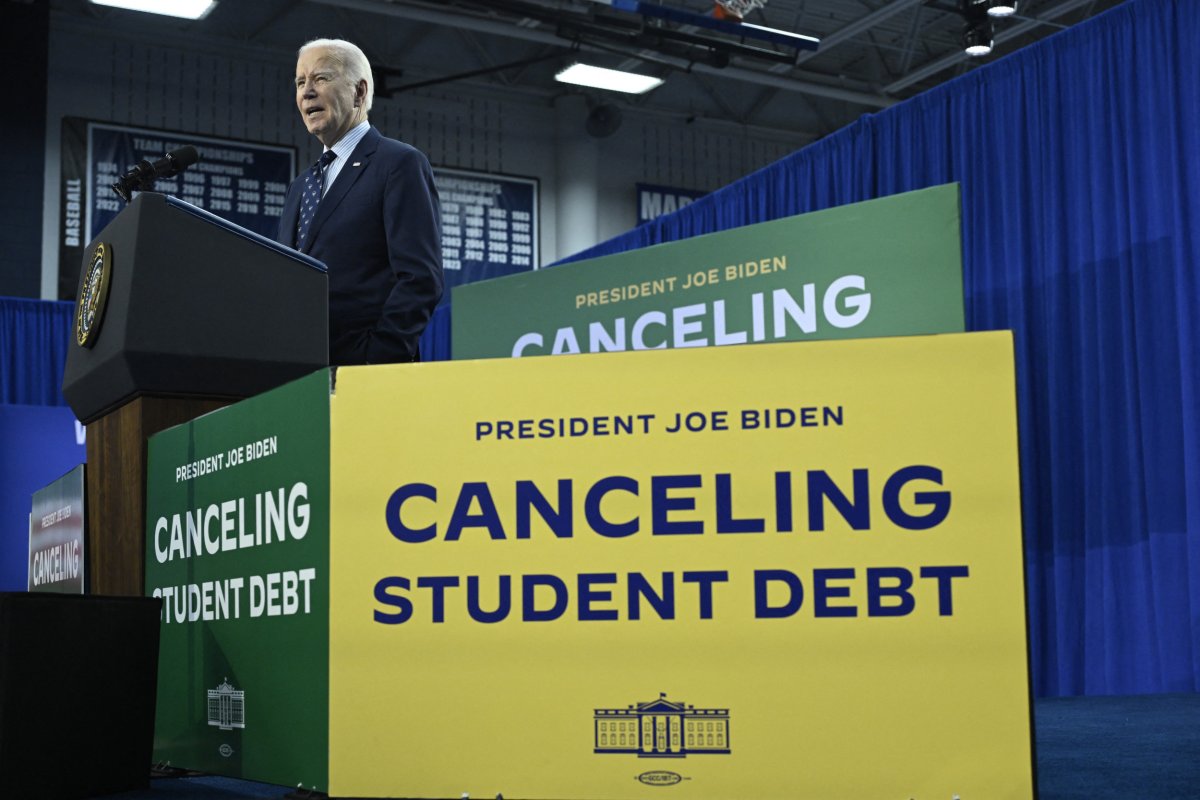

ANDREW CABALLERO-REYNOLDS/AFP via Getty Images

Experts say because of this, Americans should avoid going into default at all costs.

Fortunately for borrowers, there are some student debt resources available that weren’t around in previous decades.

Read more: Student Loan Forgiveness Updates and FAQs

Under the Biden administration, the SAVE income-driven repayment plan was approved, allowing longtime borrowers to get reduced monthly payments or even full forgiveness.

“The sad part about this situation is that even though Social Security benefits are at risk, the reality is that this problem is completely avoidable,” Michael Lux, an attorney and the founder of the Student Loan Sherpa, told Newsweek. “Borrowers who live on Social Security can often qualify for $0 per month student loan payments. These $0 payments can continue indefinitely and eventually qualify for student loan forgiveness.”

The issue for many older American borrowers, though, is the number of hoops they have to jump through to access the lower payments or all-out forgiveness, Lux added.

Read more: Federal PLUS Student Loans Review

“I’d encourage any senior with federal student loans to investigate income-driven repayment options, specifically the SAVE program,” Lux said. “It’s a great tool to ensure that student debt doesn’t destroy your retirement. Those with Parent PLUS loans can even get enrolled on SAVE if they take advantage of the double-consolidation loophole.”

Currently, the federal government is able to garnish up to 15 percent of a borrower’s Social Security benefits if in default, and the average delinquent borrower sees $2,500 taken away from their Social Security income yearly, which can quickly lower their overall quality of life as food, housing and health care costs remain inflated.

“If you find yourself in this situation, don’t panic,” Michael Ryan, a finance expert and the founder of michaelryanmoney.com, told Newsweek. “You can avoid or stop garnishment by getting your loans out of default.”

Ryan also encouraged Americans to look into income-driven repayment plans but anticipates Social Security garnishment will become more common in the years ahead.

“More and more Americans enter retirement with student debt,” Ryan said. “The Biden administration’s proposed debt relief plan could help, but it’s not a complete solution.”

Kevin Thompson, another finance expert and the founder and CEO of 9i Capital Group, said a revamp of the system is majorly needed.

“I truly believe there are a number of people paying into the system that have paid more than the original loan amount,” Thompson told Newsweek. “I know it is a matter of financial knowledge and proper repayment of the debt, but the government may consider those debtors that have repaid more than the original loan amount, and thus forgive the loan.”

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.