This story was originally published on Multifamily Dive. To receive daily news and insights, subscribe to our free daily Multifamily Dive newsletter.

In the past few months, many international investors have grown more wary of properties in the U.S. However, many of them still plan to grow their holdings in the country, and their multifamily portfolios are expected to expand in the coming year, according to a recent survey from real estate investor association AFIRE.

Sixty-three percent of respondents to the survey — conducted in March from a sample of 72 AFIRE member companies — have a negative outlook on cross-border investments in 2025, up from 45% in the fall 2024 survey. Despite this, 44% of investors outside the U.S. report that they plan to increase their U.S. property investments in the coming year, up from 24% the previous year. Only 8% intend to reduce their investments, down from 33% in 2024.

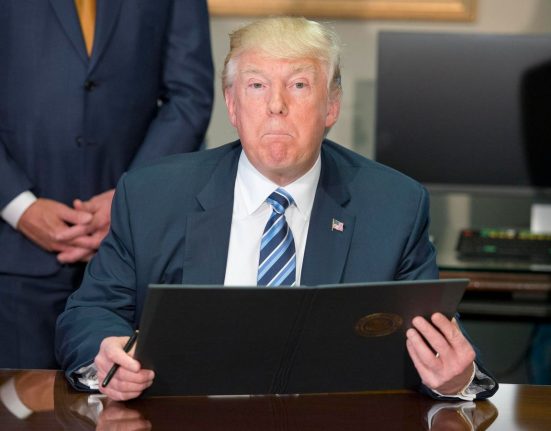

The views and actions of international investors have been heavily influenced by the abrupt political changes and uncertainty about global trade in the first half of the year, according to the report. Many of these investors are currently in “pencils down” mode, waiting to see how market conditions will play out, Gunnar Branson, CEO of AFIRE, told Multifamily Dive.

Nevertheless, he said, many individuals and companies see the U.S. as a good place to spend their money.

“In a time of global uncertainty around the economy and trade and even geopolitics generally, U.S. assets are a good thing to have,” Branson said. “The fundamentals are looking pretty positive right now. Everything from labor statistics to demographics is positive compared to other markets around the world.”

The top preferred market for real estate investors is Dallas, with over 55% of respondents expressing interest in the city, the report said. New York City is close behind, followed by Miami, Boston and Atlanta.

|

Market |

% of investors interested in the market |

|---|---|

|

57.14% |

|

|

52.38% |

|

|

38.10% |

|

|

34.92% |

|

|

31.75% |

|

|

28.57% |

|

|

25.40% |

|

|

23.81% |

|

|

20.63% |

|

|

20.63% |

|

|

17.46% |

|

|

17.46% |

SOURCE: AFIRE

Multifamily is the single largest property type in 50% of international investors’ portfolios, and the second-largest in another 25%, according to the report. It was the largest primary holding type out of all real estate sectors for the survey respondents, closely followed by industrial.