The strategic investment will likely either start a long-awaited turnaround or damage the company beyond reasonable repair.

Big news from Ford Motor Company (F 1.00%): The automaker’s investing another $5 billion in its electric vehicle business, hoping to drive much-needed sales growth while simultaneously fending off would-be Chinese competitors. The company made the announcement last week.

And, kudos. Most long-term shareholders would agree Ford needs to do something — anything — to light a fire under its lethargic stock. Ford shares are still priced where they were in 2002, after all, even if decent dividends have been paid for most of the meantime.

What’s not clear is if this is the best move Ford could make at this time to get shares moving again. Here’s what investors need to know about the plan.

This investment rethinks its electric vehicles from the ground up

The company’s already in the EV business, to be clear. It makes a handful of hybrids, although its highest-profile electric vehicles are arguably its all-electric F-150 Lightning and a pretty cool all-electric Mustang called the Mach-E.

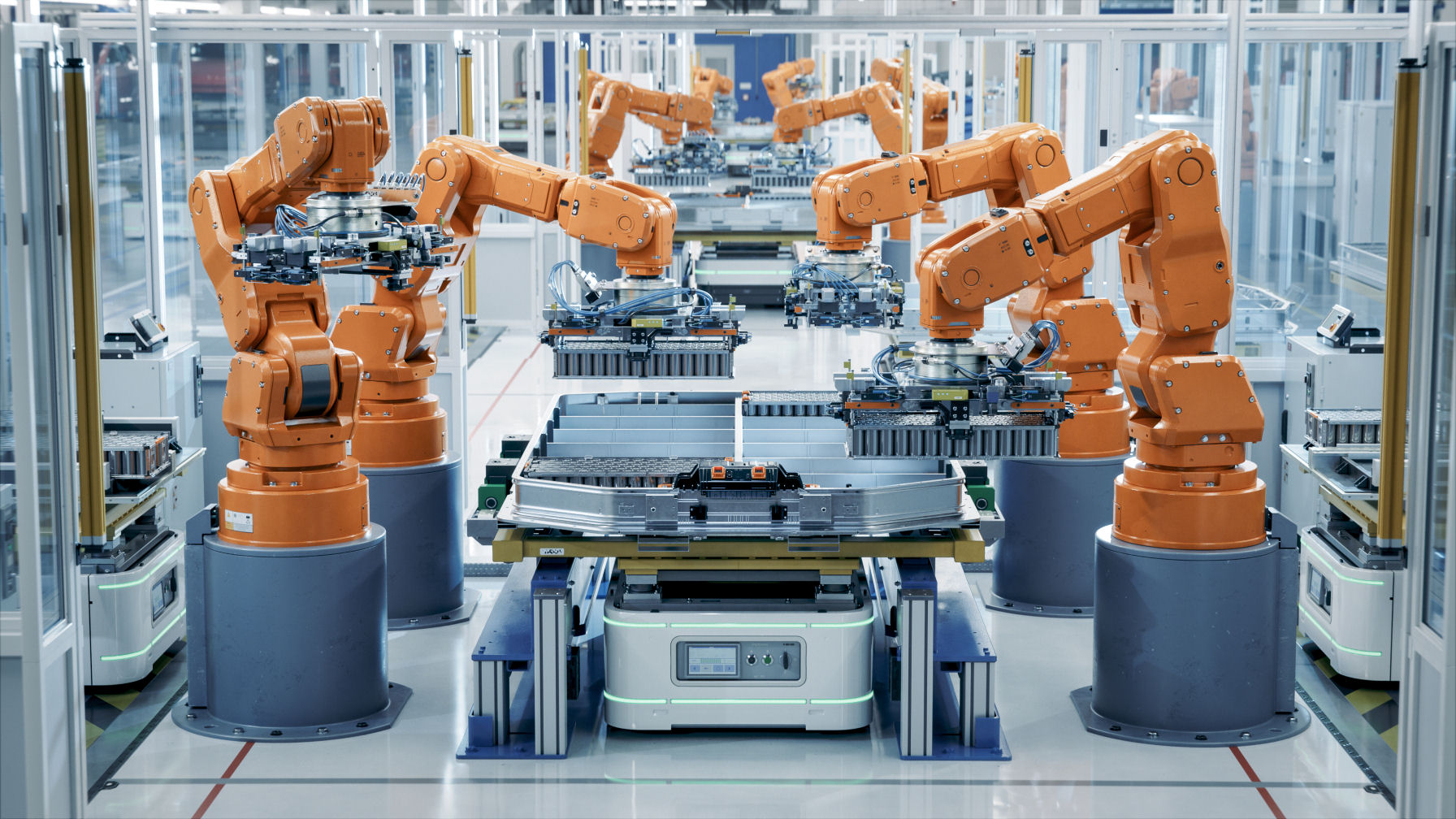

With the exception of their batteries and electric motors, however, these EVs are still designed and manufactured rather similarly to ordinary combustion-powered automobiles. Ford’s $5 billion plan includes a whole new kind of assembly line specifically for electric vehicles. And not just one. This assembly line will be capable of supporting the manufacture of several different kinds of vehicles including a light pickup truck with a targeted starting price point of around $30,000.

Image source: Getty Images.

More than half of the $5 billion investment, however, will be made in the lithium batteries required by all electric vehicles. Ford says its new battery tech can lower the size and cost of EV batteries by around one-third without sacrificing any range per charge, solving one of the EV industry’s biggest lingering problems.

Ford’s existing EV business isn’t exactly thrilling … or profitable

As exciting as this decision may be, again, it’s not exactly Ford’s foray into the electric vehicle market. It’s the company’s second (and perhaps third) chapter. And its story to date hasn’t exactly been thrilling. The aforementioned Mustang Mach-E became available in 2021, while the F-150 Lightning and a new delivery van reached the market in 2022. A few more Ford-made hybrids have been unveiled since then as well. Yet, Ford only sold $3.9 billion worth of electric vehicles last year, down 35% year over year, and only accounting for about 2% of its total top line of $185 billion. Its EV arm also lost a little over $5 billion in 2024, on an operating basis.

It’s a concern simply because it’s difficult to determine if the challenge is a lack of production scale, a lack of demand, or a combination of both.

The ambitious goal may be aimed at the wrong market

Ford will almost certainly do it right. But, figuring out how to make an affordable and marketable electric vehicle may be of little actual benefit to shareholders.

