Mexico continues to attract record amounts of foreign direct investment (FDI), with new investments soaring well above US $3 billion during the first six months of 2025, more than triple the same period last year. Total FDI, which includes reinvested profits, also showed a significant increase.

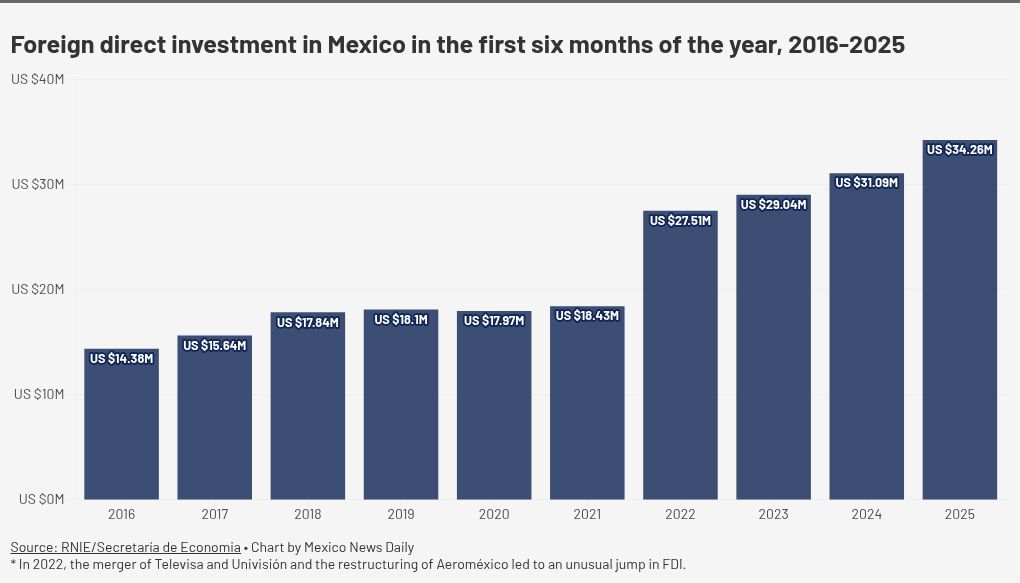

The latest report from the Economy Ministry (SE) shows that total FDI for the first six months of the year rose to nearly US $34.3 billion, continuing a steady climb after Mexico hit a record high of US $21.4 billion in the year’s first quarter.

The six-month figure reflected a 10.2% increase in total FDI over the same period in 2024 (which itself was a record). The increase is the continuation of a positive trend going back to 2021, when Mexico began to recover from the first year of the pandemic.Last year’s January-June FDI performance was 7.1% better than the same period in 2023.

Most impressively, Mexico is set to capture US $3.1 billion in new investments as part of its FDI inflows thus far this year. The SE said that amount is the most new FDI reported in the past 12 quarters.

“[The new investments] reaffirm the interest that foreign investors maintain in our country, despite the global economic and political landscape,” the SE said.

The inflows are arriving despite the protectionist trade policies implemented by the U.S. (Mexico’s No. 1 trading partner) and a weakening global economic outlook that the Organisation for Economic Cooperation and Development ascribes to “substantial trade barriers that are diminishing confidence and heightening policy uncertainty.”

So how is Mexico pulling this off?

Mexico boasts a robust network of trade agreements and a strategic location next to the world’s biggest economy (even as access to the U.S. market shrinks), making it an attractive destination for foreign investors seeking fertile ground for capital deployment.

A trade markets report by Banco Santander points out that Mexico also offers a big domestic market, a wide variety of natural resources, a well-qualified workforce and a diversified economy. Incentives introduced in 2023 for nearshoring in the semiconductor, electromobility and medical device sectors have also proven attractive.

These structural advantages have combined to create a favorable setting for business expansion even as global FDI declined by 11% in 2024, according to the United Nations.

The Pérez Correa González corporate law firm noted earlier this year that FDI is “increasingly entering sectors that have historically been less accessible to foreign capital.”

Its report identified sectors such as the food and beverage, chemical and agricultural processing industries as targets of new investment, although manufacturing still accounts for 36% of total FDI.

Mexico’s positive business environment is reflected in the fact that reinvestment of earnings remained high, reaching nearly US $29 billion. Such reinvestment accounted for 84.4% of total FDI through June.

Even though reinvestment of earnings registered a 4.5% decline compared to the first six months of last year, that decrease was offset by the record amount of new investments, which accounted for 9.2%.

Reinvestment of earnings corresponds to the portion of profits not distributed as dividends and is considered FDI because it represents an increase in capital resources owned by the foreign investor.

U.S. companies continue to be the dominant investors, accounting for nearly 43% of total FDI, down from 44.1% in 2024. Still, U.S. investments grew by US $986 million, rising from US $13.7 billion to US $14.7 billion.

Spain is second at 17.3% (US $5.9 billion), followed by Canada at 5.1% (US $1.75 billion), Japan at 4.2% (US $1.44 billion) and Germany at 3.7% (US $1.28 billion).

With reports from El Economista, El Financiero and La Jornada