SINGAPORE, May 21, 2025 (GLOBE NEWSWIRE) — HTX, a leading global cryptocurrency exchange, unveiled its next-generation “Crypto Loans 2.0” product on May 19. This enhanced version brings a refined structure and superior user experience, featuring multi-asset collateral, a smart dynamic Loan-to-Value (LTV) model, instant fund access, flexible repayment options, and zero fees. To mark this significant launch, HTX has rolled out two exclusive promotions: “Borrow & Earn” #7, where users can share a massive 5,000,000,000 $HTX prize pool, and the “Millions in Rewards Plus Margin Power-up” event, which provides BTC loan interest rates as low as 0.09% and an extra 10% discount on USDT loans.

Unlock Multiple Benefits with HTX Loan Products

To celebrate the grand launch of Crypto Loans 2.0 and commemorate the 15th anniversary of Bitcoin Pizza Day, HTX is simultaneously launching “Borrow & Earn” #7 and an exclusive limited-time margin promotion, delivering substantial rewards to our valued users.

“Borrow & Earn” #7 runs from May 19 at 02:00 (UTC) to June 2 at 15:59 (UTC), featuring a total prize pool of 5,000,000,000 $HTX. Users simply need to borrow USDT using the Crypto Loans Flexible product during the event to earn a share of the $HTX prize pool, based on the interest paid – the more interest paid, the greater the rewards. Rewards will be credited to winners’ Spot accounts within 7 working days after the event ends.

Concurrently, HTX has launched an exclusive margin promotion, “Millions in Rewards Plus Margin Power-up”, active from May 20 at 10:00 (UTC) to June 2 at 10:00 (UTC). For a single USDT loan of $1,000,000 or more, users can enjoy an extra 10% interest rate discount! This brings the annual interest rate down to as low as 3.9% (or 0.01% daily). There is no limit on borrowing frequency and each qualifying loan benefits from this generous discount.

Don’t miss the Pizza Day 15th Anniversary Bonus! During the event, the top 10 users by cumulative loan volume will share 264,000,000 $HTX (worth $500). Register via the provided link to participate. Leverage these ultra-low interest rates to maximize potential returns and aim for substantial gains.

Optimized Borrowing Experience with Multi-Asset Collateral

Loan efficiency and asset liquidity have always been two major user-focused concerns. As a key highlight of this upgrade, HTX’s “Crypto Loans 2.0” introduces a multi-asset collateral mechanism, supporting over 20 mainstream cryptocurrencies as collateral assets, including USDT, BTC, ETH, TRX, DOGE, XRP, SOL, and AVAX. This significantly boosts users’ asset utilization efficiency.

To further enhance the borrowing experience, HTX has expanded its loanable assets to include SOL, TON, and USDC, with USDC also available as a collateral option. Unlike the traditional single-asset collateral model, the multi-asset collateral mechanism allows users to unlock liquidity from their holdings while effectively reducing the risk of forced liquidation due to single-asset volatility.

Another standout feature of this upgrade is HTX’s limited-time offer: an ultra-low 0.09% annual interest rate for BTC Flexible Loans, with borrowing limits up to 100 BTC. This remarkable rate represents a 555-fold reduction from the previous annual rate of over 5.0%, making it an exceptional deal. For example, borrowing BTC equivalent to approximately 1,000,000 USDT would incur a mere 2.37 USDT in daily interest – a truly remarkable saving.

Crypto Loans 2.0 also offers the following advantages:

