Key Takeaways

- The best personal loan providers have minimum annual percentage rates around 7% to 8%, offer loan amounts of up to $100,000 and don’t charge origination fees.

- Our recommended lenders generally offer fast funding, with some providing same-day funding.

- Among the 1,000 personal loan borrowers the MarketWatch Guides team surveyed, the average credit score was 689, and the average loan amount was $14,366.48.

The best personal loans put money in your account within days and have way lower interest rates than credit cards. They can be also used for just about anything, including debt consolidation or home renovations.

To help you find the best loan for your needs, the MarketWatch Guides team analyzed 37 of the country’s top personal loan lenders based on their rates, fees and features.

The Best Personal Loan Companies of April 2025

APR Range

6.49% to 25.29%

Funding Speed

As soon as the same day

Loan Amount

Up to $100,000

LightStream’s personal loans of up to $100,000 can be used for just about anything but higher education. It offers low interest rates, along with repayment terms of two to seven years, depending on the loan type. Plus, it offers same-day funding (based on when your application is submitted and approved) and no prepayment penalties if you’re able to pay your loan off early.

Other notable perks include a best-rate guarantee, a loan-experience guarantee (where LightStream will give you $100 if you’re not completely satisfied with your loan) and an autopay discount of 0.50%.

As a downside, LightStream doesn’t offer loan prequalification. You’ll need to apply — which involves a hard credit check — to see which rate you’ll be offered based on your credit profile. Also, LightStream only approves people with good-to-excellent credit scores.

Best interest rates guaranteed: LightStream’s Rate Beat program guarantees an unsecured personal loan rate that’s 0.10 percentage points lower than any competitor’s approved loan offer.

Same-day funding: You may receive your funds the same day you’re approved — our MarketWatch Guides teammate received funds within 24 hours of applying for a LightStream loan.

Autopay discount: If you enroll in autopay before your loan is funded, you’ll get 0.50% off of your rate.

Higher credit score needed to qualify: You’ll need several years of credit history to qualify and a good-to-excellent credit score to get the lowest rates.

No preapproval: LightStream doesn’t offer prequalification, so you’ll have to apply to see the interest rate you’ll qualify for.

Our MarketWatch Guides teammate applied for a boat loan from LightStream and shared his experience with our research team.

“Approval was not automatic,” he said. “I thought that applying for a loan online would give me immediate approval. I completed the application at 3:30 p.m. and got the approval notification at 9:56 p.m. Overall, the process was clear and straightforward.”

Most Praised Features

- Easy loan application process: Many positive reviews praised LightStream for having a quick and easy loan application process. Several reviewers mentioned how user-friendly the site was and how fast approvals happened (sometimes on the same day).

- Competitive interest rates: Some positive reviews highlighted great interest rates, especially if you have an excellent credit score.

Most Common Complaints

- Customer service issues: Many of the negative reviews focused on poor customer service. Customers expressed frustration with long wait times, unhelpful representatives and account management challenges around loan terms or payments.

- Loan denials: Some reviewers complained that their loans were denied despite excellent credit scores and solid credit histories. A few reviews highlighted how they felt misled when they were preapproved but then denied for final loan approval.

We reached out to LightStream for comment on its negative reviews but did not receive a response.

*Reviews are aggregated from Trustpilot, the Better Business Bureau, Consumer Affairs, WalletHub and Best Company. Read our customer review methodology to learn more.

Best for Customer Experience

SoFi

APR Range

8.99% to 29.49%

Funding Speed

As soon as the same day

Loan Amount

$5,000 to $100,000

SoFi offers personal loans of up to $100,000, a 0.25% autopay discount and the potential for same-day funding. You can get an additional 0.25% rate discount if you receive direct deposits of at least $1,000 per month in a SoFi account. SoFi also offers prequalification (which doesn’t impact your credit score) so you can see what rates and terms you may qualify for before you apply for a loan.

SoFi personal loans have no prepayment fees or late fees, the latter of which some competitors charge. While SoFi advertises that it doesn’t require origination fees, customers can choose to pay an origination fee (up to 7%) to get a lower rate. Like many personal loans, SoFi’s can’t be used for real estate, business, investments or postsecondary education.

Large loan range: SoFi’s loan amounts range from $5,000 to $100,000.

