Nikada

Dear GreenWood Investor,

A Strong First Half

All the energy we spend trying to fix what’s broken comes at the expense of making what already works unstoppable. ―Shane Parrish

We are pleased to report strong first half returns, on top of our solid results over the past couple of years. Our core accounts, which remain open to any investor, generated 39.6% net returns vs. 9.9% for the MSCI (MSCI) ACWI. This brings inception to date net compounded returns to 12.7% vs. 8.0% for the MSCI ACWI. Individual coinvestment funds and consolidated fund returns are, as always, available on our Results page for investors.

We are pleased, but we are not satisfied.

There is still so much to do, and we have doubled down on our owner-oriented efforts to help exceptional managers guide under-appreciated companies through transformational moments in their history. We have always invested behind this strategy, first using this figure of speech over a decade ago, but increasingly, we are the change agents behind the transformational moments. What first started as a CTT board initiative has evolved into five separate situations that all have a special purpose vehicle and additional investor capital attached to them.

As we wrote in the last letter, we bring a sense of urgency to seize the day. Yet, we also only work in areas that have durable and secular growth prospects. As our investments where we have board mandates have driven nearly all our returns for the past few years, the durability of these initiatives continues to bear fruit — and we believe will continue to for at least a decade to come.

Durability & Balance

Strength lies in differences, not in similarities. ―Stephen Covey

One of the most inspiring managers that you can meet, if you’re fortunate enough to do so, is Peter Kaufman of Glenair. He is the “Charlie Munger” to the late Charlie Munger. He arranged the Poor Charlie’s Almanack – a top 5 book of all time for us. Many of Charlie’s quips, wise observations, and mental models actually came from Peter.

Peter’s criteria for identifying great capital allocators demands the following criteria:

- That they have total integrity;

- Deep fluency in their target area;

- Have a fair fee structure;

- Operate in an uncrowded space;

- Offer a long runway to their partners.

Not only do we consider these fundamental to our mission to grow your capital alongside ours, we also use very similar criteria to evaluate the companies we want to be associated with, and upon which we will do “whatever it takes” to build value.

For us to get involved in the governance of a company, the stars must align. The valuation must offer us limited downside, the company ideally is already on track for generating highly attractive returns for investors, and we need to have an obvious, tangible and highly impactful ability to add value. Yet even further, the industry drivers must offer a long runway with strong tailwinds. Ideally, and in all cases thus far, we operate in an uncrowded space. When we consider adding skills to any board, we look to fill critical gaps with candidates that have deep fluency.

Just as Peter would say, we are only interested in creating win-win outcomes — where customers, employees, and of course owners can all win together. This includes the management teams of the companies where we choose to partner. Total integrity is a must.

But we would go a bit further in considering the strength of both an investment team and a management team. They must be balanced. They must be both emotionally adept and highly intelligent. They must contain creative and abstract right-brain skills, while also having the discipline, accountability and rigor of the left brain.

Not many people possess all these traits, in fact less than 1% of humans have over-powered top, bottom, left and right brains. Yet a collaborative team and board can help fill in these missing gaps. This is the essential formula for value creation. And anyone can do it if we understand where our strengths and shortcomings are. We believe we can work with anyone, as everyone is strong at something.

We operate like this within GreenWood, where we each champion different perspectives to come up with balanced perspectives. We need to understand both risk and opportunity. It sometimes creates tension in the conversation, as different perspectives very often conflict with the opposite viewpoint. Yet these tensions only underline certain inconvenient truths that need to be addressed not just to find equilibrium, but to find the truth.

