WEST SPRINGFIELD — The Scuderi Group knows there are questions, questions from a reporter who’s called and emailed over the last few days and even reached out to its attorney and a former state representative who served as its lobbyist.

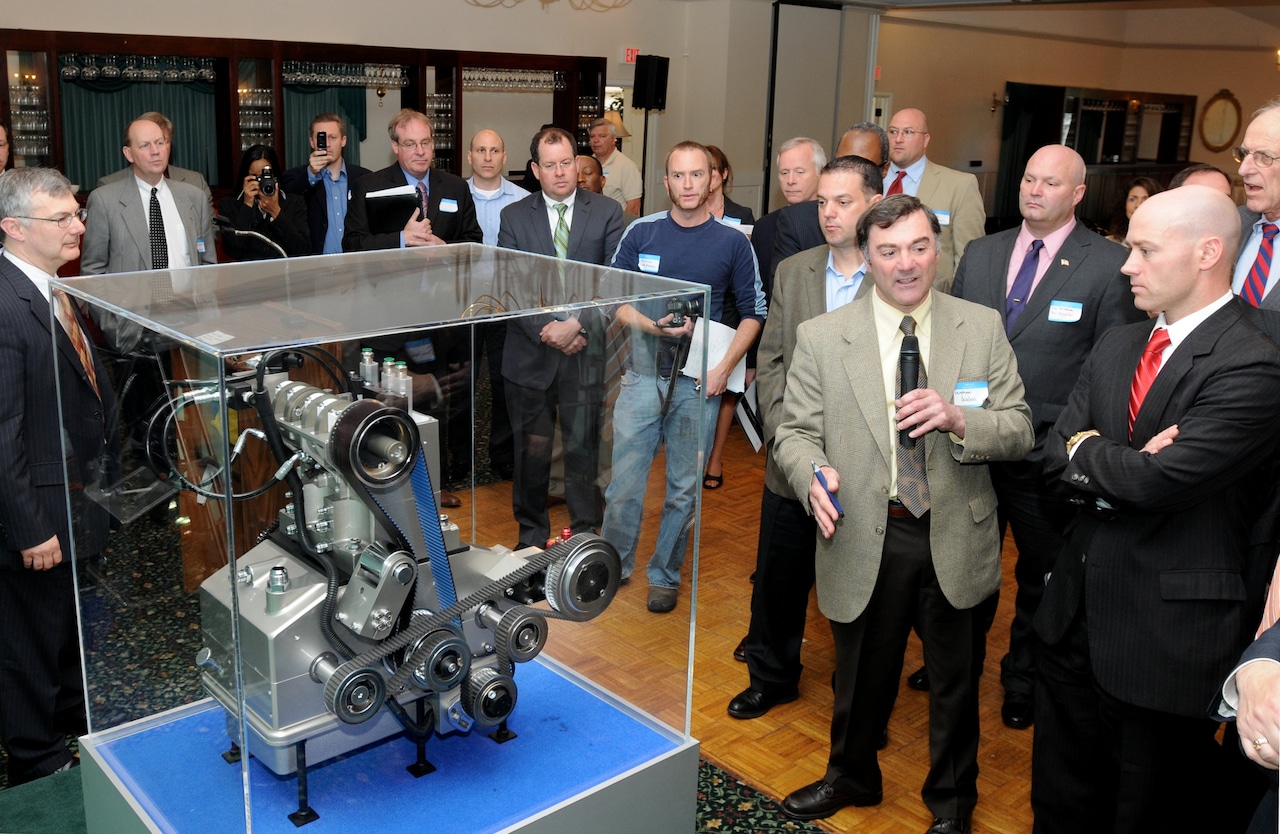

The questions have also come from the group’s small-time investors who were recruited word-of-mouth or at seminars. The Scuderi Group raised more than $80 million from 2004 to 2011, according a federal Securities Exchange Commission enforcement action, telling investors about a dream of turning an engine developed by patriarch-inventor Carmelo Scuderi into the go-to engine for carmakers worldwide.

The engine design, the group said, generated more torque while using fuel more efficiently than a conventional engine. At the same time, the Scuderi Group said the engine both stores energy while generating it.

But after years of waiting, some investors are beginning to lose hope.

“I don’t have any faith that this is ever going anywhere,” said Elizabeth Carpenter, of Clinton, Connecticut.

Elizabeth and her husband Shane Carpenter invested $25,000 back in 2005 after hearing about Scuderi and attending a talk at the Naismith Memorial Basketball Hall of Fame in Springfield.

“We took a leap of faith,” she said.

Now, those investors complain — often on a Facebook group and on the online forum Reddit — that it’s been years since they’ve gotten an update, substantive or otherwise.

