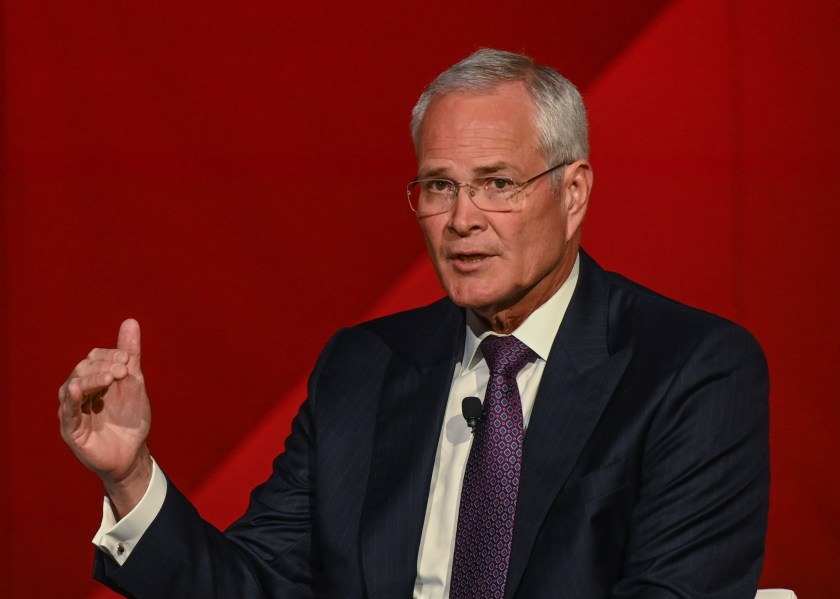

Exxon CEO Darren Woods says he wants to leave renewable energy to the experts: “We don’t bring any real capabilities to that space.” Artur Widak—NurPhoto via Getty Images

Good morning.

Exxon has never been the most media-oriented Fortune 500 company. But on this week’s episode of Leadership Next with my colleagues Alan Murray and Michal Lev-Ram, CEO Darren Woods curbed some of that image while vigorously defending Exxon’s business and profit model.

In a wide-ranging interview, he kicked off by describing Exxon, which for much of its existence has been the world’s largest oil company, as a “technology company”—just one that happens “to focus on hydrogen and carbon molecules.” But, he added, Exxon’s core activities could change as long as the company can leverage “the same core competencies, same core capabilities.”

From there, Woods defended his company’s continued focus on oil and gas (rather than renewables), as well as his view of shareholder primacy. Here’s what he said:

On Exxon’s lack of solar and wind energy investments compared to European oil majors:

“I think that’s a hollow argument…Our view is we don’t bring any real capabilities to that space…We don’t bring capabilities other than a checkbook. And so we don’t see the ability to generate a better than average returns for our investors.”

On Exxon suing activist shareholders over their repeated climate proposals:

“We want to cater to the shareholders who are real investors, who have an interest in seeing this company succeed in generating return on their investments…We don’t feel a responsibility to activists that hijack that process…and frankly, abuse it to advance an ideology.”

On decarbonization subsidies, regulation, and carbon prices:

“Building a business on government subsidy is not a long-term sustainable strategy. We don’t support that…We’re advocating to move to market forces, either through regulation [or] prices on carbon … that that will drive the markets to start innovating and find solutions.”

On Exxon’s investments in lithium to power EVs:

“The reason we’re in lithium is because we can provide our skill sets to a product that the world is going to need as we electrify…We can produce that at a lower cost and more environmentally friendly footprint…therefore there’s an advantage that we can bring to that space.”

Exxon also has a plan to become net zero in its direct emissions, Woods reminded my colleagues, and brought the ‘plan not pledge’ approach for cutting carbon emissions to Pioneer, the company it merged with last year. One of its activist investors, Engine One, “100%” supports Exxon’s sustainability strategy, he noted.

The whole interview is worth a listen, and you can do so on Apple Podcasts or Spotify.

For a different take on Exxon’s case against its activist shareholders, you can read this Fortune commentary on what Milton Friedman would say: “He was adamant that the shareholders have the last word”. Going into the 2024 proxy season, it’s a fascinating debate.

More news below.

Peter Vanham

peter.vanham@fortune.com

@petervanham

TOP NEWS

Apple’s car plans run out of charge

Apple is giving up on its plans to build an electric car and will now move 2,000 employees to work on AI projects instead. The iPhone maker has been working on a car since 2014, investing billions of dollars into the project. Executives were reportedly concerned that the long-delayed car, even if it came to market, would not be able to deliver the profit margins Apple is used to. Bloomberg

Flirting with death

Former employees at the Boring Company, Elon Musk’s venture to transform tunneling and urban transport, tell Fortune’s Jessica Mathews of a working culture that puts safety at the “bottom of the totem pole.” An OSHA investigation last year found that the work site exposed employees to serious injuries. Construction is one of the deadliest industries in the U.S., perhaps making it a poor fit for Musk’s hallmark approach of high expectations, rigid deadlines, and long hours. Fortune

Country Garden gets a winding-up petition

A creditor of Country Garden, the Chinese mega-developer that defaulted on its debt last October, filed a winding-up petition in Hong Kong court. A similar petition against fellow developer Evergrande led to a liquidation order earlier this year. Country Garden called the petition “the aggressive action of [a] sole creditor.” South China Morning Post

AROUND THE WATERCOOLER

Business leaders are failing their workers when it comes to AI guidance and it could spell disaster for productivity by Trey Williams

How the top CHRO networking groups compare—and how much they cost by Paige McGlauflin and Emma Burleigh

‘Before any crash it felt great’: Jamie Dimon isn’t sold on the good news coming out of the U.S. economy, saying it may prove a precursor of a recession by Eleanor Pringle

BYD Americas boss claims carmaker has no interest in expanding into Tesla’s home market as she prefers to focus on EV laggards Brazil and Mexico by Chritstiaan Hetzner

Wells Fargo study highlights increasing anxiety among U.S. earners: ‘We’re not getting as much utility out of our money as we used to’ by Alicia Adamczyk

Novo Nordisk faces competition close to home as Danish rival Zealand Pharma’s shares jump 35% on ‘groundbreaking’ weight-loss drug trial results by Prarthana Prakash

This edition of CEO Daily was curated by Nicholas Gordon.