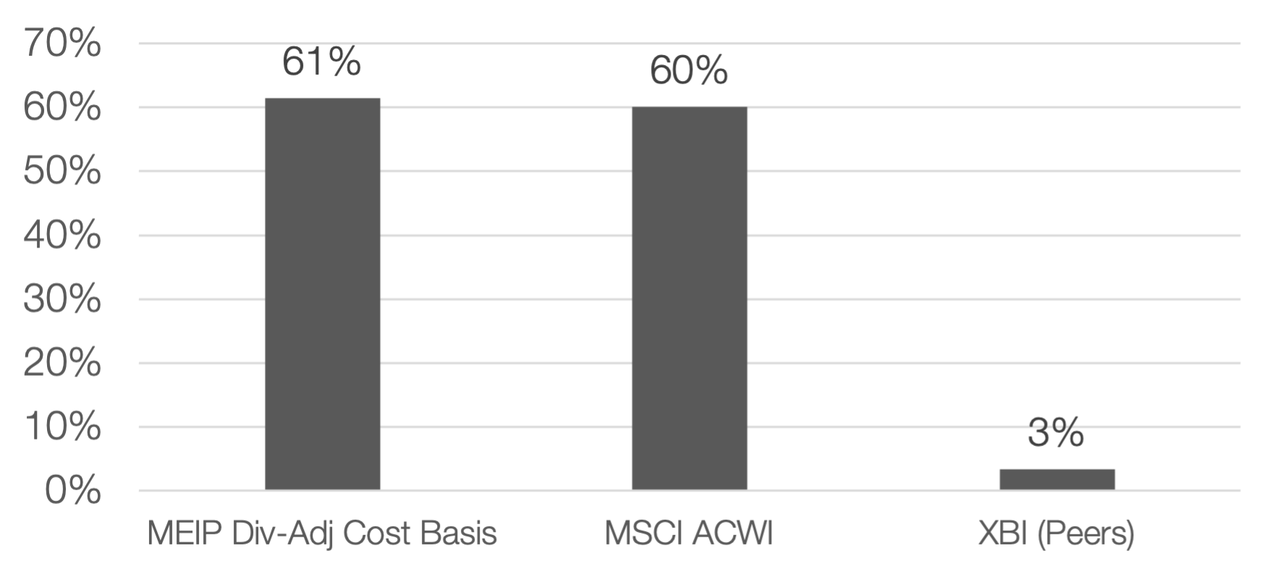

While recent press has characterized us as activists, we are defiantly not activists. We are active owners. We commit to our endeavors. We commit to win-win outcomes and aspire to be our managers’ strongest allies. We want to build better companies and build best-in-class growth. We do not just measure our underlying performance by a benchmark, but by a company’s direct competition. And thanks to MEI Pharma (MEIP) concluding its strategic alternatives process in a transaction that we took a leadership role in, we are now 3 for 3 in outperforming industry-peers’ performance.

Exhibit 1: Coinvestment III Inception to Date Returns as of July 31, 2025

Data source: CapIQ

Leonardo (OTCPK:FINMF): “A Dream Come True”

Selling your winners and holding your losers is like cutting the flowers and watering the weeds. ―Peter Lynch

Leonardo’s durable business trajectory continued to be our best-performing portfolio company, for the fourth year in a row. With a YTD gain of over 100% in US Dollars, Leonardo continues to sport best-in-class growth at the most attractive valuation in the industry. Leonardo contributed 18.0% to our accounts’ performance in the first half (excluding FX).

We were always deeply attracted to Leonardo’s under-appreciated product portfolio, which in their own verticals, are best-in-class. While nearly no investors knew this a few years ago, had they cared to chat with Leonardo’s customers, one of the largest of which are US defense primes, they would have understood that Leonardo’s radars, lasers, sensors, jammers, helicopters and trainers are truly best-in-class, and world leading.

An essential element to altering the capital markets’ perception of Leonardo from the “ugly duckling” into a swan, and a key reason we still have Leonardo as a meaningful position in our fund despite its significant outperformance, has been its CEO Roberto Cingolani. Roberto is by far one of the most impressive people we’ve ever met, in fact may not have any rival. He is candid, always honest, and always direct. He wants to make things work, and he brings out the best in people. It is an honor of a lifetime to be able to serve a crown jewel company under his leadership.

In fact, one of the important partnerships that Roberto has forged in his first two years on the job, with Baykar Systems for unmanned aerial vehicles, initially originated because Baykar’s drones in Ukraine that were armed with Leonardo’s protective jamming technology were the only ones consistently evading Russian assaults.

The exceptional managers at Leonardo, of which Roberto is the collaborative leader, have delivered some important milestones in the first half of the year — milestones that will surely drive at least a decade of sustained growth — all in the name of protecting a vulnerable continent. The company’s core competencies that started with best-in-class electronics have evolved under Roberto’s leadership to pressing advantages in space, and with drones, has enabled the company to launch a highly differentiated and best-in-class anti-missile defense shield.