Fast money: You can get funds as soon as the same day your application is approved.

Possible forbearance: If you’re unable to make payments, SoFi may modify the terms of your loan to delay payments.

Origination fee: While you can opt for a loan without origination fees, to get the best rates, you’ll need to accept an origination fee of up to 7%. This is taken out of your loan proceeds.

Requirements for discounts: SoFi’s advertised rates include a 0.25% autopay discount and a 0.25% discount for receiving at least $1,000 in direct deposits in a qualifying SoFi account each month.

Most Praised Features

- Quick funding: Many reviewers were pleased with how quickly their loans were funded after approval.

- Easy application process: Multiple reviewers liked the simplicity and speed of SoFi’s loan application process, often mentioning how straightforward it is.

Most Common Complaints

- Miscommunication and delays: Several reviewers expressed frustration with what they deemed slow response times and lack of clear communication from SoFi, especially when there were issues with the loan process.

- Account management issues: Some reviewers reported issues with account closures, funds being held or the management of loans after approval.

We reached out to SoFi for comment on its negative reviews but did not receive a response.

*Reviews are aggregated from Trustpilot, the Better Business Bureau, Consumer Affairs, WalletHub and Best Company. Read our customer review methodology to learn more.

Best for Small Loans

PenFed Credit Union

APR Range

8.99% to 17.99%

Funding Speed

Typically 1 or 2 business days

Loan Amount

$600 to $50,000

PenFed offers a lower maximum loan amount than other lenders at only $50,000, but its minimum loan amount of $600 is much lower than what many competitors offer. The credit union also offers prequalification so you can see which terms and rates you may qualify for before you apply.

PenFed’s personal loans don’t have origination fees, early-payoff fees or balance-transfer fees, but there’s a $29 fee for payments that are more than five days late. Same-day funding isn’t available, but PenFed will normally fund your loan by the next business day.

Although PenFed requires membership, the credit union is easy to join since membership is open to anyone, unlike with other credit unions.

Offers small loans: PenFed offers a minimum loan of just $600.

Prequalification: See your rates with no impact on your credit score.

Co-borrowers welcome: If you don’t think you can qualify for a loan with your credit and income alone, add a co-borrower to your application.

Shorter repayment terms: The maximum repayment term is five years, which is less than other lenders.

No discounts: PenFed doesn’t offer discounts for making automatic payments or having direct deposit.

Most Praised Features

- Easy application process: Many reviewers praised PenFed for a seamless and fast application process. Multiple reviews noted that PenFed approved loans quickly and required minimal documentation.

- Customer service experience: A large percentage of positive reviews highlighted courteous, professional and helpful in-person and online customer service.

Most Common Complaints

- Account issues and technical problems: Many reviews mentioned technical problems with PenFed’s website and mobile app, such as transaction failure and difficulty accessing their accounts.

- Slow processing times: Many negative reviews cited delays in loan processing, leading to significant frustration.

We reached out to PenFed for comment on its negative reviews but did not receive a response.

*Reviews are aggregated from Trustpilot, the Better Business Bureau, Consumer Affairs, WalletHub and Best Company. Read our customer review methodology to learn more.

Best for Low Rates

Discover

APR Range

7.99% to 24.99%

Funding Speed

As soon as the next business day

Loan Amount

$2,500 to $40,000

Discover offers competitive rates and flexible term options, but you’ll need a minimum credit score of 660 to qualify. Its maximum loan amount is $40,000, so it’s not a suitable lender for large loan needs. Discover doesn’t offer same-day funding, instead offering next-day funding after approval. There are no origination fees or prepayment penalties, but Discover charges a $39 late payment fee — one of the highest late fees we’ve seen.

If you’re using a loan to consolidate high-interest debt, Discover provides the option to pay creditors off directly. While personal loans can generally be used to consolidate credit card debt, a Discover loan can’t be used to pay off a Discover credit card.

Monthly credit score: Discover provides access to free FICO credit score updates.

Few fees: There are no origination fees or prepayment penalties.

Easy-to-use online services: More than 38% of customers who left positive reviews appreciated the ease of using Discover’s online and mobile services.

Smaller loan range: The minimum amount you can borrow is relatively high ($2,500), and the maximum amount you can borrow is only $40,000.

