Key takeaways:

- Processing for the PSLF program is paused through July to work on updating the Department of Education’s system.

- The PSLF and TEACH programs will move to the Department of Education to manage. However, your loans will still be managed by an approved loan servicer.

- Some borrowers may be moved from MOHELA to a new servicer.

- Borrowers should continue to make monthly payments during this pause.

- The Department of Education will not process forgiveness applications during this time. But borrowers eligible for forgiveness during the pause should still submit their PSLF forms.

After several years of dizzying loan servicer changes and debt relief program overhauls, the Public Service Loan Forgiveness program is being moved in-house for the Department of Education to manage. But not before throwing one more curveball at teachers, nurses and public service workers.

The Department of Education has paused processing debt relief applications for borrowers in the PSLF and TEACH programs. This pause is expected to last through July, with processing resuming later this summer. That means borrowers in these programs who become eligible for forgiveness during the pause will have to hold tight until the processing freeze is over.

This delay will give the Department of Education time to move PSLF and TEACH accounts to StudentAid.gov. Later in 2024, Federal Student Aid plans to simplify the login process, requiring only your FSA ID to access both your loan and forgiveness program accounts.

“This pause allows the ED to update their systems and prepare for the influx of borrowers from [loan servicer] Mohela, minimizing potential disruptions or errors during the transfer process,” said Bill Townsend, CEO of College Rover.

In the meantime, you’ll still need to make monthly payments with your current loan servicer, but don’t be surprised if your payment counts look off.

“It is crucial for borrowers to continue making payments unless otherwise instructed.”

There’s plenty of confusion to unpack regarding the PSLF processing pause. Here’s what you need to know about what this freeze means for your loan payments, whether you’re getting a new loan servicer and what to do if you qualify for debt relief during the pause.

What’s happening with the Public Service Loan Forgiveness program?

The PSLF program has been plagued with problems since it launched in 2007. Designed to help teachers and public service workers achieve debt relief, borrowers found it was nearly impossible to get approved for loan cancellation. Prior to the 2021 expansion, almost 99% of borrowers who had applied since 2008 were denied.

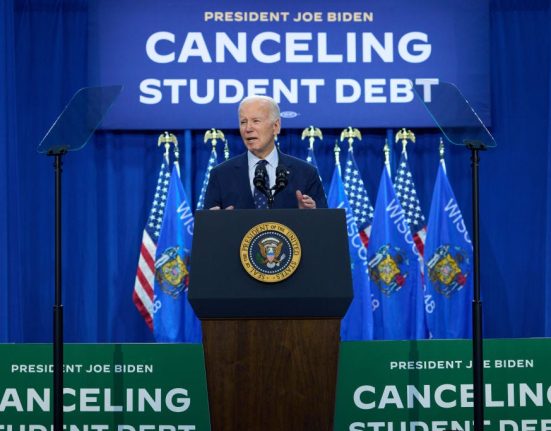

In October 2021, the Biden administration introduced an expanded temporary waiver designed to provide relief to borrowers who were previously turned down by the program. The Department of Education also made permanent changes to the program in 2023 to allow more flexibility for borrowers.

Since these changes have been implemented, the administration has forgiven more than $68 billion in student loans for more than 942,000 borrowers in the PSLF program.

The work being done during the processing pause is intended to help streamline student loan accounts to make it easier for borrowers to access their payment counts and apply for forgiveness, said Elaine Rubin, a higher education finance and policy expert and director of corporate communications for Edvisors.

“The US Department of Education has been working on their Next Gen servicing initiative, aimed at streamlining the student loan repayment process across all federal loan servicers,” Rubin said. “One of the initial borrower-facing phases of this initiative involves transitioning federal loan servicers to a new platform, enhancing the overall borrower experience.”

Is my student loan servicer changing?

If you’re working toward loan forgiveness in the PSLF or TEACH programs, you may be moving to a new student loan servicer. Right now loans for borrowers in these programs are managed by student loan servicer, MOHELA. Some borrowers may be transferred from MOHELA to a different loan servicer.

“Not all borrowers will be transferred,” Rubin said. “Only those who receive notification of a transfer to a new federal student loan servicer will have a new servicer.”

The Department of Education is moving the management of the PSLF and TEACH programs in-house, said Mark Kantrowitz, financial aid expert and CNET Money expert review board member. But your loans will still remain with a loan servicer.

To add more confusion to the mix, MOHELA is also transitioning to a new loan servicing platform. If MOHELA remains your loan servicer, expect a notification explaining the move from its current platform to an upgraded one, Rubin said.

MOHELA, which previously served as the sole loan servicer for borrowers in the PSLF program, was penalized in October 2023 by the Department of Education for failing to send on-time billing statements to over 800,000 borrowers, which caused loan delinquencies.

Why do my student loan payment counts look wrong?