While Leonardo’s radars and products are already used in a well-known US missile defense system, Leonardo will now offer this core capability to a western world in desperate need for it. Contrary to any US product, the company will enable customers to take full operational control of the system, without any interference from an “ally,” like the US.

But even more interesting, is the missile defense system will be a global-first that will allow customers to use local individual components, missiles, trucks, satellite constellations, and even their own radar, to selectively complement the full suite of services. As I told Roberto when he surprised the board with this finished turnkey system, “this is a dream come true.” For so long we have known that Leonardo’s core competencies were the key enablers for most of these technologies in the world. But now, the company will be able to sell this system directly to customers in a highly differentiated way.

Exhibit 2: Leonardo’s Integrated Air Defense Solution

Source: Leonardo Q2 2025 Investor Presentation

As Roberto articulated on the most recent earnings call, he and his team are studying capacity boosts to meet the decade of tailwinds ahead with efficiency and with the most capital-light approach possible. While the company’s security products will be in high demand for a decade to come, instead of splashing around capital as if there’s no tomorrow, he and his team are first studying how to get more out of the existing industrial footprint. Only after optimizing the industrial machine will he then commit to investing further into the industrial base.

As many other companies in the defense space announce repeated and casual billion dollar plus write downs as if they were immaterial, Leonardo is committed to maintaining its industry-leading efficiency. That has always allowed it to offer customers platforms with the lowest total cost of ownership, which its products have had to carry by design. With most other defense companies able to pass on inefficient cost structures onto captive governments, as an international-first business, Leonardo has always had to compete on the merits and cost effectiveness of its products.

Roberto and his team are far from finished synthesizing the world-class segments of Leonardo to becoming a stronger company together. The demands that an increasingly volatile geopolitical climate are putting on all peaceful nations will mean that Leonardo’s services and capabilities will remain in a robust bull market for a very long time. We are glad to be on this journey with such insanely great managers.

We’re excited to have you, our investors, interact directly with Roberto on a zoom in the coming months. We look forward to providing the details to our investors in short order and having you see for yourself why Roberto is one of the best executives we’ve ever had the privilege of working with.

After all, Ginger Rogers did everything that Fred Astaire did. She just did it backwards and in high heels. ―Ann Richards, Former Texas Governor

Speaking of insanely great managers, the executives at CTT continue to over-deliver. As they are “committed to deliver” this is performance we’ve come to expect — but it is still highly differentiated in a logistics world where most companies continue to miss and lower expectations. With early M&A execution going better than our own internal high bar predicted, the managers took the opportunity to raise guidance beyond just the non-organic update of the most recent customs business integration. Even before this took place, CTT contributed 9.8% to our accounts’ performance during the first half of the year (excluding FX gains).

CTT continues to create a highly unique business model, without comparison in the global logistics investment universe. Focusing on providing the “rails” that e-commerce runs on in Iberia, and now greater Europe, through customs clearance, fulfillment, best-in-class last mile delivery capabilities, as well as the largest out-of-home delivery network in Iberia, the company provides highly differentiated services to clients, who increasingly cannot do business in Europe without CTT.

By providing more services across the e-commerce stack, not only does CTT capture synergies, which it shares with its clients, but it also outperforms all competitors from a quality-of-service and order-to-delivery performance standpoint. Its last mile density in Portugal, and now Spanish e-commerce, affords it increased competitive advantages that are reinforced by the full turnkey e-commerce services.

Given e-commerce adoption in Portugal & Spain is still at a fraction of the levels seen in other European or western markets, the runway for growth is very long and durable. With the newly acquired customs operation now opening other markets for the group, we look forward to our best-in-class team seizing every possible opportunity for profitable growth.

Of course, it all started with a highly dense mail network. While that provided its own advantages, it also demanded rigorous, pro-active network management. Business models that other postal companies are only adopting today were adopted by CTT more than a decade ago and have now become obsolete for the company. As one of the few low-cost mail countries without formal government subsidies, the company continues to invent the future of efficient and reliable delivery models. It was forced to do so to stay alive. Executives had to work at least twice as hard as other logistics companies, and in doing so, the company has built a work ethic and record of execution that is without parallel in the industry.

In postal logistics circles, the company has become a benchmark for others looking to focus on efficiency and profitability. Yet, this network evolution continues to happen while the company invests in the e-commerce stack that has enabled more and more families to shop online in a low-cost manner in Spain & Portugal.

