Nvidia’s CEO has sold millions of dollars worth of his company’s shares this year, and he’s not done selling yet.

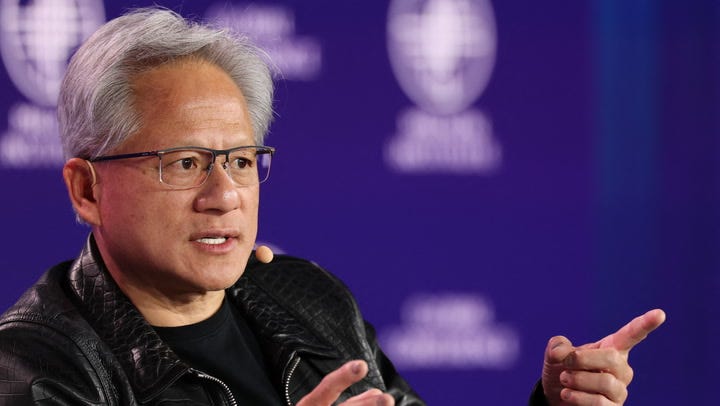

Nvidia CEO sells 100,000 shares of company stock

Jensen Huang sold 100,000 Nvidia shares between June 20 and 23, bringing in nearly $15 million at an average price of $144.04 per share.

Cheddar

Investors oftentimes view insider selling as a sign that a stock may be in trouble, or perhaps as a hint that insiders don’t see more room for it to rise. That can potentially raise red flags for a stock, especially when a CEO is involved.

Nvidia (NASDAQ: NVDA) has been a top-performing stock for years, and the company is now the most valuable in the world. But its CEO, Jensen Huang, has been unloading shares of the business recently. This month, he has sold hundreds of thousands of shares, and that won’t be the end of the selling. What’s behind his moves, and should retail investors also consider cashing out in light of them?

Huang’s stock sales are minimal in relation to his overall position in Nvidia

Although Nvidia’s CEO has been selling shares this year, there are a couple of reasons investors shouldn’t be spooked.

The first is that his stock sales are part of a pre-published plan that he made known to the public. In March, Huang submitted a Rule 10b5-1 plan to sell up to 6 million shares. Once such plans are put in motion, they are executed by a designated broker who makes the trades at preset times. That ensures that the sales aren’t being influenced by new insider information the executive might have. It’s not uncommon for executives to periodically unload some of their shares over time, especially when they hold a lot of stock in a company. And it certainly doesn’t mean that they are expecting their stock to struggle.

Secondly, even after all of those 6 million shares are sold, Huang will still have a considerable position in the company. He now owns around 858 million shares — around 3.5% of Nvidia’s outstanding shares. He remains its top individual shareholder by far, and only a few institutions hold more of its shares than he does. So while these stock sales may seem significant, in the context of his overall position, they are not drastic by any stretch.

Nvidia’s stock has been rising and is trading at an elevated premium

Huang’s stock sale isn’t a reason to be concerned about the business. Demand for Nvidia’s artificial intelligence (AI) chips remains strong, and there’s little reason to be worried about that growth slowing down just yet. Analysts at Grand View Research project that the AI chipset market will grow at a compound annual rate of 28.9% through the end of the decade, and Nvidia should be a huge beneficiary of that.

But investors should still consider valuation. Right now, Nvidia is trading at 55 times its trailing earnings, which is a fairly high multiple given that the average ratio for the S&P 500 is less than 25. Although its growth prospects are high, investors shouldn’t assume that Nvidia’s dominance in the AI chip market will remain uncontested, as some tech giants are designing their own custom AI chips. And given that it trades at such a high premium, expectations will be high for the business. Effectively, there’s a lot of future hoped-for growth already priced into Nvidia’s stock, which may limit the returns of investors who buy right now.

Should you buy Nvidia’s stock today?

Investors may want to consider mirroring Huang’s recent stock sale and cash out some shares right now while still maintaining a position in the company. Nvidia is a market leader, and even if you don’t expect it to double or triple in value again in the short term, it still has the potential to deliver market-beating returns.

A buy-and-hold position may still make a lot of sense for growth investors, but if you’re holding onto Nvidia stock today, you may also want to consider selling a fraction of your position and booking some profits.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Should you invest $1,000 in Nvidia right now?

Offer from the Motley Fool: Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $633,452!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,083,392!*

Now, it’s worth noting Stock Advisor’s total average return is 1,046% — a market-crushing outperformance compared to 183% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.