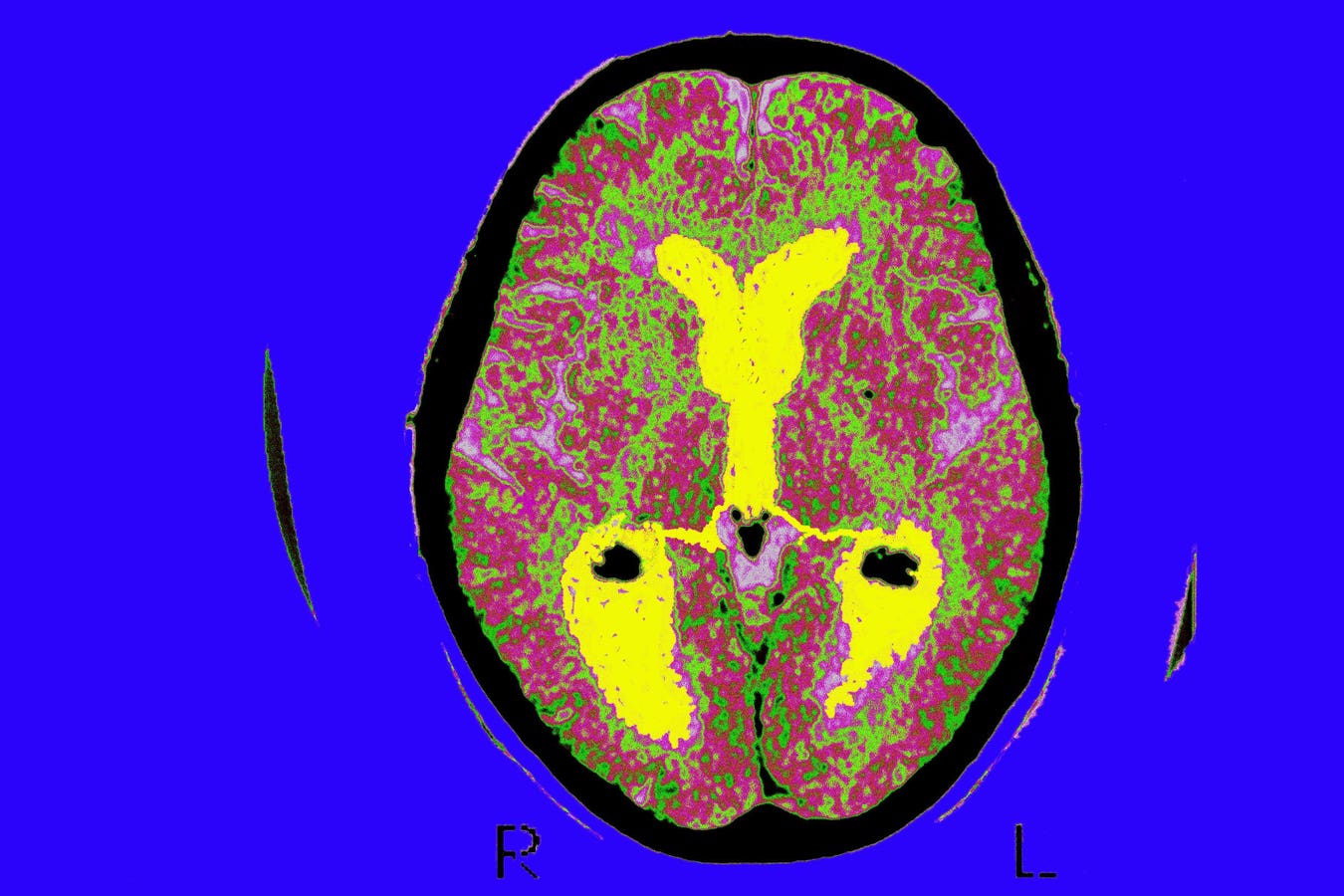

Alzheimer’S Disease, Scan, Brain Of A Patient Affected By Alzheimers Disease, Axial Section, Median … More

Alzheimer’s disease ranks as the sixth leading cause of death in high-income countries like the United States. This is according to the World Health Organization (WHO). It’s a positive development, a sign Americans are living much longer, and they’re living much longer because what used to kill them with ease no longer does. Enhanced investment could eventually push Alzheimer’s off the list.

The WHO report instructs on investment and cures. In low-income countries, tuberculosis to this day ranks #8 among the most common killers. Notable there is that tuberculosis last loomed as the biggest threat to American life in the 19th century.

Wealth creation explains the change. As wealth expanded in the U.S., so increased capital that could be matched with doctors and scientists on the way to cures for diseases that formerly killed us with ease. As the late Dr. Lawrence D. Dorr explained it in his 2011 book Die Once, Live Twice, medical and pharmaceutical advances meant and mean that Americans are increasingly surviving maladies that used to be deadly. Thought of another way, in the not-too-distant past Americans and people from other high-income countries didn’t live long enough to get Alzheimer’s.

It brings to mind where we go from here. What diseases, including Alzheimer’s, can be met with pharmaceutical and other medical advances that render today’s top killers tomorrow’s afterthoughts? The list is long.

At the same time, the investment necessary to discover a much better health future is growing. According to a report from ALLIANCE, a coalition out to enhance biopharmaceutical discoveries, since the passage of the 2017 Tax Cuts and Jobs Act (TCJA), top U.S. pharmaceutical companies have invested over $160 billion in new pharmaceutical developments.

The challenge now is that assuming the TCJA isn’t extended, the corporate tax will revert to the 35 percent rate that prevailed prior to its reduction to 21 percent. It’s useful to keep the potential corporate tax increase prominently in mind while contemplating the investment mentioned in the previous paragraph. Precisely because drug development is so expensive, and so costly over such long stretches, tax policy over long stretches looms large. Uncertainty about the taxation of investment and success borne of investment renders the commitment of capital necessary to drive development a daunting prospect.

Which speaks to the good and bad of the TCJA. Necessary corporate tax cuts were “paid for” in 2017 with other tax increases, including higher taxation on top earners with a shrinkage of the SALT deduction.

The very notion of “paid for” is problematic. A reduced tax burden on individuals and corporations needn’t be “paid for,” the burden should just be reduced.

The well-to-do shareholders of corporations frequently pay high rates of taxation, and they were as mentioned required to pay more in the way of individual taxes under the TCJA as a path to “paying for” the corporate tax cuts. Again, this is wrongheaded. It implies that individuals and corporations work for government, and that tax policy must be tailored to meet government needs, not that of individuals and corporations from whom governments attain their sustenance. No thanks.

American corporations and individuals are overtaxed, period. And the latter is made evident by the fact that a mere reduction of the corporate tax was “paid for” via higher individual taxes. From this truth the aim must be to keep corporate taxes at TCJA levels, or reduce them, and doing this without raising taxes on individual earners.

The simple truth is that there is no progress, and there are no health advances, without knowledge borne of wealth. So let’s reduce taxes on individuals and corporations to increase the capital commitments that make discovery and knowledge possible. Life and health depend on it.