While much of our effort has focused on the e-commerce opportunity, the entire journey started in 2018 as we saw the opportunity for CTT to streamline its business model and realize the sum-of-parts values for investors by separating the industrial business from BancoCTT.

Unfortunately for our own execution timeline, interest rates going negative in Europe for a prolonged period would force us to wait on this core initiative. Yet, as the old saying goes, “the longer the wait, the sweeter the reward,” is thankfully likely going to apply here.

With Lonestar having successfully sold NovoBanco, a BancoCTT competitor, during the quarter for 1.7x trailing book value (1.4x forward), the company’s startup bank is the only major asset available for a banking market that continues to want to consolidate. With Iberian bank multiples now approaching 1.5x book value, the timing seems ideal for CTT to be entertaining options for the future of the bank.

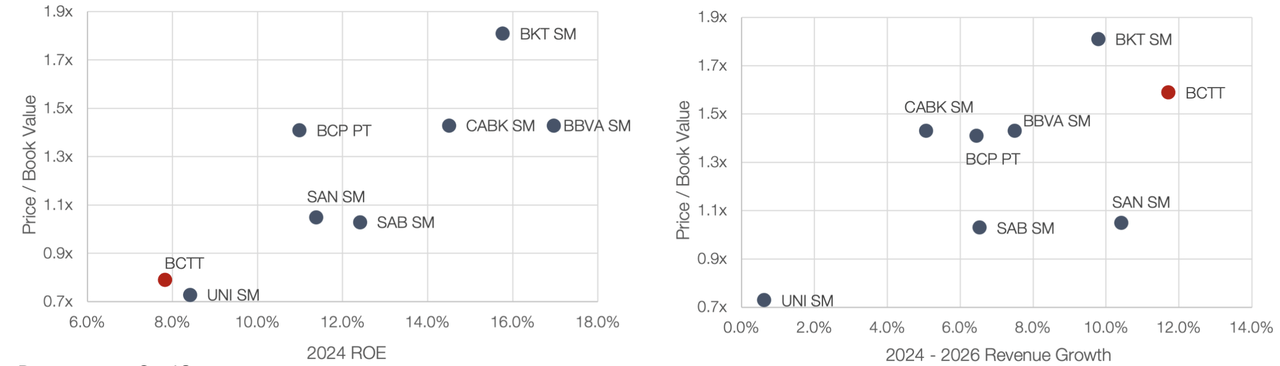

Exhibit 3: Iberian Bank Multiples & 3M (MMM) Euribor

Data source: CapIQ. Iberian Banks include UNI SM, SAN SM, BKIA SM, CABK SM, BBVA (BBVA) SM, SAB SM, BCP PT

Aside from the significant synergies CTT and BancoCTT can offer a merger partner, the company offers best-in-class growth. BancoCTT’s simple and low-cost banking offer has led to it taking roughly half of all gross additions for new accounts in the entire country. The company is taking the most share in a banking market that is profitable, but post-growth for most competitors.

BancoCTT’s new CEO Francisco Barbeira is focused on accelerating this growth rate by reinvesting in technologies and systems to enable more services, more credit products and a more robust customer experience. We look forward to him replicating his formidable track record to bring BancoCTT’s growth profile from good to great.

Exhibit 4: Iberian Bank Valuations & ROE, Revenue Growth

Data source: CapIQ

In analyzing trading valuations of European Banks by both growth & profitability, we find strong correlations between the Price / Book value ratio and both the ROE and the revenue growth rate (correlations of 79% and 58%, respectively). With a short lifespan of less than a decade, BancoCTT is likely not going to sport a best-in-class profit ratio vs. post-growth incumbents that have been around for a century or more. However, it can indeed sport best-in-class growth, and we believe that will show up in the fair value of the bank.

While the last thing we wanted to hear years ago was “not yet” when we asked for strategic alternatives for the bank, we believe the wait to realize CTT’s sum-of-the-parts has been highly worth it. We never anticipated a banking market that would fetch above-book-valuations, yet here we are, solidly north of 1x book value for lower-growth banks.

