Even as their acronym-riddled internet slang may leave you guessing— IYKYK—Gen Z has its priorities straight. Fresh into their working years, these digital natives aren’t afraid to splash the cash, indulging in the latest fads and fashions. At the same time, they are actively investing their money in various avenues.

What sets them truly apart from previous generations? They splurge on Korean ramen and Ed Sheeran concerts while simultaneously building investment portfolios through Systematic Investment Plan (SIP) via apps on their phones, often starting with their first internship stipends..

“A quiet but compelling shift is underway in India’s financial ecosystem,” observes Ajay Kumar Yadav, CEO and CIO of Wise Finserv. “It’s not happening in boardrooms or stock exchanges, but on the smartphones of students, freelancers, and first-jobbers. At the heart of this transformation is Gen Z, India’s youngest and most digitally connected generation.”

In this story, we delve into the quirky money habits of the free-spirited Gen Z. We identify what they are doing differently, the proclivities that will push them towards financial security and the foibles that could put their financial well-being at risk.

Vanshika Kumar,24, New Delhi, runs home decor business

SPENDING HABITS

- Prefers spending liberally

- Doesn’t consciously monitor everything, but keeps track of where money goes

- Major spending is on food and experiences

SAVING/INVESTING HABITS

- Started investing in 2021 after getting first job at age 20

- Prefers long-term investments (mutual funds and stocks) over shortterm or day trading

- Researches on her own or takes advice from family

Living the Instagram life

Unlike their predecessors—the more circumspect millennials—Gen Z prefer living in the moment. This reflects in their attitudes towards spending. Aspirational spending, or the Instagram lifestyle, is this generation’s “flex.” Running her own home décor business in New Delhi, Vanshika Kumar, 24, prefers spending liberally, often overlooking the price tag. “My major spending is on food and experiences. Those are the areas I value the most and try to save for,” shares Vanshika.

For some who have just started earning, it’s as if the handcuffs have come off. No wonder then that 43% of India’s total consumption spending is led by Gen Z, according to the BCG Snapchat study. Mumbai resident Sawnee Jogdand, 17, got her first gig only three months ago, making reels for small business owners. Her spending has already increased since. “I would hesitate to ask for pocket money from my parents, as my lifestyle expenses were quite high. Now that I have started earning, I feel independent and confident enough to spend on myself,” she says. Her indulgences include frequenting premium cafes, arcade gaming parlours, among other outings.

Gen Z spends generously on food, with eclectic tastes spanning Korean ramen, kimchi, kombucha, oat-milk lattes, and bubble tea. They aren’t stingy about ‘experiences’ either. Instagram-friendly travel ranks high on their list, offering both lasting memories and self-discovery. In India, Gen Z averages two to three trips a year, according to Hilton’s 2025 report. Outings tied to sports events like the Cricket or Football World Cup, or music festivals such as Sunburn, Lollapalooza, and concerts by Coldplay, are especially popular. Many don’t think twice before shelling out Rs.20,000-25,000 to watch Ed Sheeran or Dua Lipa live.

They love to flaunt their “drip”—appearing stylish through clothing and accessories. Girls stay on top of glam trends via social media posts tagged #OOTD (Outfit of the Day) and #GRWM (Get Ready with Me). The latest drops from Zara or H&M, tote bags from Zouk, and cosmetics from Juice or Nykaa are all the rage. Boys, meanwhile, are hooked on the newest smartphones, gaming gear, and sneakers. Nike Air Jordans or official merchandise from The Souled Store aren’t just cool style statements—they also make for eye-catching unboxing content. “My peers are instantly drawn to hype around anything new. They will rush to buy it just to look cool or keep up with the trend, however heavy on the wallet,” Sawnee says. This FOMO (fear of missing out) is what drives the hysteria around collectables like Labubu dolls.

These young consumers are bingeing on the good life. To be sure, many are acutely aware of their spendthrift ways. They rationalise purchases to make them seem like worthy expenses: “I saved Rs.1,200 in the Big Billion Days sale, so I basically earned Rs.1,200.” Or, “Rs.1.5 lakh for an iPhone is fine because I’ll use it for 3 years—only Rs.137 a day, cheaper than a latte.”

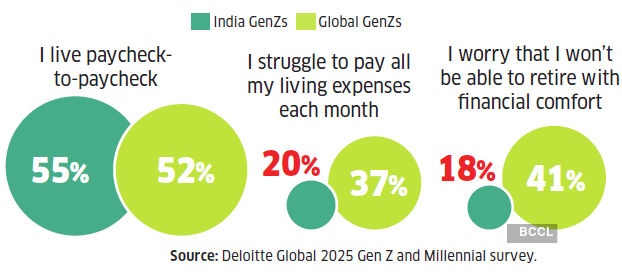

But loose purse strings are also chafing their finances. A Deloitte study shows that 55% of Indian youth report living paycheck to paycheck—higher than the global average. Easy access to loans via fintech apps has put many on the credit treadmill. Those in their early 20s account for 20-25% of loans disbursed through digital platforms—a significant share, given their recent entry into the credit market. A chunk of these borrowings is now turning sour, with recent RBI reports flagging high stress in fintech loans, particularly among individuals under 25.

