Corporate America and out-of-state landlords are swooping in on unsuspecting neighborhoods across the U.S. to snap up properties for long-term rentals. However, lawmakers in one Indiana city want to level the playing field for homebuyers.

The city of Fishers, about 20 miles north of Indianapolis, unanimously passed a controversial rental cap ordinance: Properties being rented out will need to be registered with the city, and each subdivision will have a 10% cap on long-term rentals. It takes effect on Jan. 1, 2026.

Mayor Scott Fadness tells Realtor.com® that during a housing study for future projects, one finding stood out: the unusually large growth of investor-owned properties in a short period of time.

“When we looked at it further, there was a significant percentage of those homes that were actually owned by out-of-state investors,” he says. “That data married up with what we were hearing on the ground from our HOA presidents and board members saying, ‘Hey, our neighborhoods are really changing in nature.’”

More than 2,500 single-family homes are being rented out in Fishers, representing 8% of the total homes in the community. The study revealed that of these rentals, 1,186 are owned by out-of-state landlords and 583 were owned by corporate investors.

“Homeownership is really important,” says Fadness. “For most people, it was their way of transferring generational wealth.”

(Getty Images)

Investor insights

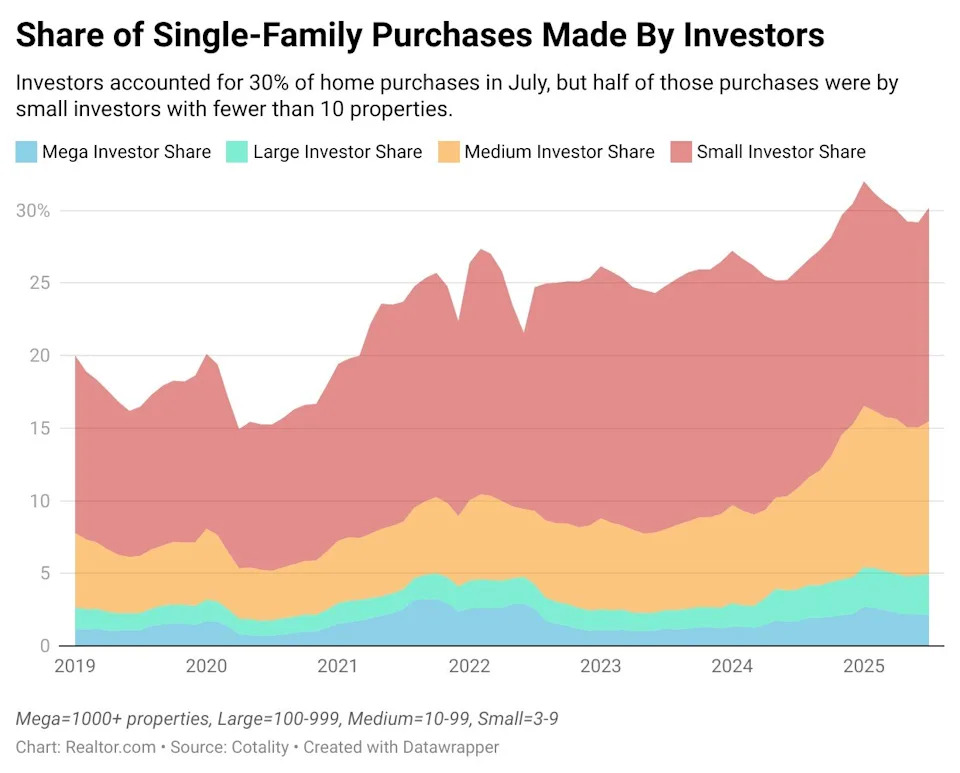

The practice isn’t isolated to Fishers. Major metros across the U.S. are seeing an influx of investors, both corporate and out-of-town buyers. Dallas and Houston are the top markets with the greatest number of purchases, according to a report by Cotality. The top five are rounded out by Atlanta, Los Angeles, and Phoenix.

Small investors with fewer than 10 properties make up a large majority of single-family purchases. In July 2025 alone, Cotality found that small investors made up 14.7% of the share, while mega-investors accounted for 2.16%. That percentage might seem small, but mega-investors are defined as owning 1,000 or more properties—a big stake in communities across the country.

That’s the case in Indiana, where a 2025 Fair Housing Report found investors owned almost half of all rental homes in the five Central Indiana counties (Hamilton, Hancock, Hendricks, Johnson, and Marion).

The money being lost is just as staggering. The median rent for a single-family home across those five counties was $1,799 a month in 2024. With over 20,000 rental homes owned by out-of-state investors in these counties, that equated to over $36 million a month, or over $438 million a year, in rent payments going to out-of-town investors, according to the study.

“Wall Street understands that I can go park my money in these assets. They’re going to appreciate over time, and I get an earning or I get a profit every year,” says Fadness.

(Realtor.com / Cotality)

Local lawmakers take action

Lawmakers are hearing the concerns from their residents.

Minnesota lawmakers tried to pass a bill limiting corporations or LLCs from purchasing and renting out more than 10 properties, but the bill failed in 2024.

During the 2025 legislative session, Nevada lawmakers tried to pass a bill addressing corporate homeownership. The goal was to try to limit how many purchases big companies can make in Nevada in a year.

The Las Vegas Review Journal found that corporate investors purchased 264 homes in a “single day in the summer of 2023, totaling $98 million.” The proposed bill, SB391, would have limited corporate investors to 100 homes a year, but it stalled in this year’s legislative session.

The same cannot be said for Fishers. Its rental cap ordinance will grandfather in some investor-owned properties, but it hopes that it will prevent future investors from elbowing residents out of the market.

“I would hear from all these couples saying that they were getting beat out to buy a home by investors who were willing to pay cash at closing, with no inspection, sight unseen, or even above the asking price,” says Fadness.

It got to the point that residents, and even some of his own employees, started to write letters to homeowners “to try to convince them that this would be, quote, unquote, a worthy owner of their home as they move forward,” he adds.

Carmel, which is next to Fishers, passed a similar bill—both drawing concern from MIBOR, the Metropolitan Indianapolis Board of Realtors.

“We do not feel that these ordinances create a level playing field,” Chris Pryor, MIBOR chief advocacy officer, tells Realtor.com. “They infringe on private property rights by limiting a homeowner from renting [out] their home if they desire or need to.

“This will artificially limit rentals at a time when it is increasingly difficult for the average person to purchase a home. This interferes with the free market and will likely drive up rents.”

Fadness disagrees: “Most people are not independently wealthy. They’re not going to send a trust fund on to their children.

“But if they owned a home in a decent community, they took care of it, they paid down their debt on that home, when they passed on, they could transfer that wealth to the next generation.”