In many respects, we like CTT more at €7.60 than we did when we were buying at our fund’s dividend-adjusted cost basis of €2.04. Similarly for Leonardo today at €45.43, the opportunity set is accelerating and more robust than when we established our position at an average dividend-adjusted cost basis of €5.70. There is no doubt the market has rewarded the performance of these stocks, however, today we see companies that are better positioned and have a stronger competitive moat than when we entered. Both have more attractive profit and growth profiles today as reasonably priced assets than they did when they were priced for near extinction.

Swatch: Worth The Effort

People will stare. Make it worth their while. ―Harry Winston

During the first half of the year, we launched two new coinvestment funds for two new companies that are priced for extinction. The first of which was The Swatch Group (OTCPK:SWGAY) (UHR SW), which is trading for an unprecedented net-net valuation, or just over half of tangible book value. As one of the most shorted stocks in Europe, investors are saying that the company is worth more dead than alive. We beg to differ.

The company’s world-class brands Harry Winston, Omega, Breguet, Blancpain and Longines, among many others, have immense potential. We were pleased to see other investors support our position when, at the company’s ordinary general meeting on May 21, 61.9% of bearer shareholders elected Steven to the company’s Board of Directors. That is a legally binding vote according to Swiss law, and cannot be rejected by the Hayek family, which serves not only as the controlling shareholder, but also whose members serve as executives and chairs the board – regardless of their desire. We are currently engaging with the company and its counsel and hope to resolve this in a swift and amicable manner.

As we noted earlier in this letter, we believe we can work with anyone, and that includes the existing board members and managers of Swatch. While dramatic rivalries between views often makes for great headlines, in reality, it is a balanced equilibrium of viewpoints that enables true value creation. This is not about GreenWood’s views vs. anyone else’s. This is about bringing fresh perspectives, and more balance to a one-sided discussion that has not served the company’s stakeholders well. With both shares and revenue at multi-decade lows, perhaps it’s time for the company to consider another way.

In the past year, we’ve had well over 100 discussions with former managers and executives from Swatch, as well as shareholders, luxury experts, and watchmakers. We agree whole-heartedly with one of the most influential executives in the industry that we had the pleasure of meeting who said “We are just getting started. This is just the beginning,” of the luxury Swiss watch industry.

Never before have so many blogs, podcasts, magazines, and media covered the high-end mechanical watch industry. Collectors can now track their portfolios daily, and the addiction is spreading. According to Watchfinder & Co., Generation Z is 2-4x more likely to spend on a mechanical watch than any other generation. Those that have modernized their marketing strategies for the current age have taken substantial share from the Swatch Group, which remains at the core of a very important industry.

The company’s flawed and illegal response to the bearer shareholders expressing their will at the ordinary general meeting to finally have a representative on the board is exactly the demonstration of what needs to change at The Swatch Group. The company’s culture has become infamous for rejecting the viewpoints of important customers, wholesalers, shareholders and even managers (now mostly former managers) of the group. It’s time for the group to take in advice from their active owners who very much want to see reforms to the company’s governance procedures.

We look forward to being a part of the solution and will continue to refrain from being critical of a company in need of much cultural evolution.

Men in the Arena

It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly… ―Teddy Roosevelt

Our refusal to engage in a critical public campaign “against” The Swatch Group unfortunately meant we lost the opportunity to earn ISS’s recommendation. While the proxy advisory firm’s report argued for a clear need to reject nearly every measure the company put forward and argued for significant changes to governance — apparently it decided we failed to make a case for change. That was paradoxical to us, because the entire report calls for changes and new independent directors. Perhaps the firm will change its mind if and when we have an opportunity to submit our new proposals to shareholders in a forthcoming extraordinary general meeting.

Yet, we want to present solutions, not critiques.

In our constructive engagement with our other new investment and coinvestment opportunity, which also started last year, we are working with management to fill skill and experience gaps which the company has suffered from for far too long. While we support the CEO’s attempt to right the wrongs of the past decade, there are clear and obvious skillset areas the company needs to add to have a more balanced and sustainable strategy. If the company and its board get it right, we think shares have material upside potential.

Chris has led our efforts on this most recent name, and we have some incremental capacity to add to the investment before we anticipate becoming restricted. As we told the CEO of the company, we will be the company’s most committed and best ally in the quest to unlock a decade of profitable growth for a company that has previously only focused on financial engineering.