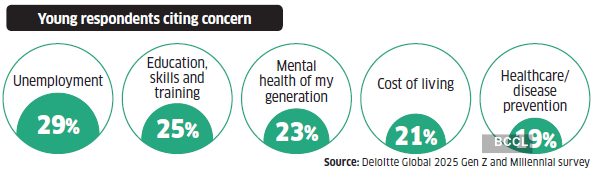

A significant portion of these young adults needs to come to terms with reality soon. Ironically, unemployment is the most critical concern for Indian Gen Z, according to the Deloitte survey. Layoffs and retrenchment are affecting thousands as AI advances rapidly. Yet, the cost of living (topmost concern for millennials) comes in at a distant fourth for Gen Z.

Financial pitfalls: Falling into the debt trap so early is hazardous. If your credit scores tank, it will dent your ability to access loans for critical expenses in the future. Discretionary expenses must be curtailed to align with income. Krishan Mishra, CEO, FPSB India, insists, “Striking a balance between present enjoyment and future security is key. By maintaining an aversion to unnecessary debt and reinforcing savings habits, Gen Z can future-proof their finances in an increasingly unpredictable economic environment.”

If you find yourself giving into FOMO and impulse buying, reflect on the purchase: Wait 24 hours before buying anything trending. Ask yourself if you will still use the item a year from now?

Investing – To The Moon!

Soon after she got her first job at age 20, Vanshika identified her first investment in the Nifty100 index fund. She doesn’t invest regularly yet, but prefers long-term investments over short-term or day trading. “My preferred choices are mostly index funds or mutual funds, because I find them safer. I’m not deeply involved in investing, so I feel more comfortable with lower-risk options,” she says.

New Delhi-based Prerit Singhania, 26, a credit officer at a prominent foreign bank, started investing four years ago. His first investments were in a Nifty50 index fund and Parag Parikh Flexi Cap Fund. Prerit has already formed a disciplined investing habit. He allocates a generous 50%-60% of his income toward savings and investments. Around 40% of his salary is invested in equities, and another 20% in fixed deposits (FD) or bonds. He transfers approximately 10% to a separate bank account linked to his UPI (United Payments Interface), which helps him track and control his monthly spending. He stashes the remaining 30% in liquid funds for any emergencies or spontaneous opportunities. “Since I don’t have dependents so far, I prefer an aggressive approach: a larger allocation to equities for longterm growth,” says Prerit. He mainly prefers SIPs in equities as it instils a habit of saving before spending. Additionally, he occasionally deploys some of his liquid funds to capitalise on market dips.

Prerit and Vanshika are among many other Gen Zers who have started investing early. “Earlier, investment was something people started after getting a stable job. But Gen Z begins earlier. Many invest from their pocket money or internship stipends,” avers Yadav.

Sawnee Jogdand, 17, Mumbai, makes reels for small business owners

SPENDING HABITS

- Secured first gig few months ago, spends have jumped since

- Major spending on outings, arcade activities, cafes

SAVING/INVESTING HABITS

- Yet to start investing formally

- Uses Fampay account for spends (where fixed percentage of money credited gets locked into savings).

Where young consumers spend

Gen Z is impacting $860 billion of consumer spends – 43% of total.

Gen Z drives a big share of consumption

48% Eating out and ordering in

47% Fashion and lifestyle

47% Travel and vacation

47% Video OTT

45% Consumer tech devices

44% Beauty and personal care

72% of Zoomers search on creator pages while purchasing products

Living in the moment

55% of Gen Zs in India living paycheck to paycheck, higher than the global average.

Share of Gen Z agreeing with these statements on financial security:

A recent Share.Market analysis of over 6 lakh mutual fund investors between 1 August 2024 and 31 July 2025 reveals that approximately 48% of mutual fund investors is in the age bracket of 18 to 30 years. The research indicates a substantial shift in young people’s mindset towards investing and long-term wealth creation. Furthermore, the data highlights that nearly 95% of Gen Zers begin their investment journey in mutual funds through equities. Almost 92% of the young investors invest through SIPs on the platform.

Note:“By maintaining aversion to unnecessary debt and reinforcing savings habits, Gen Z can future-proof their finances.”

KRISHAN MISHRA,CEO, FPSB INDIA

“I believe this is an extremely healthy trend, as it helps young investors gain valuable experience early on, which can go a long way in making them confident investors by the time they enter their 30s and have more substantial sums to invest,” says Nilesh D Naik, Head of Investment Products, Share.Market. Particularly encouraging is Gen Z’s affinity for financial assets over physical assets, such as real estate. “Their focus on investment before asset ownership and early retirement planning is commendable,” says Mishra.

