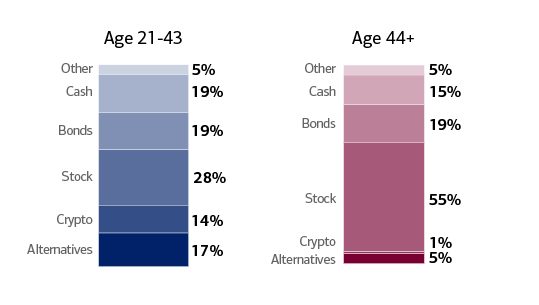

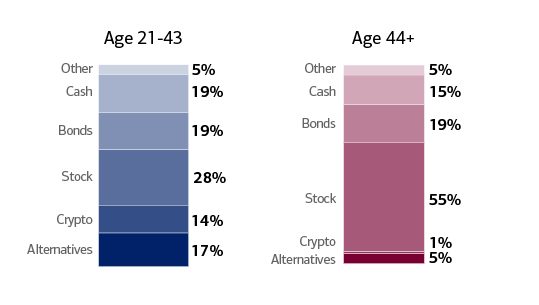

Much has changed since Bank of America (BAC) released its last Private Bank Study of Wealthy Americans report in 2022. With the youngest Baby Boomers approaching their 60th birthdays and a massive generational transfer of wealth already begun, the study revealed that older and younger generations have very different ideas about the value of stocks and bonds versus alternative investment classes like art.

The 2024 report reveals how Millennials and Gen Z are increasingly looking beyond the traditional markets to build and preserve wealth: alternative and ‘pleasure’ assets account for 17 percent of their portfolios, compared to 5 percent allocated by older investors. The study found that 65 percent of all respondents were interested in collectible assets, but among those under 44, it was 94 percent.

Millennials and Gen Z are at least two times more likely than older generations to collect watches (46 percent), wine or spirits (36 percent), rare or classic cars (32 percent), sneakers (30 percent) and antiques (30 percent). Additionally, younger wealthy Americans are far more likely to be “very interested” (18 percent) or “somewhat interested” (25 percent) in owning art when compared to wealthy Americans over 44, with only 2 percent “very interested” and 15 percent “somewhat interested.” The study also revealed that 93 percent of respondents plan to allocate more of their investment dollars to alternatives in the next few years.

When it comes to art in particular, older generations are now looking to pass their holdings to the next generation, with 6 percent of collectors 44 years of age or older saying it was “very likely” they would sell work from their art collections in the next year. “We’re living through a period of great social, economic and technological change alongside the greatest generational transfer of wealth in history,” said Katy Knox, president of Bank of America Private Wealth, in a statement.

We can identify this as occurring over the past two years, with significant art collections coming up for auction and some postwar artists experiencing disappointing results, with the classic white male artists now seen as less relevant and appealing to newer generations. Art market and auction professionals are increasingly thinking differently about the kinds of art that will pass the test of time and meet the changing tastes and sensibilities of the next generation of collectors.

SEE ALSO: Unpacking the Recent Shakeups in Gagosian’s Succession Planning

A report conducted last year by Sotheby’s and ArtTactic found that Boomers (born between 1946 and 1964) accounted for 40 percent of bids on $1 million-plus art in 2022, down from 48 percent in 2018. Last May, we saw relevant works by artists including Frank Stella and Richard Diebenkorn fail to meet expectations. Other underperforming lots included works by Georges Braque and Sam Francis, which were withdrawn before the auction, and Pablo Picasso’s magnificent Femme au chapeau (1939), which was estimated to sell for between $6 million and $8 million but failed to attract a buyer.

One looming concern is that art owned by members of the Boomer generation, which has been overrepresented among art buyers, won’t resonate with younger art collectors. The Bank of America report reveals Millennials and Gen Z are much more willing to dynamically think about art in their wealth management strategy, with 28 percent considering using art as collateral for loans, and when members of these generational cohorts inherit art, they’re much more likely to sell and then buy something that speaks more to their personal tastes.

It’s not just about the investment: emotional factors are also crucial drivers for the younger generations of collectors, and in the decisions of wealthy Millennials and Gen Z investors, 86 percent consider sentimental value in addition to economic value. Perhaps for this reason, they are also interested in philanthropy, even though this is more commonly associated with those who come from inherited wealth.