If your payment counts look off, don’t panic. During the student loan processing pause, you may not see updated payment counts, and your total count may not be correct.

“Borrowers shouldn’t worry if their qualifying payment counts are incorrect during the pause,” Kantrowitz said. “Everything will be updated by the end of the pause.”

If you have screenshots of your payment counts from before May 1 when the processing pause started, they may come in handy if there are any discrepancies after the pause is lifted. However, if you didn’t take screenshots, you likely won’t be able to access your payment counts until the transition is complete.

“The ED is working to migrate data accurately, and any discrepancies will be addressed once the transfer is complete and processing resumes,” Townsend added.

In the meantime, if any other figures look off in your student loan account, Rubin suggests picking up the phone. “If the account balance or monthly payment looks incorrect, it’s best for the borrower to reach out to their student loan servicer.”

Although your updated counts may show in your account after the PSLF processing pause ends in July, the broader payment count adjustment currently happening for all qualifying federal student loans may delay your payment counts until this fall.

Why are payment counts getting adjusted?

The Department of Education is reviewing federal student loan past payment counts to ensure you’re receiving full credit for your loan payments. This review could help maximize relief for any federal student loans that have been in repayment for enough time to qualify for forgiveness programs.

Since not all federal loan types were previously eligible for forgiveness programs, borrowers with ineligible loan types — Perkins, HEAL or commercially-managed FFEL loans — can consolidate them into a new federal Direct Loan that is eligible for debt relief options.

For example, if you have a federal loan that wasn’t previously eligible for the PSLF program, consolidating it into a new Direct Loan before June 30 could help you ensure all your loans are eligible for forgiveness.

Borrowers have until June 30 to consolidate their loans in order to potentially maximize their forgiveness. This could also help you qualify for full relief sooner if you have multiple student loans with different repayment timelines. If you consolidate after June 30, however, your payment count may reset to zero.

Do I have to pay my student loans during the processing pause?

Yes, you still need to make student loan payments to your current servicer during the processing pause. “It is crucial for borrowers to continue making payments unless otherwise instructed,” Rubin said.

Not making payments during the processing pause could hurt your chances of getting debt relief. “Failure to do so could result in delinquency or default, which could negatively impact credit scores and eligibility for future loan forgiveness programs,” said Townsend.

If you’re getting a new servicer, you might be worried about where to send your payment. But you’ll be notified in advance if you need to make any payment changes.

“Borrowers transferring to a new servicer will receive instructions on how to submit payments in their transfer notice,” Rubin added.

Consider keeping a record of the student loan payments you make during the processing pause in case you notice any errors on your account once the payment count review is complete.

What if I qualify for student loan forgiveness while processing is on hold?

If you reach the total number of payments required to forgive your debt during the processing pause, you have a few options.

First, you can keep paying your student loan bill each month and wait for a refund for the amount you overpaid. For example, if you need to make 120 qualifying payments as part of the PSLF program and you make 122 payments, you should receive a refund for the two additional payments, according to Federal Student Aid.

Secondly, if you’re certain you’ve reached your required number of payments during the processing pause, you can also apply for forbearance to avoid making unnecessary monthly payments.

“If a borrower is certain that they will qualify for forgiveness during the pause, they can ask their loan servicer for a forbearance. But, if they don’t actually qualify for forgiveness, interest may accrue during the forbearance, and the forbearance will not count as a qualifying payment,” Kantrowitz added.

Your payment count information may not be accurate during the processing pause, which can make it difficult to determine if you’ve reached the correct number of qualifying payments. If you’re not 100% certain of your payment count, it may be safer to continue to pay your loans and wait for a refund.

Can I submit PSLF forgiveness forms during the pause?

Yes, if you reach 120 qualifying payments during the pause, you can submit your PSLF forms for debt cancellation now.

“It’s best to submit the form as soon as you believe you qualify,” said Rubin. “While the form will not be processed until the transition is completed in July, it will be in the queue.”

If you have already submitted your PSLF forms or if you submit them during the pause, the Department of Education says you should not resubmit them when processing restarts later this summer. Doing so could delay your debt relief.

You can submit PSLF forms online using Federal Student Aid’s PSLF Help Tool.

What if my payment counts are incorrect after processing resumes?

During the processing pause, your loan servicer won’t be able to answer any questions about your payment counts, according to the Federal Student Loan website. But after processing resumes, your payment counts should update.

However, there’s a chance updated counts may be delayed, since the Department of Education is undergoing a more widespread payment count that’s expected to be complete on Sept. 1.

“The payment count adjustment might not happen until the fall,” Kantrowitz said. So you may need to wait a few extra months for accurate counts to come in.

If your payment counts still look wrong after the adjustment, contact your loan servicer or submit a complaint with Federal Student Aid. You also may need to submit a PSLF reconsideration request, Rubin added.