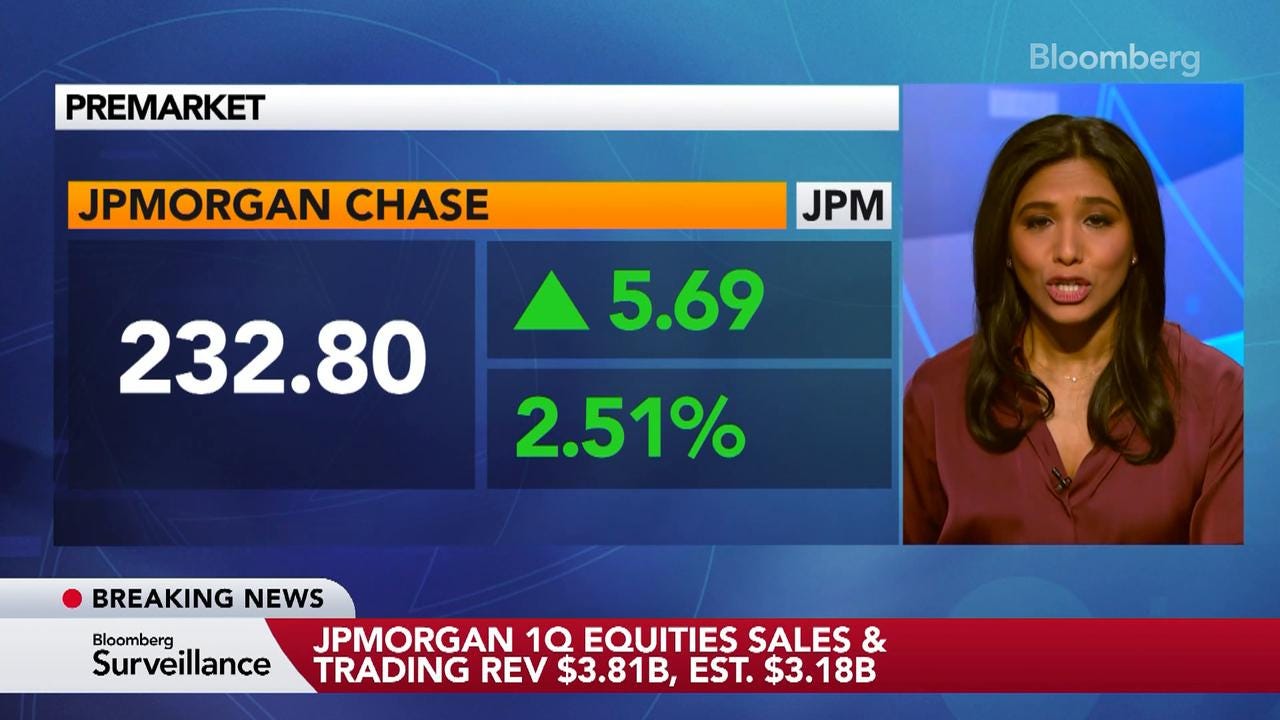

JPMorgan’s stock traders see record revenue in Q1

JPMorgan Chase’s stock traders took in a record haul in the first quarter as the biggest US bank boosted equities markets revenue 48% to $3.81 billion. Sonali Basak reports on Bloomberg Television.

Bloomberg

- Magnificent 7 tech giants saw gains in May, too, though Apple lagged its peers.

- But consumer pessimism persists, even as inflation cools.

Wall Street just closed out another week of robust gains, sealing May as the strongest month for U.S. equities since November 2024, driven once again by explosive rallies in big tech names.

An index tracking the so-called Magnificent Seven — Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta Platforms and Tesla — surged 15% in May. But beneath the surface of this eye-popping figure is Apple’s rare underperformance.

While six out of the seven tech giants logged monthly gains, the iPhone maker not only lagged its peers but delivered its weakest relative performance against the S&P 500 Index since 2018.

In contrast, Nvidia posted a staggering 24% monthly jump — its best performance since May 2024 — after delivering stronger-than-expected quarterly earnings.

Despite facing export restrictions on its chips to China, Nvidia’s revenue resilience confirmed that artificial intelligence demand remains healthy. Overall revenue came in at $44.1 billion, up 69% from a year ago.

“Countries around the world are recognizing AI as essential infrastructure — just like electricity and the internet — and Nvidia stands at the center of this profound transformation,” CEO Jensen Huang said.

While Wall Street paints a positive picture, Main Street is telling a different story as pessimism among U.S. consumers runs high.

The U.S. economy contracted by 0.2% in the first quarter, a slight upward revision from the initial -0.3% estimate, yet a stark reversal from the 2.4% growth rate seen in late 2024. Inflation, as measured by the Personal Consumption Expenditures price index, cooled to 2.1% in April — its slowest pace in six months — from 2.3% in March.

But the public doesn’t seem to trust the disinflation narrative.

According to the University of Michigan’s May survey, Americans expect inflation to run at 6.6% over the next year, the highest level since 1981. That figure reflects the widest gap ever recorded between perceived and actual inflation. Meanwhile, overall sentiment remains near three-year lows.

In a notable development on the trade front, the U.S. Court of International Trade struck down significant portions of President Donald Trump’s newly proposed tariff actions.

While the move sparked brief investor optimism, analysts caution the Trump administration retains various legal avenues to reintroduce similar trade barriers.

Benzinga is a financial news and data company headquartered in Detroit.