The Owner’s Mentality

Three ingredients make up the essence of the owner’s mindset and establish it as a source of competitive advantage. The first is a strong cost focus—treating both expenses and investments as though they are your own money. The second advantage is what we call a bias to action…The third advantage is an aversion to bureaucracy—an aversion, that is, to the layers of organization. ―Chris Zook & James Allen in The Founder’s Mentality

Reconnecting ownership to the board and management team of companies has become a core mission for us. As we have written at length about the benefits of owner operators to both value creation and long-term business sustainability, we see it working every day. Highlighting one of the surprises we had during the research of our white paper, which was published last month in the International Review of Financial Analysis (IFRA), share repurchases and dividends are surprisingly minimal within the global owner operator set.

Our latest investment, which has been focusing on dividends and share repurchases, nearly at the exclusion of every other metric, is case in point. It has yet to have a growth-oriented and committed owner on the board, and its focus has been instead on financial engineering. We think there is incredible untapped potential for this globally recognized brand as it looks to conquer new markets. We are certain it can only happen with the right skills in the board room.

And we end on an optimistic note for a case study that was heading for a gloomier outcome.

We went on the board of MEI Pharma (MEIP), along with two other committed owners of the company back in the fourth quarter of 2023. Our idea was to have the company attempt to progress two biotech clinical assets through ongoing trials in hopes of creating value from the remainder of the company’s pipeline. Unfortunately, both compounds, while transmitting promising signals, failed to clear the very high bar the owner-oriented board had set out for them.

Accordingly, the company initiated a strategic alternatives process in July of 2024. While the biotech and healthcare sector has been downright hostile for investors and bankers alike since then, starting late in the first half of this year, we led a shift in the company’s strategy towards a digital asset treasury strategy. We believe the new treasury strategy offers attractive and accretive capital allocation options for the company as it continues some pre-clinical work to eventually monetize the remainder of its drug pipeline under more accommodative market conditions.

The outcome has helped us secure a decent return for investors and owners of the company given an extremely tough environment. We are grateful to our collaborative investors and partners that helped connect us to Litecoin (LTC) founder Charlie Lee, who joined the company’s board last month. Just this past week, GSR Asset Management’s chief strategist Joshua Riezman took Steven’s board seat in order to drive the attractive capital allocation strategy from the board room. We feel we couldn’t have left the company in better hands, as it looks to execute on a highly differentiated digital asset strategy with Litecoin as the company’s core treasury holding.

Litecoin has more attractive attributes versus most other digital assets, in addition to carrying a smaller total market capitalization — with a fixed number of coins into perpetuity. That means as MEI grows its holdings, it will easily surpass the leader in the space (and former portfolio company) Strategy (MSTR) as a percentage of underlying digital asset owned. That creates an even more attractive capital arbitrage opportunity for the company given it can much more directly influence the underlying momentum of LTC versus the other companies pursuing Ethereum or Bitcoin strategies.

Exhibit 5: Peer Group Valuations & KPIs

| Company | Crypto Asset | Market Cap | NAV | Price / NAV | % of Asset Owned |

| Strategy (MSTR) | BTC | 107,752 | 69,121 | 1.56x | 3.1% |

| Bitmine Immersion (BMNR) | ETH | 3,162 | 2,030 | 1.56x | 0.5% |

| Sharplink Gaming (SBET) | ETH | 2,020 | 1,292 | 1.56x | 0.3% |

| Upexi (UPXI) | SOL | 283 | 296 | 0.96x | 0.3% |

| Tron Inc (TRON, fmr SRM) | TRX | 1,503 | 121 | 12.4x | 0.4% |

| Volcon (VLCN) | BTC | 491 | 475 | 1.03x | 0.0% |

| MEI Pharma (MEIP) | LTC | 181 | 112 | 1.62x | 1.2% |

Data sources: coin market cap, CapIQ, SEC, company reports

We believe MEI’s new treasury strategy will allow shareholders not only to experience another source of upside but will allow the company more time to partner its remaining drug assets — creating a win-win outcome during a very trying time for healthcare and biotech companies.

