-

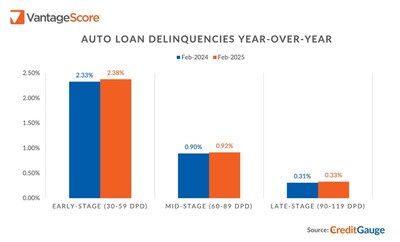

Auto Loan Delinquencies Increased Year-Over-Year, Balances Grew and Originations Stalled

-

Average VantageScore Credit Score Declined by One Point to 701

-

Late-Stage Delinquencies Rose Sharply as Student Loan Payment Reporting Resumed

SAN FRANCISCO, March 27, 2025 /PRNewswire/ — Auto loan credit delinquencies increased across every Days Past Due category for the second straight month, according to the February 2025 edition of CreditGauge from VantageScore. Additionally, the credit scoring company noted that overall late-stage delinquencies grew by 0.25% on a month-to-month basis, partially due to the auto loan delinquencies and the impact that renewed student loan reporting had on consumer credit files. The average VantageScore dropped to 701 over the same period, resulting from the same factors.

“Borrowers are making tough choices to prioritize their debt obligations and auto loans are decreasing in priority. Nationwide, the average VantageScore dropped by one point,” said Susan Fahy, Executive Vice President and Chief Digital Officer at VantageScore. “It’s unusual to see a decline of this size, and we attribute the change to the increased demands of car loan balances and student debt repayment.”

Key insights for the February 2025 edition of CreditGauge include:

AUTO LOAN SECTOR STRESSED: Auto Loan delinquencies increased across all Days Past Due (DPD) categories in February 2025, both year-over-year and in comparison to pre-pandemic levels. In addition, Auto Loan balances increased year-over-year by $413 (+1.7%), while originations remained unchanged year-over-year at 1.36%. Consumers struggled to stay current on their auto loans and reduce their account balances. Lenders have also slowed down the issuance of new loans. Potential economic and geopolitical headwinds, including tariffs, could continue to challenge the sector in the coming months.

AVERAGE VANTAGESCORE DECLINED TO 701: The average VantageScore 4.0 credit score dropped by one point to 701 in February 2025, after remaining at 702 for the past 11 months. This decline was driven, in part, by the resumption of student loan reporting, which led to an increase in overall late-stage delinquencies.

OVERALL LATE-STAGE DELINQUENCIES SURGED: Early- and late-stage credit delinquencies rose overall in February 2025 compared to the prior month, and all stages remained elevated over the prior year. Late-stage (90-119 DPD) delinquencies rose sharply month-over-month, from 0.20% to 0.45% in February 2025, as missed student loan payments over 90 days late began to appear on consumer credit files in February. Consumers now face the added demand of catching up to missed student loan payments that have been reported as delinquent, as predicted by a recent quantitative analysis issued by VantageScore. Additionally, new credit originations decelerated month-over-month across all products, led by Personal Loans (-0.58%) and followed by Credit Cards (-0.32%), Auto Loans (-0.08%), and Mortgages (-0.07%).