The Bangladesh Investment Summit 2025 will be hosted at a critical juncture this year against the backdrop of foreign direct investment (FDI) inflows hitting a six-year low, raising concerns about the investment climate.

Scheduled to take place from April 7 to April 10 at the InterContinental Dhaka, the event aims to attract global investors and highlight Bangladesh’s evolving economic landscape.

Amid political uncertainty, stray incidents of labour unrest and economic challenges, the summit presents a crucial opportunity to restore investor confidence, showcase economic reforms, and position Bangladesh as a competitive investment destination.

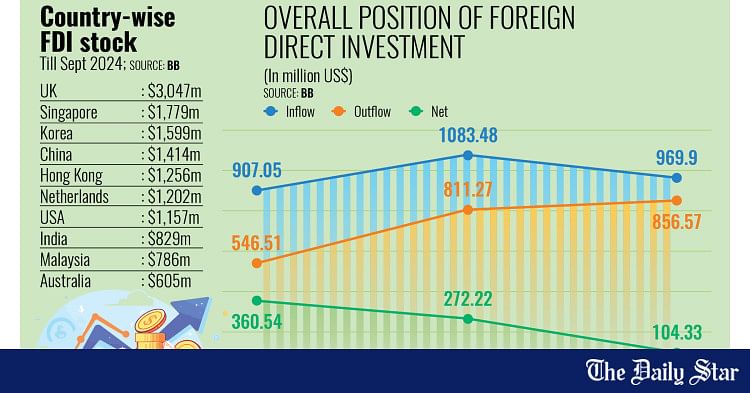

FDI inflows dropped by 71 percent year-on-year, falling to $104.33 million in the July-September quarter of FY25, the lowest in six years, according to Bangladesh Bank.

The country’s total FDI stock stood at $17.68 billion as of September 2024, with the United Kingdom, Singapore, and South Korea emerging as the top three investors.

The UK remains the leading investor, with $3.05 billion, primarily in banking, power, and pharmaceuticals. Singapore follows with $1.78 billion, while South Korea ranks third with $1.6 billion, driven by investments in manufacturing and telecommunications.

A recent survey by the Japan External Trade Organization (Jetro) 2024 highlighted policy inconsistency and bureaucratic hurdles as significant barriers, discouraging reinvestment and leading to capital outflows.

Japanese investors frequently cite complex approval processes, tax inconsistencies, and sudden policy shifts as challenges to long-term commitments.

While Bangladesh has made progress in infrastructure, logistical inefficiencies and slow project execution also continue to impact business operations.

Additionally, currency depreciation, inflationary pressures, and the rising cost of doing business have made the country less competitive compared to regional peers.

The Bangladesh Investment Summit 2025 presents an opportunity to reverse the downward trajectory of FDI inflows by presenting new investment opportunities and showcasing economic reforms and policy incentives.

More than 550 investors from 50 countries have registered to attend, alongside 2,500 local investors.

Chief Adviser Prof Muhammad Yunus is expected to inaugurate the summit on April 9, alongside top executives from multinational corporations.

Speaking at a press conference at the Foreign Service Academy in Dhaka, Ashik Chowdhury, executive chairman of the Bangladesh Investment Development Authority, emphasised the government’s commitment to investment-friendly policies and economic stability.

He assured investors that Bangladesh would not make false promises but would instead present an accurate and realistic picture of investment potential.

While acknowledging challenges, Chowdhury highlighted Bangladesh’s strong economic growth, expanding industrial capabilities, and reform measures aimed at improving the ease of doing business.

Despite the current slowdown in FDI, Bangladesh remains a promising investment destination, offering a growing domestic market, competitive labour costs, and strategic geographic positioning, he said.

However, he acknowledged that sustaining long-term investor interest will require policy consistency, infrastructure improvements, and regulatory streamlining.

The Investment Summit 2025 is expected to serve as a catalyst for renewed investor interest, allowing global businesses to explore Bangladesh’s opportunities while giving policymakers a platform to address investor concerns, he added.