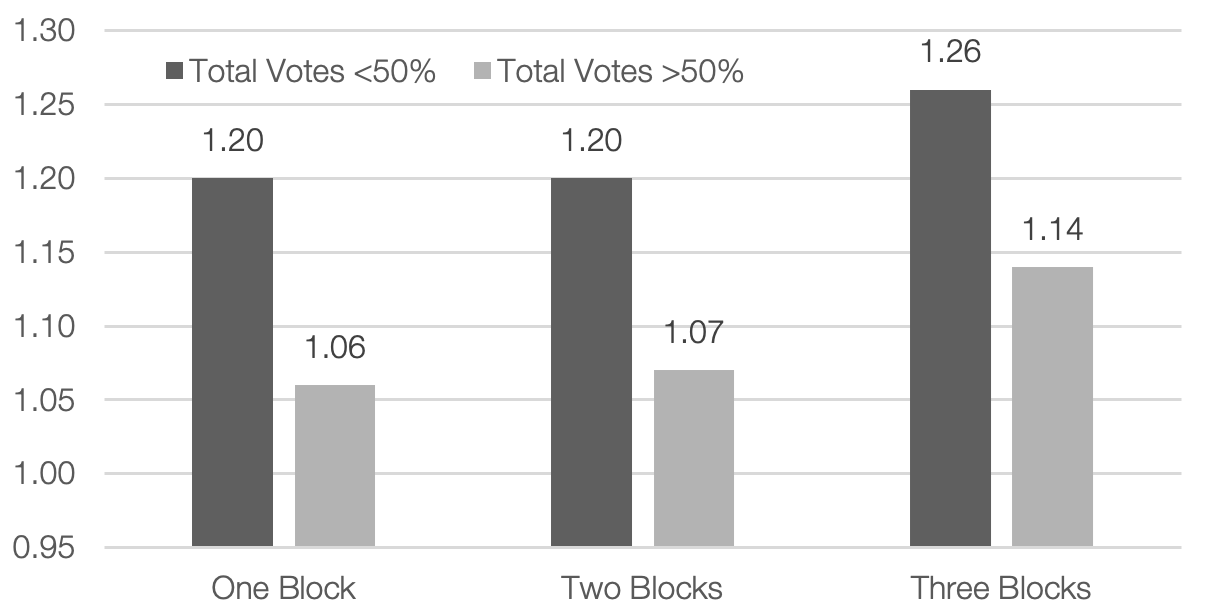

The win-win outcome at MEI is a testament to prior work by Maury & Pajuste (2005) that we’ve referenced before, which showed that multiple large shareholders on the board are better than only one large shareholder. We can say for certain the MEI outcome would not have been this graceful had it not been for a highly collaborative board environment, with constant idea sharing and unanimous open minds.

Exhibit 6: Valuation (Tobin’s Q) of Firms by # of Key Shareholders

Data Source: Maury & Pajuste (2005)

We are grateful to the other owners that collaborated to getting to this outcome, and are even more grateful the Litecoin founder Charlie Lee will take an active role in guiding the company’s strategy.

Founders are special people, and those that have staying power are rare. Even more than a normal owner, they live and breathe their creation as if it was an extension of them. There are often no renumeration schemes that will sufficiently pay for this level of focus. It is constant and considers failure to never be an option.

While most of the businesses in our portfolio have strong founder-like managers, we know diversity of thought is absolutely essential in the guidance and governance of these firms. We see the benefits every day within our own organization, and being able to partner with these accountable, driven and humble executives either on the board or off, is the honor of our careers.

We look forward to working with them to continue to build your capital alongside ours.

Committed to deliver,

Steven Wood | Chris Torino

Disclaimer:This article has been distributed for informational purposes only. Neither the information nor any opinions expressed constitute a recommendation to buy or sell the securities or assets mentioned, or to invest in any investment product or strategy related to such securities or assets. It is not intended to provide personal investment advice, and it does not take into account the specific investment objectives, financial situation or particular needs of any person or entity that may receive this article. Persons reading this article should seek professional financial advice regarding the appropriateness of investing in any securities or assets discussed in this article. The author’s opinions are subject to change without notice. Forecasts, estimates, and certain information contained herein are based upon proprietary research, and the information used in such process was obtained from publicly available sources. Information contained herein has been obtained from sources believed to be reliable, but such reliability is not guaranteed. Investment accounts managed by GreenWood Investors LLC and its affiliates may have a position in the securities or assets discussed in this article. GreenWood Investors LLC may re-evaluate its holdings in such positions and sell or cover certain positions without notice. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of GreenWood Investors LLC. Past performance is no guarantee of future results. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.