Simply put, Americans as a whole are anything but stoked about battery-powered automobiles. A recent survey performed by the American Automobile Association (which you know as AAA) indicates that only 16% of U.S. adults are likely or very likely to purchase a fully electric automobile. That’s down from 2024’s figure of 18%, marking three years of declines from 2022’s 25%. Conversely, the number of American consumers who are unlikely or very unlikely to purchase an EV has grown from 51% to 63% during that four-year stretch.

Ford isn’t just a U.S. company, to be clear. It also makes and markets vehicles overseas — even if largely through partnerships — where EVs are considerably and increasingly more marketable. For instance, the International Energy Agency believes that 80% of China’s new automobile sales will be EVs by 2030, versus only about half of the country’s new-car sales now.

Ford is mostly an American company though, where it produces roughly two-thirds of its total sales and very nearly all of its profits. And, while the U.S. company’s electric vehicle production know-how and battery technology could be utilized elsewhere, it’s difficult not to notice the American-ness of its $5 billion plan. The EV production facility in question is located in Louisville, Kentucky, while the new-tech lithium batteries will be manufactured in Marshall, Michigan. Let’s also not look past the fact that the one vehicle Ford has touted that will be made by this new assembly line is a low-cost pickup truck, which, of course, is wildly more popular here than anywhere else in the world.

This is (almost) an all-in bet on the company’s future

Given the American-centric nature of Ford’s big investment in EVs, largely aimed at a market that isn’t exactly in love with battery-powered vehicles, the concerns being voiced are understandable.

Although the cost doesn’t quite present the existential crisis that some analysts are hinting at, it is a sizable bet for any struggling company that only clears about $5 billion in net income per year and is sitting on more than $100 billion in long-term liabilities. If Americans don’t come around on electric vehicles by the time they start coming off of Ford’s new assembly line in 2027, the company’s current challenges will only worsen. As such, there’s no room for any error here, including errors in judgment as to the future marketability of EVs in the United States. That’s why any interested investor will want to think very carefully before plowing into a new stake in this carmaker.

Still, with Ford shares priced at only about 8 times next year’s expected per-share earnings of $1.40 and a trailing dividend yield of just over 5%, it seems most (if not all) of this risk is already priced in. It wouldn’t be unreasonable to find a little bit of room in your portfolio for Ford stock at this time. You just might want to contain your risk by keeping any position in this name smaller than you might normally take on.