No discounts: Discover doesn’t offer an automatic payment discount.

Minimum income requirement: You must have a household income of at least $25,000 per year to qualify for a loan.

Late payment fee: There’s a $39 late payment fee, which is on the higher end.

Most Praised Features

- Digital experience: Reviewers frequently mentioned how convenient Discover’s mobile app is, highlighting features such as easy account management.

- Customer service: Several reviewers praised the responsiveness and helpfulness of Discover’s customer service, often noting that it’s based in the U.S. and available 24/7.

Most Common Complaints

- Customer service inconsistency: Some reviewers had inconsistent experiences with the quality of service, especially with complex issues such as disputes or account closures.

- Unexpected loan denials: Many reviews expressed frustration with the loan approval process, reporting unexpected denials despite strong credit scores and financial history.

We reached out to Discover for comment on its negative reviews but did not receive a response.

*Reviews are aggregated from Trustpilot, the Better Business Bureau, Consumer Affairs, WalletHub and Best Company. Read our customer review methodology to learn more.

Best for Comparing Lenders

Upstart

APR Range

7.80% to 35.99%

Funding Speed

As soon as 1 business day

Loan Amount

Up to $50,000

Upstart is a lending marketplace that uses artificial intelligence to connect consumers to loans from more than 100 banks and credit unions. The company is focused on improving access to credit for all, so some of its lending partners may accept applicants with lower credit scores.

Upstart offers loans of up to $50,000 with three- or five-year terms, and its rates tend to be on the higher side. It’s easy to get prequalified before applying, and you can typically receive funding in about one business day if you’re approved. There are no prepayment penalties, but Upstart lenders typically charge origination fees and late fees.

Fair credit OK: You may be eligible for a loan even if your credit score is as low as 620.

Fast and efficient loan processing: Fifty-three percent of Upstart customers who left positive reviews appreciated how quick and easy the loan process was.

High interest: Upstart has a higher maximum rate than other lenders.

Fees: Fees vary by provider, but most Upstart lending partners charge origination fees and late fees.

Most Praised Features

- User-friendly experience: Many reviewers highlighted how easy it was to use Upstart’s online platform, citing a straightforward process that required minimal paperwork. They also liked how transparent loan terms and conditions were.

- Flexible loan options: Reviewers liked Upstart’s flexibility, especially around repayment options and loan amounts. Many appreciated the ability to customize loan terms.

Most Common Complaints

- Customer service issues: A few reviews mentioned challenges with customer service, such as difficulty reaching representatives and trouble resolving issues on payments or loan terms.

- Loan denials: Some reviewers complained about unexpected loan denials or changes in loan terms after preapproval. Customers felt frustrated and misled.

Tom Brennan, director of communications at Upstart, had the following comment in response to these negative reviews:

“Upstart is dedicated to delivering a positive experience for our customers, which includes offering robust support to address any issues that may arise in the lending process. Live customer service agents respond to both our helpline and email. A final ‘hard credit pull’ before the loan agreement is signed can result in a denial if additional information is found. Upstart works to ensure the most accurate and fair decisioning to best serve our lending partners.”

*Reviews are aggregated from Trustpilot, the Better Business Bureau, Consumer Affairs, WalletHub and Best Company. Read our customer review methodology to learn more.

Best Personal Loans Compared

Compare our picks for the best personal loans below:

*APRs accurate as of April 09, 2025

Expert Insights: What Are Some Tips for Choosing a Personal Loan Lender?

What Are Personal Loans Used For?

Personal loans can typically be used for almost any legal purpose. Two of the most popular ways to use personal loans are debt consolidation and home improvements. In our latest personal loans survey, 30.8% of the respondents said debt consolidation was their primary reason for getting a personal loan, and 15.4% said it was home improvements.

However, repayments on these loans could be high: The average loan amount among our survey respondents with good credit (a FICO score of 670 to 739) was $26,334, which would require a monthly payment of $900.03 if you had a three-year repayment term and a 14% APR.

What Are Personal Loans Typically Used For?

