The copper industry has been soaring as futures have surged 27% year-to-date. Many blame recent tariff fears for this rise, but copper has actually been increasing in price for a long time. If you zoom out, you’ll see that copper prices have risen by over 135% in just the past five years.

This is a long-term trend that isn’t going to be reversed anytime soon, as there’s a copper shortage along with supply woes. And now, tariffs are making copper even more expensive. China’s stockpiles dropped by 9,000 metric tons in early March, and U.S. reserves on COMEX and the London Metal Exchange followed suit.

If these trends hold, copper could be the golden ticket for early investors. Here are three copper stocks that could deliver blockbuster gains if copper keeps rising:

Ero Copper (ERO)

Ero Copper (NYSE:ERO) is a hidden gem in my opinion, and is primed for a significant breakout if current trends continue. This undervalued growth stock has all the ingredients for a jaw-dropping rally.

This company operates out of Brazil, but it has a non-tier-one mining jurisdiction that often scares some investors away. This is exactly why Ero Copper’s assets have been off the radar and trading so cheaply compared to its peers. The stock is sitting at a dip right now, and Ero Copper has historically bounced back significantly from these cyclical downturns.

From late 2023 to early 2024, the stock rocketed over 100% from its trough to peak as copper prices fueled a rally. Copper prices are rising again, so I believe the same could happen.

Ero Copper trades at just six time forward earnings for 2025. Analysts see EPS growing from $2.1 in 2025 to up to $5 in 2028. Moreover, revenue is expected to climb from $820.6 million to over $1 billion in the same timeframe.

Tucumã’s ramp-up is on track to hit commercial production by mid-2025, and Caraíba’s new external shaft at the Pilar Mine will boost output by 2027. These projects could double consolidated production to 95,000 tonnes by 2026-2027. Pair that with copper prices staying hot, and you could have explosive returns in the coming years.

The consensus price target of $26.3 implies 101.6% upside potential.

Taseko Mines (TGB)

Taseko Mines (NYSEAMERICAN:TGB) has historically been quite volatile as it has gone through cycles that’d make anyone’s stomach churn. However, it’s making a sharp comeback from its lows many years ago, and it looks more solid than ever as copper prices keep rising.

That could catapult it to multibagger territory in the next few years if the trends continue. The Florence Copper Project in Arizona makes me very bullish here. That project is 56% complete as of December 2024, and it is on track to start producing copper by late 2025.

Florence will boost Taseko’s production by 70% and push annual output from around 120-130 million pounds at its Gibraltar mine to over 200 million pounds company-wide. Even better, it slashes C1 cash costs significantly. Analysts peg Florence’s all-in sustaining costs at around $1.11 per pound, compared to Gibraltar’s $2.92 in Q3 2024.

As a result, EPS is expected to grow from $0.16 this year (up 21% YOY) to as much as $0.77 by 2027. Revenue is expected to grow from $520.4 million to $916.5 million on the high end in the same timeframe.

TGB’s a screaming buy if you’re a copper bull.

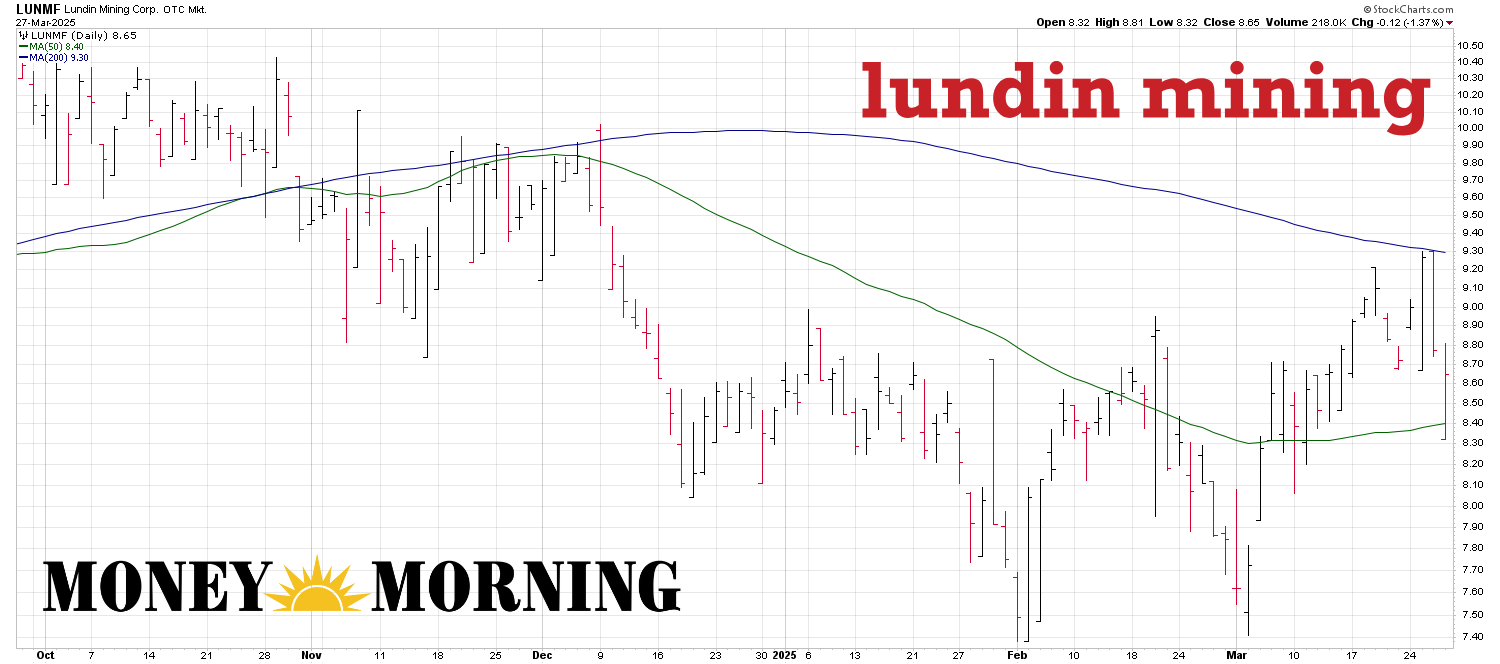

Lundin Mining (LUNMF)

Lundin Mining (OTCMKTS:LUNMF) is a profitable copper company that has weathered plenty of storms over the past two decades but hasn’t been a superstar for delivering consistent upside. The stock has spent most of its life hovering below $10.

It has broken that ceiling multiple times but has always stumbled back below it. The current price is at $8.65, and I think it’s a solid buy as the company has slashed its dividend by 69% to pivot toward share buybacks. I think this move could be the secret sauce to finally push it above $10 and keep it there once it breaks through.

Technicals aside, the fundamentals here are rock-solid. It did miss Q4 earnings estimates, but it reaffirmed 2025 guidance, and increasing copper prices could push the stock up regardless. Analysts expect EPS to jump 18.7% to $0.45 in 2025, with some bold predictions pushing it close to $1 by 2028 if copper prices keep their upward trajectory.

This is a stellar pick if you’re in it for the long haul. The near term carries some risk, though. Lundin is divesting two European mines for $1.52 billion, with the deal set to close in mid-2025. That’s a big shift, and it could rattle the stock short-term as the market digests the change.