US President Donald Trump’s pro-fossil fuel policies spell opportunity for some climate investors.

Trump’s push for to drill more oil and gas and reduced reliance on clean power may be drawing the ire of climate activists and have helped Big Oil firms pivot back to what they are best at. But as fossil fuel giants shun even limited efforts at solar and wind, inflation fears keep interest rates steady, and Washington rhetoric chills the green-power sector, some investors see bargains to be picked up.

“The US is going to be a very relevant, meaningful market for us in the next few years,” said Oscar Perez, CEO and managing partner of Qualitas Energy, a Madrid-based private equity firm that in late 2023 closed a €2.4-billion fund, one of the biggest on the continent. After selling down its last investment in the US in 2012, Qualitas used its latest fund to acquire a North Carolina solar-and-battery-storage business.

“Overall, there was a feeling of potential. This was the perfect environment, we found.”

The barrage of executive orders and agency appointments in the first two-plus months of the second Trump administration has triggered a measure of despair from climate-forward types: For example, ExxonMobil — confident that in its drilling technology but also, as my colleague Tim McDonnell put it, in “a growing sense that the climate ambitions of… world leaders are losing political momentum” — plans to increase oil output in the coming years.

Yet that doesn’t mean that the energy transition has stalled, much less reversed. Deep-pocketed investors instead see the bad vibes as creating value by driving down the purchase price of major renewables assets. Qualitas is far from alone: the deputy chief investment officer for renewables at the giant firm Brookfield Asset Management told Bloomberg last week that “a dislocation between what the market noise is and the fundamentals, that creates a very good opportunity for us.” Senior executives at the investment bank Jefferies and the private equity behemoth KKR echoed those sentiments.

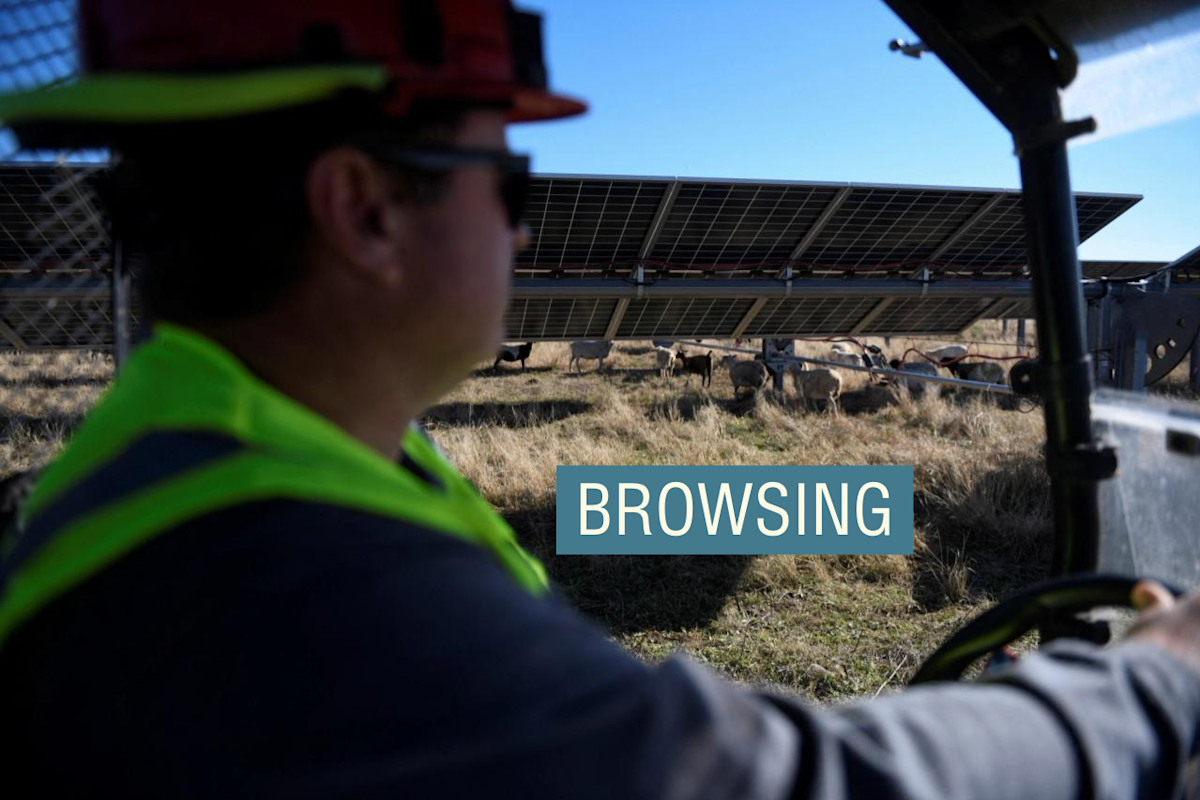

For Perez, the case for the 2024 North Carolina deal, as well as future ones Qualitas is eyeing, is driven both by surging demand for power thanks in large part to the growth of data centers, as well as mounting stresses on solar developers making them attractive acquisition targets: Such firms often borrow heavily in order to ready sites for solar farms with the aim of selling them on to operators at a profit — a model that worked well when interest rates hovered near zero, but which has been strained in recent years as the Federal Reserve has ratcheted up borrowing costs.