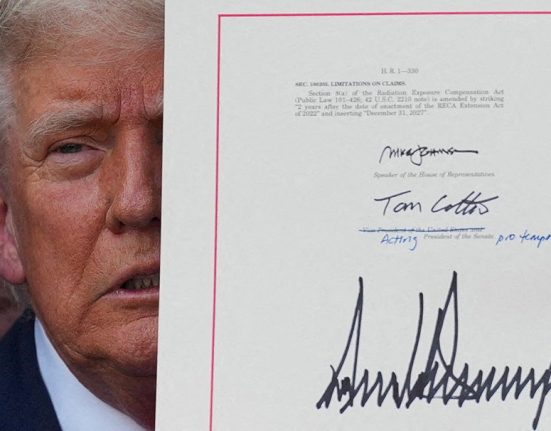

Bond yields were down Tuesday, but over the last few months they’ve been rising. Bond investors have been demanding higher yields, because they’re concerned about the GOP’s plan to cut taxes without making any meaningful spending cuts.

That will force the government to issue a whole lot of new bonds in the future, which will drive bond prices lower and yields higher.

The thing is, bond investors aren’t only driving yields higher here in the States. They’re also demanding higher yields in Japan, Germany and the U.K.

Let’s start with Japan. For decades, interest rates there were extremely low.

“Japan was the country that invented ZIRP. The zero interest rate policy,” said Ulrike Schaede, a professor of Japanese business at the University of California, San Diego.

She said over the last year, prices in Japan have started to rise. So to tamp down inflation?

“The Bank of Japan knows that interest rates eventually have to go up,” Schaede said.

Bond investors know that, too.

In the last few weeks, Schaede said big, institutional investors in Japan have been concerned that if interest rates rise in the future, the bonds they buy today will lose their value.

So they’re demanding higher yields, said Kenneth Rogoff, a professor at Harvard and former chief economist at the IMF.

“They’re absolutely still lending money to Japan. But they want to be paid more,” he said.

Another reason why investors are demanding higher yields, according to Rogoff: They’re concerned about countries’ debt loads. Because when debt gets too high, countries have to raise taxes, cut spending, or borrow even more.

Investors expect the U.K. to be one of the borrowers and issue more bonds, because tax revenue is being limited by a slow economy.

“The U.K. is stuck in this uncomfortable position, where its growth is still really weak, and at the same time, it’s experiencing the same pressures on interest rates everyone else is,” Rogoff said.

Germany’s debt levels are rising, too. But its bond investors aren’t as pessimistic.

The government recently approved a massive infrastructure and defense spending package.

And Zachary Griffiths, a senior strategist at CreditSights, said that kind of spending can juice the economy.

“If you are able to boost economic growth through the manufacturing sector, increase employment, that creates more optimism around the ability for at least a portion of the deficit spending to be paid for,” he said.

Griffiths said that’s why many investors are more optimistic about German bonds than they are about U.S. Treasuries.