Paul Caron, the lobbyist who worked with Scuderi, said recently that he believes Scuderi is still developing the engine.

Messages left in person at the company’s West Springfield offices were unreturned. A visit to a related company, ESG Clean Energy in Holyoke, revealed what looked like an operating power plant on Water Street in an industrial neighborhood between the canals and the Connecticut River. But there were no cars in the parking lot on a weekday afternoon.

Shane Carpenter shares his wife’s sense of frustration-turned-anger-turned-resignation. The same sorts of complaints — often expressed in blunter terms — are common among other investors who spoke to The Republican but didn’t want their names used in print.

“A lot of the investors were all very naïve, us included,” Shane Carpenter said. He added, refencing Sal Scuderi, Carmelo Scuderi’s son who once rain the company, “But Sal made it sound like this was going to take off in the next year or two.”

Bob Swick invested $11,000 in 2009. At the time, he lived in Wallingford, Connecticut. His last successful connection with Scuderi was a few years ago when he notified them that he moved to North Carolina.

“I understand capital risk. I’m not oblivious to that,” Swick said. “Capital risk with no communication is not acceptable.”

A bankruptcy filing

Within the last few weeks, eagle-eyed investors spotted something new: a bankruptcy petition filed last month by ESG Clean Energy and ESG H2 LLC, companies led by President Nicholas J. Scuderi, who also heads the Scuderi Group and shares offices in West Springfield.

ESG Clean Energy in Holyoke, Tuesday, May 20, 2025. (Douglas Hook / The Republican)Douglas Hook

There is no investor money at stake with ESG Clean Energy, said James P. Ehrhard, the attorney handling the bankruptcy proceedings. In phone interviews over the last week or so, he explained that ESG is developing carbon-capture technology.

In 2022, it built a 3.9 megawatt generating plant on Water Street in Holyoke with the backing of Colliers Funding LLC “to demonstrate the technology,” he said.

The ESG system design utilizes patented technology, the company has said, that captures all the carbon from the plant by first removing moisture from the exhaust, which increases the amount of carbon-dioxide that can be captured.

Holyoke Gas and Electric spokesperson Kate Sullivan Craven confirmed that there is a power supply agreement in place.

Aaron Vega, Holyoke’s director of planning and economic development, said he knows of the plant and of plans to build a second plant as well.

“I know they had some staff changes over the past year, and I have not visited the site in some time,” Vega wrote in an emailed response to questions.

Ehrhard, ESG’s bankruptcy attorney, said the lender for the project has “gotten aggressive,” forcing the company to seek bankruptcy protection from its creditors while it completes a sale of the existing plant. The proceeds of the sale would pay off debts from both plants, Ehrhard said. However, construction has not begun on a second plant.

There is a buyer, he said, but he declined to name the buyer, only saying that the deal should be done in July.

A meeting of creditors in the bankruptcy case is set for May 28.

Scuderi’s split-cycle engine

As for the Scuderi engine, Springfield-born engineer Carmelo Scuderi patented his version of a split-cycle engine in 2001 just before his death.

Conventional engines use the same cylinder to perform the four cycles to generate power: fuel intake, fuel compression, fuel ignition and exhaust of waste.

That means two revolutions of the crankshaft for every power stroke.

Scuderi Group’s engine employs two cylinders to do what a single cylinder does. One of the cylinders does power and exhaust, another does intake and compression, forcing the compressed fuel air mixture into the power cylinder via a connecting port.

With that, the Scuderi engine has a power stroke every rotation of the crankshaft. The engine also works to store energy in the form of compressed air, the company said.

For a time, the Scuderi family was vocal about its success, presenting to the Society of Automotive Engineers and having computer simulation tests performed by Southwest Research Institute of Texas.

But the only thing that followed seemed to be litigation.

In 2013, Salvatore C. Scuderi, the company’s president at the time, agreed to pay a $100,000 civil penalty to the Securities and Exchange Commission. The SEC said Scuderi spent $3.2 million of the $80 million it raised from investors on improper payments to Scuderi family members, according to a finding released by the SEC.

In 2015, Hino Motors, Toyota’s truck and diesel engine division, sued Scuderi seeking a refund of the $150,000 it invested in a research consortium in 2013.

That suit was settled later that same year.

Scuderi also settled lawsuits brought by investors, with the wronged investors citing the SEC‘s findings. The terms of those settlements remain confidential.

In 2022, the Massachusetts Secretary of the Commonwealth’s office, which enforces state securities law, secured $500,000 in restitution from Nonotuck Investment Group because the investment was an unregistered security.

ESG Clean Energy in Holyoke, Tuesday, May 20, 2025. (Douglas Hook / The Republican)Douglas Hook