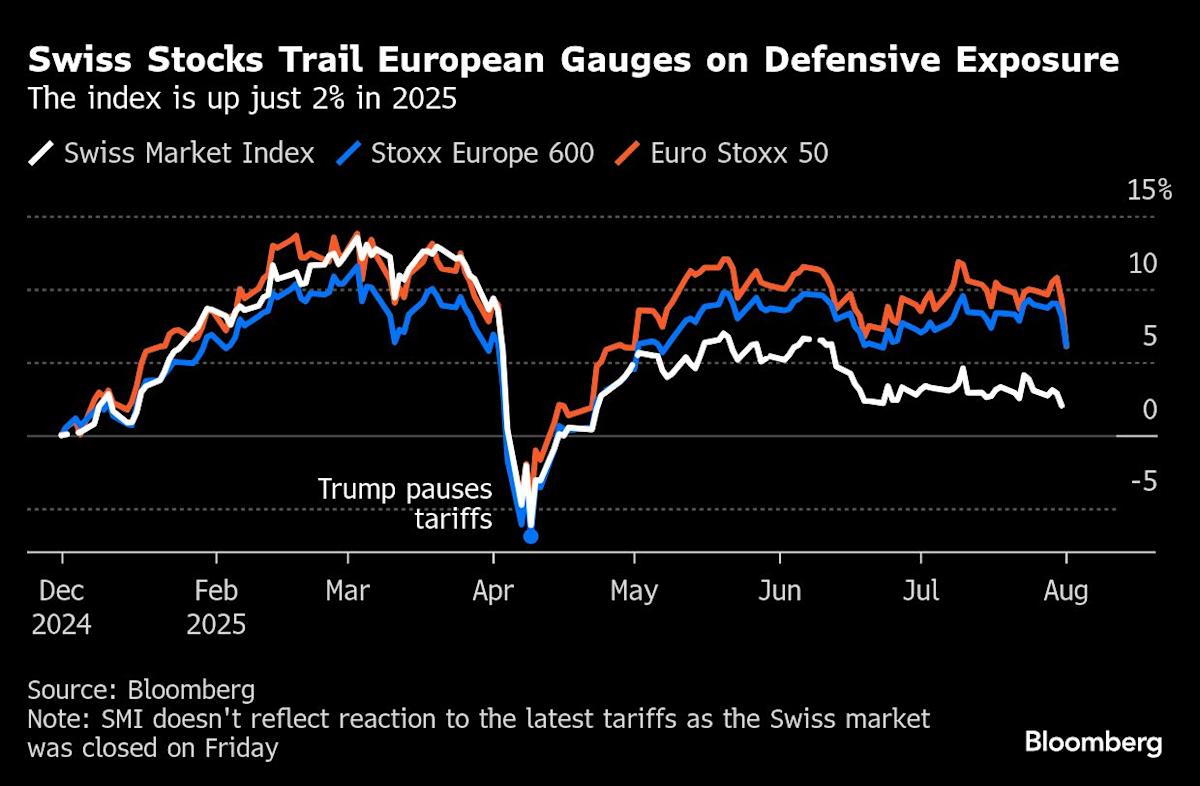

(Bloomberg) — Swiss stock investors are bracing for Monday’s market reopening after US President Donald Trump slapped a punitive 39% export tariff on the country, among the highest in the world.

Most Read from Bloomberg

Trump’s tariff rollout landed on a holiday, Swiss National Day, which means any market fallout will only be felt once trading resumes on Monday. While Trump’s fresh tariff salvo left baseline rates unchanged for many of the US’s trading partners, some like Canada and Switzerland got hit with significantly higher duties.

Switzerland, known for its luxury watches, rich chocolates and banking giants, is one of the US’s biggest trade partners. Last year, it exported more than $60 billion of goods to the US, ranging from pharmaceuticals and medical devices to Nespresso coffee. So the 39% tariff rate is likely to roil the market Monday even if some investors cling to the hope that it’s just another one of Trump’s negotiating ploys.

“Clearly, the Swiss market’s first reaction will be negative,” said Andreas Wosol, head of Amundi SA’s European equity value strategies. “But then attention turns to negotiations. This is an announcement where Trump wants a reaction rather than to impose this level of tariff.”

On Friday, several US-listed Swiss stocks fell. Shares of the country’s biggest bank UBS Group AG slid 1.8% and computer hardware maker Logitech International SA dropped 3.5%. American depositary receipts for Compagnie Financière Richemont SA — owner of luxury maisons like Cartier, Chloé and Van Cleef & Arpels — fell 2.5%. And Watches of Switzerland Group Plc slumped 6.8% in London trading.

What stings more is that Switzerland’s European Union counterparts were able to secure a 15% tariff rate. That creates a “competitive disadvantage” for the Swiss, according to a Friday note from authors including Daniel Kalt at UBS Global Wealth Management’s Chief Investment Office.

Last year, the US accounted for a 19% chunk of Switzerland’s goods exports, the authors point out. Their base case is for the two countries to reach a similar tariff deal to the EU. But even then, they say a 15% tariff rate is still sizable compared to before “Liberation Day,” while the US dollar’s depreciation against the Swiss franc makes matters worse for Swiss exporters.