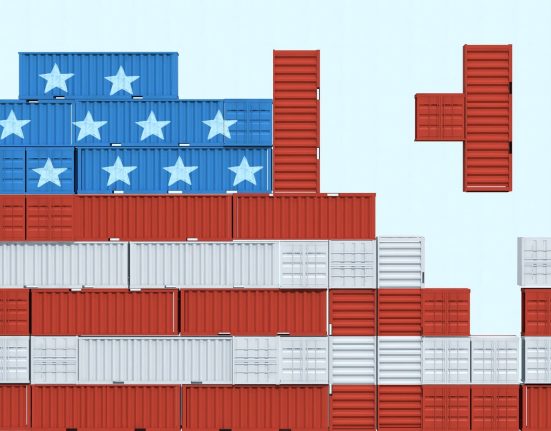

As part of the U.S.–Japan trade deal the White House announced on Tuesday, Japan has committed to providing $550 billion worth of investment in the U.S. So where might that money go, and what might this investment look like?

Japan is already the number one foreign investor in the U.S., with $754 billion invested as of last year — and that number has grown by 50% since 2018. But $550 billion more is… a lot.

“This is a meaningful promise,” said Kristi Govella, Japan Chair at the Center for Strategic and International Studies. “And especially the fact that it will be directed in areas that apparently can be influenced to some extent by President Trump and the U.S. government is something different than we’ve seen before.”

So where might the money go? The White House has highlighted some sectors — ones the U.S. sees as critical to national security and is looking to tariff.

“Things like semiconductors, on pharmaceuticals, on shipbuilding and critical minerals,” Kate Kalutkiewicz, a senior managing director at McLarty Associates, said. “These are all things that the U.S. government is trying to sort out a policy approach that gets more companies here.”

In this case, it may be Japanese companies that bring with them expertise. There are some other likely options for Japanese investment.

“It would not surprise me at all if it’s at some level connection to the sovereign wealth fund the Treasury Department is still working on getting set up right now,” said Drew DeLong, head of geopolitical dynamics at Kearney.

There’s also a liquefied natural gas plant and pipeline being developed in Alaska that DeLong suspects would be a likely target of Japanese investment too. He said this kind of investment promise may offer a lifeline to other countries in the throes of negotiation with the Trump administration.

“Now countries can say, ‘OK, look, if we pledge additional investment into the U.S. following what Japan has done, we can close that gap,’” DeLong said.

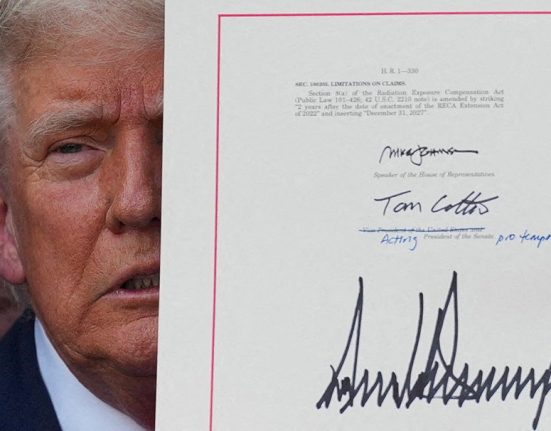

For Ryan Young, senior economist at the Competitive Enterprise Institute, this deal — where the president allegedly directs investment — sets a different kind of precedent.

“This is one person directing it without input from Congress or agencies, without any check or balance,” Young said.

But so much about this deal is in the details — the timing, the exact form of the investments, who truly has control over them. Details that may not have even been worked out yet; details that could change.