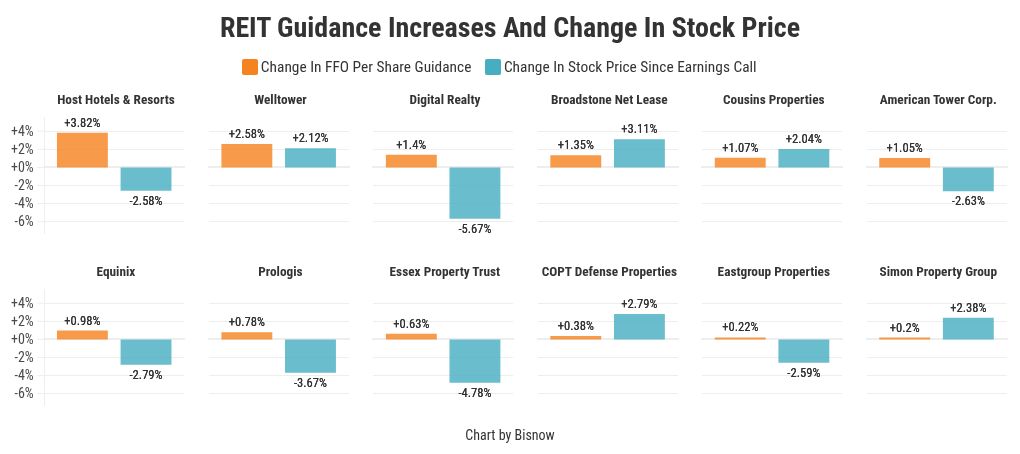

As second-quarter earnings continue to roll in, REITs are consistently beating forecasts and increasing guidance. But for many of the firms, their stock price doesn’t reflect those changes.

REIT stocks fell faster than the overall Dow Jones Industrial Average in the last week of July as investors, unimpressed with the positive results, sold out. REIT operators are improving their margins but struggling to raise cash, a dynamic that threatens to leave the sector flat-footed as capital markets come unstuck.

“From a business point of view, for all intents and purposes, these companies are doing what we thought they would do. It’s just not finding a home with a lot of investors,” said Anthony Paolone, a senior analyst at JPMorgan Chase.

Bisnow/created with assistance from Adobe Firefly

Investors have returned to the broad universe of publicly traded commercial real estate companies in 2025, just not REITs.

The Dow Jones U.S. Real Estate ETF, which includes REITs and advisory firms like brokerages, is up more than 3% this year — roughly in line with the broader Dow — while the Dow Jones Equity All REIT index is flat year-to-date.

On a shorter-term basis, the Dow REIT index fell 3.6% last week compared to a 2.9% decline in the Dow overall.

The weak performance is despite a generally strong financial position for the sector. Two-thirds of the 74 REITs that had reported second-quarter earnings by Aug. 1 lifted their full-year funds from operations guidance, according to Connecticut-based investment adviser Hoya Capital Real Estate. Just two REITs, both in the office sector, cut their guidance.

Midyear increases to guidance are common in REIT operations as executives get a clearer picture of revenue for the year. Despite earnings beats in the first quarter, REITs were generally cautious in revenue forecasts, which left investors expecting more substantial increases to guidance at the halfway point of the year.

Instead, REIT executives came to second-quarter earnings calls with modest upward revisions that, in many cases, had already been baked into the REIT’s stock price. The dynamic was especially apparent among multifamily REITs, Paolone said, where operators continue to work through a record wave of new supply that has weighed on rent growth.

“What we saw was that momentum seemed to slow, which means that you were able to bring that guidance up a little bit, but the second half of the year seems to be slowing a bit more than we hoped, which potentially means that growth into 2026 is not as robust as we thought,” Paolone said.

Still, the single-digit growth being offered by REITs isn’t far off from bond yields, making the sector a hard sell for investors in the current rate environment, said Alex Pettee, founder and president of Hoya Capital.

“This last couple of years has been historically bad for the public REIT industry. But what we’ve seen is that it takes one shift in the rate expectations and you get this significant rally,” he said. “A lot of the animal spirits come back very quickly.”

REITs ended July priced at a median 20.3% discount to their net asset value — effectively the total worth of their properties — a gap that has existed since 2021 and has been widening since the middle of last year.

For REITs, which typically return the majority of their profits to investors in the form of dividends, the NAV discount makes debt more expensive and acquisitions less feasible in today’s market. Many REITs currently have historically low leverage and are looking for deals, but pricing and debt service continue to keep most from closing deals.

Property investment by REITs has fallen steadily since 2021, when it peaked at around $130B. In 2024, REITs spent $46.5B on commercial real estate, according to Nareit. That doesn’t mean they aren’t looking for deals, however.

“Preparing to use balance sheet capacity is probably a theme across many companies. You’re hearing, especially from the housing REITs, that they’re looking for opportunities,” said Lori Marks, vice president of corporate finance at Moody’s Ratings.

The erratic tariff policy coming from the White House has been less of a drag on commercial real estate and the broader economy than many analysts expected, at least for now. That has helped boost leasing activity in the retail and industrial sectors, said Ranjini Venkatesan, vice president of corporate finance at Moody’s Ratings.

“There was a lot of concern on the macroeconomic softness and potential that tariffs will start affecting consumer buying patterns and tenants’ leasing patterns, but that hasn’t really played out yet,” she said.

Prologis, the globe’s largest industrial landlord, boosted its guidance for FFO per share by four cents during its second-quarter earnings call in mid-July, where executives said the company’s performance had exceeded their expectations.

The industrial giant’s stock is down more than 3% since its earnings call.

Retail REITs Regency Centers, Kimco Realty, Brixmor, Tanger and Simon Property Group all slightly boosted the midpoint of their FFO guidance and were rewarded for it, with their stocks up slightly Thursday compared to the day they reported earnings.

In office, an uptick in leasing volume and rising office attendance have not only lifted spirits, but also led at least four office REITs — Cousins Properties, Highwoods, BXP and Kilroy Realty — to raise their guidance.

Kilroy, which has a mixed portfolio dominated by office assets, lifted its FFO guidance by nearly 3.8%. It’s one of the few REITs to see a significant boost to its stock value since financials were released, with the stock up more than 10% over the last 30 days.

“The first half has possibly been better than anticipated at the margin,” Venkatesan said. But executives on calls sounded similar notes of caution, she said. “They also alluded to the fact that the second half could be softer. So that’s something to watch out for.”

Residential REIT ETF, a fund managed by Charles Schwab, is down roughly 4% over the last 30 days despite half of the eight apartment REITs that reported earnings by Aug. 1 increasing their guidance, according to Hoya Capital. The other four kept guidance unchanged.

Multifamily sellers are still holding out for pricing beyond what the public market can afford, and Marks is closely watching the job market for signs of weakness that could impact tenant demand after large downward revisions to employment numbers at the start of the month.

“The opportunity has to be there from a quality perspective and a cost perspective,” she said.

The same sentiment is true for investors today as they consider the menu of investment options, from the steady safety of bonds to the volatile but booming world of artificial intelligence. REITs are positioned to continue to see growth rates in the mid-single-digit range in most economic scenarios. The question is more about when that looks attractive to investors, Paolone said.

“Where REITs are today, they may not look as interesting for people because they’re looking at the sizzle of the growth rate in the S&P 500 being double digits,” he said. “But if there’s ever an instance where that fades a bit, and there’s a cyclical change, REITs will look pretty attractive, and you’ll see that capital rotate back.”