“Many people use personal loans to consolidate high-interest debt, such as credit card balances, into a single, lower-interest payment, which can simplify repayment and reduce overall costs. They are also frequently used for major expenses, such as home improvements, medical bills, or unexpected emergencies that might exceed savings. Some individuals take out personal loans to finance large life events, such as weddings or vacations, while others use them to cover education-related expenses or business startup costs. Because personal loans are typically unsecured, they provide an accessible option without requiring collateral, making them appealing for short- to medium-term financial needs.”

Personal Loan Interest Rates

The interest rate determines the amount of money you’ll have to pay the lender in addition to the amount you borrow.

“The interest rate is certainly important when considering a loan,” Tom Arnold, a finance professor at the University of Richmond, told MarketWatch Guides in an interview. “However, fees and service are also important. Rates are competitive and generally very similar between lenders. Some lenders, however, will offer a lower rate with higher fees that more than offset the lower rate.”

Average Personal Loan Interest Rates by Credit Score

The table below lays out average personal loan interest rates based on data from Credible.

| Credit Score | Average 3-Year APR | Average 5-Year APR |

|---|---|---|

| >780 | 12.92% | 18.16% |

| 720 to 779 | 17.07% | 22.55% |

| 680 to 719 | 22.39% | 25.96% |

| 640 to 679 | 29.04% | 30.65% |

| 600 to 639 | 31.17% | 32.73% |

| <599 | 32.12% | 33.99% |

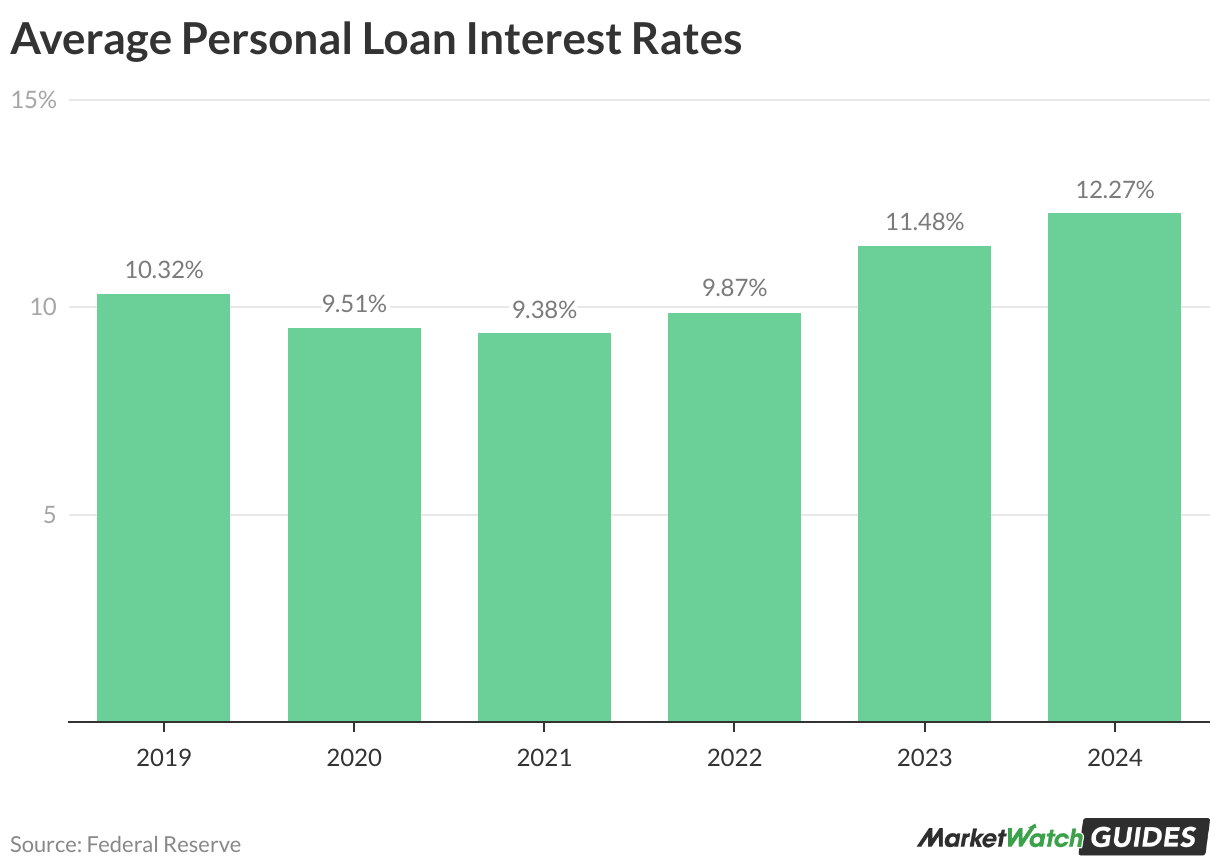

Historical Trends for Personal Loan Rates

Despite interest rate cuts from the Federal Reserve, the average personal loan interest rate in November 2024 was 12.32%. Personal loan rates began increasing in 2022 as the Fed raised its benchmark interest rate in an attempt to slow inflation by curbing borrowing and spending. Before that, the average personal loan rate hadn’t exceeded 11% since 2011.

In the News: Personal Loans

The Federal Reserve opted to keep the federal funds rate steady at its current range of 4.25% to 4.5% after its March meeting, citing concerns of an uncertain economic outlook and elevated inflation.

The Fed’s decision to maintain its target interest rate range in January and March came after three rate cuts in a row at the end of 2024. Despite political pressure, the Federal Reserve seems committed to its dual mandate of keeping inflation low and job growth high.

“For now, the Fed wants to be extra careful, as inflation is still a little above its 2% target,” Ohan Kayikchyan, Ph.D., a certified financial planner and the founder of Ohan The Money Doctor, told MarketWatch Guides in an interview.

“[After the January meeting,] Fed Chair Jerome Powell reminded the central bank of its independence and assured that the Fed’s decisions are based on economic data only and not political pressure. While these decisions may not align with all political views, they are aimed at maintaining financial stability, a common goal for consumers and businesses, by ensuring that interest rates and inflation are kept in check.”