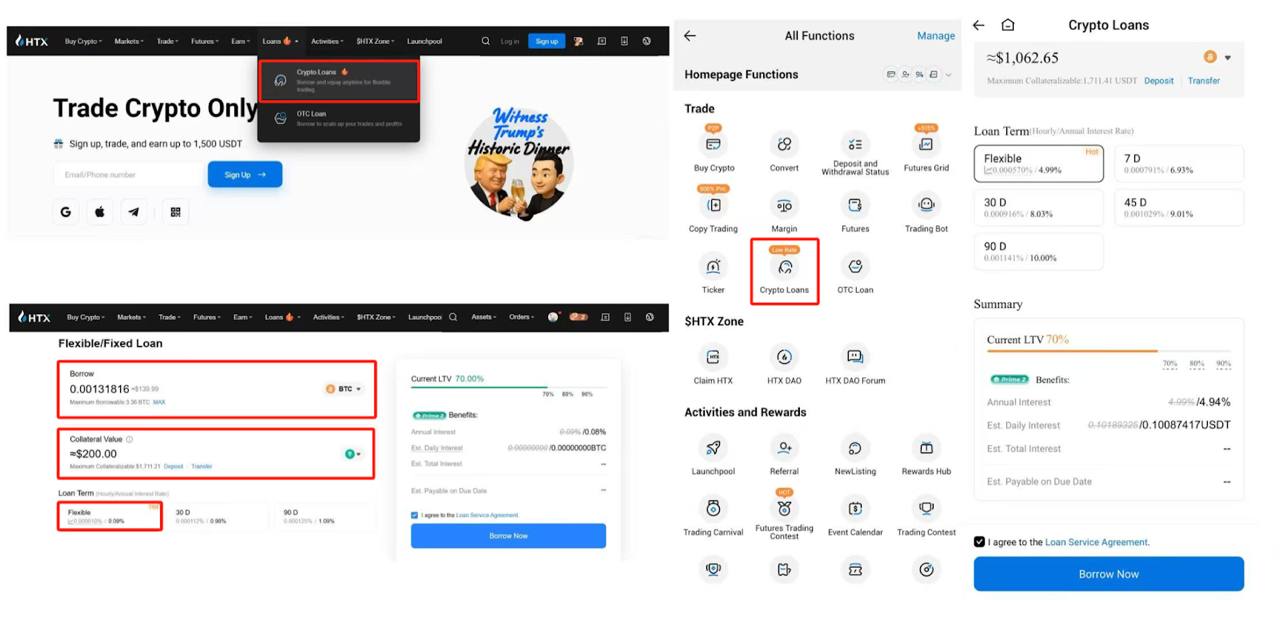

- Smart Dynamic LTV Mechanism: Interest rates adjust in real time based on market conditions, ensuring industry-leading competitiveness. Annualized interest rates for Flexible Loans include 3.9% for USDT, 2.4% for ETH, and as low as 0.09% for BTC.

- Flexible Term Options: Supports flexible configuration for both flexible and fixed terms (7/30/45/90 days).

- Instant Fund Access & Flexible Repayment: Borrowed funds are delivered instantly, interest accrues every hour, and users enjoy the freedom to repay at any time, ensuring optimal fund efficiency.

- Institutional-Grade Risk Control: Supports overcollateralized loans with leverage capped under 1X and tiered liquidation to safeguard accounts. Users retain all remaining collateral assets.

- Personalized 1-on-1 VIP Service: Delivers customized loan limits, flexible currency selections, and special discounted interest rates for SVIP users.

Crypto Loans 2.0 is now live! Users can access it via the HTX website by clicking “Loans” > “Crypto Loans”, or through the HTX App by tapping “More” > “Crypto Loans”. Here’s how to get started:

HTX’s Crypto Loans 2.0 leads the industry with its ability to boost capital efficiency, lower liquidation risk, provide flexible investment options, and allow multi-asset collateral. Moving forward, HTX will continue to enhance its lending products, pushing the platform’s financial services toward greater efficiency, lower barriers, and broader diversification. Try Crypto Loans 2.0 now to enjoy seamless borrowing, ultra-low interest rates, and access to massive prize pools. Make every digital asset your strategic liquidity advantage on the road to financial freedom.

About HTX

Founded in 2013, HTX has evolved from a virtual asset exchange into a comprehensive ecosystem of blockchain businesses that span digital asset trading, financial derivatives, research, investments, incubation, and other businesses.

As a world-leading gateway to Web3, HTX harbors global capabilities that enable it to provide users with safe and reliable services. Adhering to the growth strategy of “Global Expansion, Thriving Ecosystem, Wealth Effect, Security & Compliance,” HTX is dedicated to providing quality services and values to virtual asset enthusiasts worldwide.

To learn more about HTX, please visit HTX Square or https://www.htx.com/, and follow HTX on X, Telegram, and Discord.

For further inquiries, please contact Ruder Finn Asia ,[email protected].

Disclaimer: This is a paid post and is provided by HTX. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice.Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector-including cryptocurrency, NFTs, and mining-complete accuracy cannot always be guaranteed.Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility. Globenewswire does not endorse any content on this page.

Legal Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/14b88ed3-a6c4-4385-a159-c4c19897c5fe

https://www.globenewswire.com/NewsRoom/AttachmentNg/890afb12-c1fa-4228-aace-ec265f82d5c3