Enthusiasm about artificial intelligence has fueled a good portion of the stock market’s rally in recent years. That’s unlikely to change soon, but investor interest could move from company to company, at least temporarily.

The Magnificent Seven—Google parent

Alphabet

,

Apple

,

parent Meta Platforms,

Nvidia

,

and

—that propelled so much of 2023’s stock gains were all big tech names, leading some investors to worry that there was too much concentration risk in the market.

Yet in reality, despite their superficial similarities, the M7 never really traded in lockstep, as evidenced by their diverging performance in 2024: While Tesla stock is down nearly 30% this year, Nvidia stock has surged almost 140%.

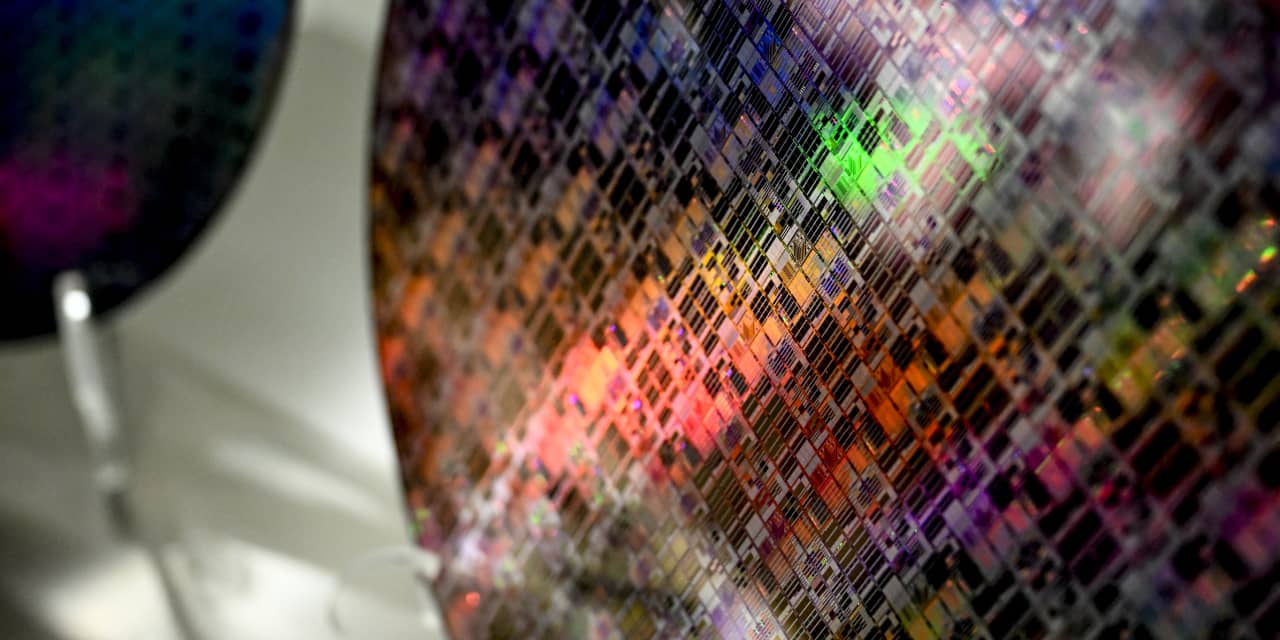

Capital Economics Market Economist James Reilly argues that this has come amid a broader shift in investor sentiment surrounding AI. While previously both software and semiconductor stocks benefited from AI optimism, more recently equities in the former category have lagged behind, while those in the latter have continued to soar.

“Contrary to some suggestions, we don’t think this weakness in part of the IT sector is evidence that AI enthusiasm is waning,” writes Reilly. “This shift in favor of semiconductor manufacturers and utilities suggests investors are focusing more on those companies expected to benefit early on from AI, rather than those expected to benefit from ultimately using the technology.”

Advertisement – Scroll to Continue

In a way, this makes sense: AI technology is still nascent, so it’s difficult to predict at this point who the true end-use winners will be, whereas no matter who ultimately takes the lead, it’s clear there are a few chip companies that will provide the “picks and shovels” to get there.

That said, Reilly doesn’t believe that this shift is a permanent one, rather natural variance in investors’ views, with the pendulum eventually swinging back. In addition, he thinks that once it becomes clearer which players are at the head of the pack, AI-users could once again rally—across industries.

“Our sense remains that the IT sector is the most likely source of such winners and will outperform most other,” he writes. “And we wouldn’t be surprised if the big-tech firms continued to lead the charge. But compelling use cases for AI can be made for stocks across most sectors of the market. So, as these uses become clearer, we suspect that the rally will broaden a bit, at least relative to much of the past year or so.”

Advertisement – Scroll to Continue

That’s of course good news for the broader market, as it would make gains less reliant on just a few big players.

Nvidia’s dominance has understandably made investors nervous. While the stock has shown on signs of slowing down, and doesn’t necessarily seem ripe for a pullback, its huge size means that it gets harder to deliver big leaps in growth.

As Bespoke Investment Group noted earlier this week, when Nvidia last traded around 22.6 times forward sales, in March 2023, its market cap was just 20% of its current level, and its expected revenue for the next 12 months was a quarter of current estimates.

Advertisement – Scroll to Continue

The firm doesn’t think Nvidia necessarily looks vulnerable, but highlights that “if sales forecasts were to rise by as much again as they did versus the March 2023, they would need to approach $600 billion. Similarly, another quintupling of the stock from these levels would yield a $15.3 trillion market cap (13% of the current global market cap). By no means do these types of moves have to reverse themselves, but we do caution against thinking that these sorts of extreme moves are sustainable and recommend investors set realistic expectations.”

The good news is that despite Nvidia’s huge outperformance, there is evidence that even now the market rally isn’t too narrow.

“While the Tech biggest names clearly are helping the most, many others have been doing well, too,” notes CappThesis’ Frank Cappelleri. “If/when we start to see a noticeable divergence WITHIN the

Tech Sector, that’s when we’ll really know the foundation is weakening. Not yet.”

With so many potential headwinds piling up, that’s one piece of good news for investors.

Write to Teresa Rivas at teresa.rivas@barrons.com