FAQ About Personal Loans

To qualify for a personal loan with most lenders, you should generally have a good credit score (670 or higher). However, some lenders may accept poor or fair credit scores. If you want the lowest possible interest rates, you’ll need a credit score in the range of very good (740 to 799) or excellent (800 to 850).

It likely won’t be hard to get a personal loan if you have a good-to-excellent credit score and a low debt-to-income ratio. It can be more difficult to qualify if you have poor credit, and your rates will generally be higher. It’s best to shop around for options that best fit your circumstances.

For an unsecured personal loan (a loan that doesn’t require collateral), you generally need at least a good credit score and a DTI ratio below 50%. You also typically need to show a government ID, proof of residence and your last pay stub.

Yes, you can usually choose from a range of repayment terms for personal loans. Most lenders offer terms from one to seven years, but your options are determined by each lender.

Methodology

Our team researched 37 of the most prominent lenders in the U.S., analyzing disclosures, websites and sample loan agreements. To determine the best personal loans, we ranked the top lenders over five categories: affordability, loan features, customer experience, company reputation and accessibility.

For further insight into consumer banking trends, MarketWatch Guides surveyed 1,000 American personal loan consumers using Pollfish. The results were post-stratified to reflect a nationally representative sample based on age, gender, marital status and household income. Pollfish uses an organic random device engagement method for sampling. To learn more, read our full personal loans methodology.

30%

Affordability

25%

Loan Features

20%

Company Reputation

15%

Customer Experience

10%

Accessibility

Affordability

Top-rated institutions provide the most competitive APYs, which include interest and upfront fees.

Loan Features

The best scores go to lenders that offer the widest range of terms and loan amounts, lenient credit requirements, fast funding and the ability to pre-qualify.

Company Reputation

High scores are given to lenders with excellent reputations based on BBB and Trustpilot ratings, legal standing and number of years in business.

Customer Experience

Lenders that receive high marks in this category offer online applications, have various customer support options and allow a co-borrower.

Accessibility

High marks go to lenders in this category that are available in all 50 states and don’t require membership or another account to apply.

Customer Review Methodology

To provide an in-depth perspective on how customers feel overall about banks that offer personal loans, the MarketWatch Guides team compiled 8,049 reviews from publicly available user-review sites such as Trustpilot, the Better Business Bureau, Consumer Affairs, WalletHub and Best Company.

We then categorized each review and analyzed the sentiment to determine whether it was positive or negative and highlighted the most praised features and most common complaints for each bank.

*Data accurate at time of publication