AGNC Investment (AGNC -4.19%) has a massive 15.5% dividend yield, which is why it pops up on the screens of dividend investors. Before jumping at what looks like a huge income opportunity, you need to examine the real estate investment trust’s (REIT’s) history. You’ll likely be better off with lower-yielding REITs like Federal Realty (FRT -2.65%) and Rexford Industrial (REXR -3.05%) if generating reliable income is your goal.

The big problem with AGNC Investment

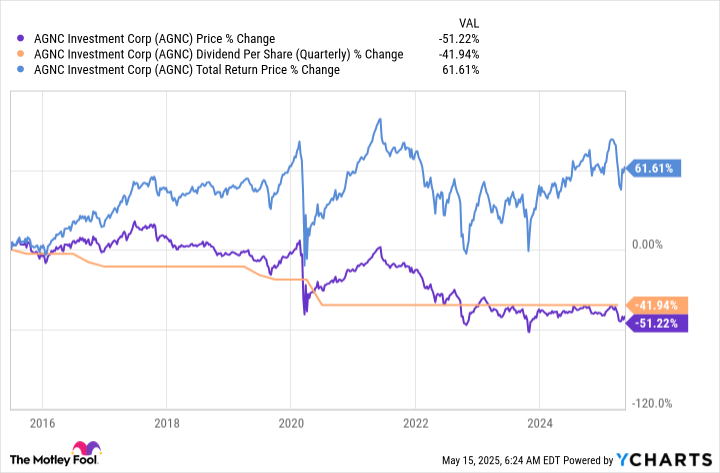

AGNC Investment is a mortgage REIT that lives up to its goal of providing investors with an attractive total return. If total return is your goal, you might want to consider it. But most dividend investors aren’t looking for total return, which requires dividends to be reinvested. Dividend investors are usually looking to use their dividends to pay for living expenses. It takes one single graph to highlight the problem.

Notice that the total return line above is rising even as the dividend is falling. AGNC Investment’s share price follows the dividend lower. If you had reinvested the dividend, you would have ended up OK. But if you’d spent the dividends this mortgage REIT generated, you would have ended up with less income and less capital. Given the huge 15.5% dividend yield, this dynamic doesn’t seem likely to change.

Image source: Getty Images.

More income and more capital is a better choice for most dividend investors

So AGNC Investment’s huge yield probably isn’t as attractive as it seems. You will probably find the still attractive yields on offer from Federal Realty and Rexford Industrial a lot more to your liking if you are a dividend investor.

Federal Realty is a Dividend King, with over five decades of annual dividend increases behind it. Rexford is a much younger company, but it still has a 12-year dividend streak that it’s working on growing. That’s much more attractive than AGNC Investment’s history of dividend cuts. Federal Realty’s dividend yield is currently around 4.5%, while Rexford is offering a yield of 4.8%.

Federal Realty is focused on retail assets, specifically strip malls and mixed-use developments built around retail. Rexford Industrial owns industrial assets, but is hyper-focused on the supply-constrained Southern California market. Both have proven very capable on two fronts. They both use acquisitions to grow. But redevelopment is a core aspect of their acquisition approach, as they both excel at improving their portfolios by investing in them to make them more valuable over time.

In comparison, AGNC Investment owns mortgage securities that have been pooled into bond-like investments. There’s no way to improve the value of mortgage securities via capital investment. In fact, AGNC Investment is more like a mutual fund than an operating business. As long as the dividend payment remains as large as it is, the value of the mortgage REIT is likely to keep shrinking because it’s paying out so much of the capital it uses to invest. But Federal Realty’s and Rexford’s businesses will keep growing, thanks to their investment and redevelopment efforts.

Different choices for different types of investors

AGNC Investment isn’t a bad company — it just has a different focus than that of most dividend investors. But if you’re looking for a total return investment, it could be a good option for your portfolio.

For dividend investors, meanwhile, both Federal Realty and Rexford Industrial are likely to work out better over the long term. Even here, though, there is a material difference. Federal Realty is a slow and steady tortoise. Its dividend has grown just 26% over the past decade (for reference, AGNC’s dividend declined by 40%). Rexford Industrial’s dividend has grown by more than 250% over that same span. So Federal Realty is more appropriate for conservative dividend investors, while Rexford will likely be appreciated most by dividend growth investors.

All that said, Federal Realty and Rexford are both a little out of favor on Wall Street right now, which is likely a long-term buying opportunity. Sure, tariffs and economic concerns will affect each over the near term. But their strong business models, including well-honed redevelopment skills, set them apart from the pack and set them up to keep growing for years to come once the current uncertainty passes.