Here are three solid reasons for investors to consider selling shares of the artificial intelligence (AI) chip leader.

The Nvidia (NVDA 3.55%) stock story keeps getting better, thanks primarily to the incredible demand for the company’s graphics processing units (GPUs) and related technology that enable artificial intelligence (AI) capabilities. It’s not too late to buy shares. Indeed, I just outlined 25 reasons to buy Nvidia stock now.

But there’s a key question worth addressing that doesn’t get much attention: When should you consider selling shares of Nvidia stock?

There are no “right” answers. Investors vary in terms of financial and personal factors. That said, below are three solid reasons for any investor to consider selling shares of Nvidia stock.

1. When CEO Jensen Huang no longer leads the company

Investors should consider selling at least some of their Nvidia shares when Huang no longer leads the company he co-founded in 1993. He reportedly turned 61 earlier this year and seems to love his work, so barring any health issues, he could be at Nvidia’s helm for a good number of years more. To say that Huang will be difficult to replace is an understatement.

Nvidia is many years ahead of the competition in AI-enabling technology thanks to Huang’s foresight. Starting more than a decade ago, he began to steadily use profits from Nvidia’s once-core computer gaming business to position the company to be in the catbird seat when the “AI Age” truly arrived. And arrive it did in late 2022, when generative AI made a big splash on the tech scene with OpenAI’s release of its ChatGPT chatbot. Generative AI greatly expands the potential applications for AI.

2. If and when the company’s GPUs seem to be losing their AI-enabling “gold standard” status

A more exact (but too long) subheading is the above plus the following tacked on: “And if the company fails to develop whatever tech is knocking its GPUs from their lofty position.”

Nvidia’s GPUs are by far the favored chips for speeding up the training of AI models and the running of AI applications in data centers. Estimates vary, but it’s widely projected that the company has more than a 90% share of the market for AI GPU chips for data centers, and more than an 80% share of the overall data center AI chip market.

This is a fantastic market to control. Advanced Micro Devices CEO Lisa Su projects that the global data center AI chip market will reach $400 billion in revenue by 2027, which would equate to a compound annual growth rate (CAGR) of more than 72% from its estimated size of $45 billion in 2023.

Nvidia’s data center business accounted for about 87% of its total revenue last quarter, and some greater (but unknown) percentage of its total profits. So, investors should consider selling shares if signs start pointing to the company’s tech being displaced as the gold standard for enabling AI processing in data centers.

How will we know? What signs will there be?

Other than staying abreast of the general space, there are two specific things investors can do. First, listen to Nvidia’s quarterly earnings calls. Besides being interesting, Huang and CFO Colette Kress are very forthright. Recordings of these calls are posted on Nvidia’s investor relations site, so you can listen at your leisure.

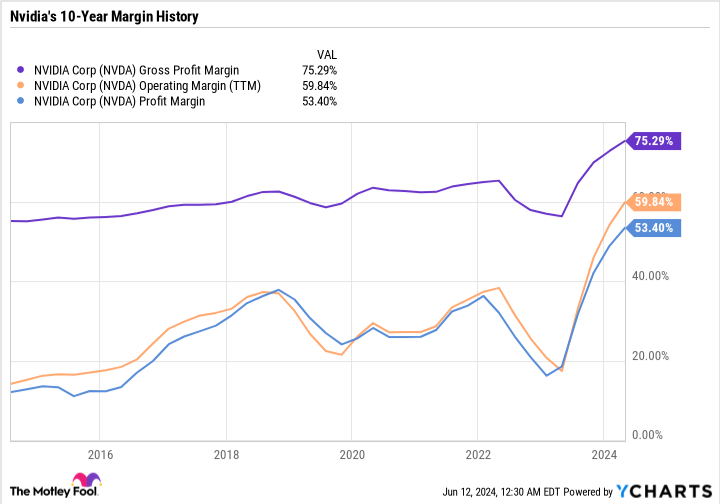

Second, monitor Nvidia’s margins — gross, operating, and profit, with special attention to gross margin. A company’s margins will steadily decline when it’s losing its competitive advantages. The key word is “steadily.” Occasional short-term declines or ups and downs aren’t usually reason for concern.

Below is Nvidia’s 10-year margin history. There are ups and downs, but the overall trend has been decisively up. This is a winner of a margin profile chart. (I used trailing-12-month margins for all three margin types because this smooths out some of the quarterly ups and downs. But you can also use quarterly data, as that might be easier.)

Data by YCharts. Gross margin = gross profit/revenue. Operating margin = operating income/revenue. Profit margin = net income/revenue. Gross profit, operating income, net income, and revenue can all be found on a company’s quarterly income statements.

3. To rebalance your investment portfolio

Nvidia stock has performed amazingly well over the long term, and particularly since 2023. So, in the last year and a half, it has no doubt grown to account for a much larger percentage of many investors’ total portfolios.

No matter how terrific a company, it’s risky to have too many of your eggs in one basket. That’s especially true with technology stocks, which tend to be inherently more volatile than stocks of companies in more stable industries.

So, it makes good sense for investors to regularly — perhaps, quarterly or annually — rebalance their portfolio so no single stock becomes too large a holding relative to their total investments. “Too large” is highly subjective, so you’ll have to decide what percentage range you’re comfortable with.