The preference for DIY (do-it-yourself) investing is evident among this generation. More than half of Gen Z learns about investing from YouTube, Instagram, or finance creators, according to a 2024 Groww Insights report. “Just like elsewhere globally, Gen Z investors in India find unprecedented access to financial information through digital platforms and from sources such as finfluencers,” remarks Pankaj Sharma, Director – Capital Markets Policy, India at CFA Institute. This has led to some cultural shifts in investing habits. “To say Gen Z is different is an understatement. They’re not just learning about money earlier; they’re taking action—early, digitally, and intentionally. They’ve made UPI their first financial language, SIPs their first commitment, and ETFs their first equity exposure,” Yadav remarks. “Armed with mobile apps, YouTube explainers, and trialand-error investing, they’ve built their own curriculum. It’s not always perfect, but it’s proactive,” he adds.

Prerit Singhania, 26, New Delhi, Credit Officer at foreign bank

SPENDING HABITS

- Prioritises essential expenses first

- Allows for discretionary spends after allocating towards savings

- Major spends on gadgets such as mobile phones, smartwatches, stand-up comedy

- Transfers fixed sum to separate bank account every month for online spends

SAVING/INVESTING HABITS

- Allocates 50-60% towards savings and investments

- Prefers SIP in equity and FDs or Bonds for fixed income

- Has experimented with cryptocurrencies

- Relies on own analysis rather than any advice on social media

However, this affinity for self-education also exposes Gen Z to misleading advice and investment scams that can ruin finances. Naik cautions, “Although there is now an abundance of educational content available on social media, young investors must perform due diligence to ensure they choose genuine educational material from educators and content creators who possess the necessary knowledge and experience in the investment domain.” Some are already cautious about taking unverified financial advice on social media platforms with a grain of salt. Prerit insists, “When it comes to making decisions, I rely on my analysis and fundamentals. Platforms like YouTube and Instagram are good for awareness, but I always do my due diligence.”

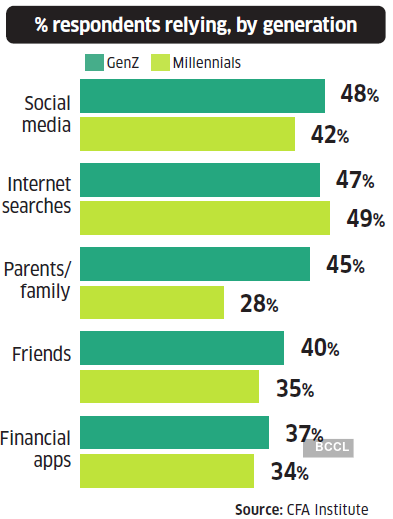

Gen Z relies more on social media to learn about money, investing

Parents and family remain the most trusted resource.

Some among Gen Z also exhibit adventurism in their choice of investments. The pursuit of higher returns has driven many towards speculative bets on cryptocurrencies, F&O, as well as high-yield bonds. These are hazardous investments. A Securities and Exchange Board of India (Sebi) study shows that nine out of 10 retail investors end up making losses in F&O. The recent default in TruCap bonds, where retail investors chased a 13% yield, reveals the inherent risks of high-yield bonds. CFA Institute’s Sharma cautions, “Gen Z’s strong focus on higher returns without sufficiently analysing the associated risks, frequent investment decisions based on unverified recommendations and preference for engaging content over its quality, heighten vulnerability to misinformation and ill-informed financial decisions.” Prerit has recently started investing in bonds, attracted by 3-4% higher yield over FDs. He has also experimented with cryptocurrencies. However, these pursuits may have to be tempered. Naik of Share. Market asserts, “While Gen Z investors’ openness to exploring newer investment products is commendable, they should be cautious not to fall for false claims from unregulated or extremely high-risk products.”

Unemployment is the biggest concern for Zoomers

Millennials are most concerned with the cost of living, Gen Z have other worries.

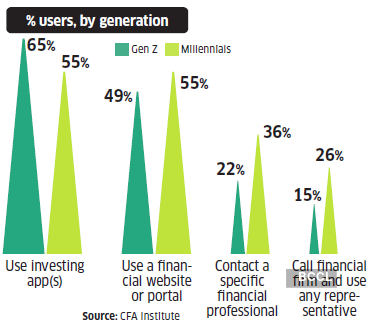

Digital apps have powered Gen Z investing habits

67% of young users say app nudges influence investments.

Experts maintain that Gen Z must lay the foundation for their finances. Mishra of FPSB India remarks, “While Gen Z often embraces a ‘live in the moment’ mindset, building a strong emergency fund should remain a top financial priority—alongside managing debt and investing wisely.” Mrin Agarwal, Founder, Finsafe India, asserts that Gen Z remain vulnerable if they don’t work on making a habit of savings and investing and tone down returns expectations. “Do not get swayed by trending products. Remember that wealth building takes time.