The big story around AGNC Investment (AGNC -1.07%) is its shockingly large dividend yield of more than 15%. To put that yield into perspective, the S&P 500 index (^GSPC -0.40%) is yielding just 1.3%, and the average real estate investment trust (REIT) is offering 4.1%. You should never buy a stock just because of the yield, and that is important when considering AGNC Investment. Here’s what you need to know.

AGNC Investment is complicated

In general, REITs are simple to understand. They buy properties and lease them out to tenants, just like you would do if you owned a rental property. The difference is the scale of the assets, not the business model. AGNC Investment, however, isn’t a property-owning REIT. It is a mortgage REIT.

Image source: Getty Images.

Mortgage REITs like AGNC buy mortgages that have been pooled together into bond-like securities. That’s nothing like owning a property. What AGNC Investment does is more like running a bond mutual fund, which isn’t something that most investors do. The mortgage securities it owns have pretty unique price drivers, including interest rates and things like housing market dynamics and mortgage repayment trends. It can be hard to track AGNC’s business given the complexity here.

There’s a big data point that dividend investors need to understand. AGNC Investment’s dividend, as the chart below highlights, has been falling for years. Even before that trend started, the dividend was a bit volatile. The stock price has basically tracked along with the dividend, up and down — but mostly down — over time.

This isn’t unique to AGNC Investment. The mortgage REIT sector is filled with graphs like the one above. Sometimes the dividend goes up and sometimes it goes down. If you bought this stock expecting a sustainable, and perhaps even growing, dividend, you ended up caught in a yield trap. The high yield just didn’t live up to the expectations you had.

Change your expectations with AGNC Investment

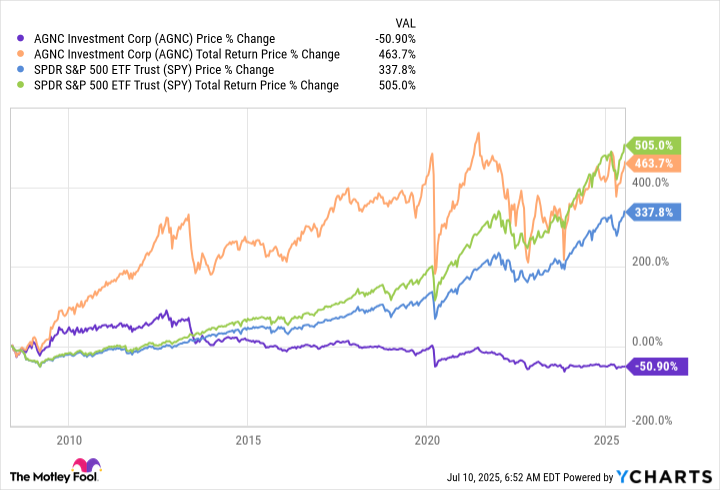

The interesting thing here is that AGNC Investment’s goal isn’t exactly income. It is looking to provide an attractive total return, with reinvested dividends playing an important part in that story. As the chart below shows, AGNC’s total return is actually pretty solid.

Despite the stock price losing half its value over time, AGNC’s total return has been competitive with that of the S&P 500 index. In fact, over some stretches, AGNC Investment’s total return has handily beaten the index’s return. That makes it an attractive choice for investors using an asset allocation model.

But the key factor here is that total return requires shareholders to reinvest their dividends. If you spent those dividends, you ended up with less income and less capital, which is pretty much the worst possible outcome for a dividend investor.

AGNC Investment can be a yield trap if you don’t know what you’re buying

It’s entirely possible that AGNC Investment will increase its dividend. Mortgage REIT peer Annaly Capital (NLY -0.92%) did just that at the start of 2025. But that doesn’t change the fact that, like AGNC, Annaly has a long history of dividend cuts behind it. Volatile dividends are simply a part of the mREIT business model.

If you buy AGNC Investment, or Annaly Capital, just because they have huge dividend yields, you are probably going to end up disappointed on the dividend front. If you buy them for their ability to provide a solid total return via an alternative asset class, well, you will likely be much happier. But you will need to reinvest the dividend to achieve strong long-term results.