Virtually every large producing firm in the U.S. started as a small business, usually in a home or garage, financed by the personal savings of the entrepreneur, and family and friends. Microsoft and Amazon come to mind. Most starts, of course, will not replicate those growth experiences. But drive down the Main Street of any U.S. city and you will pass the storefronts of America’s largest employer – small business.

Investment comes in two forms: time and money. Both are in short supply but necessary for a successful small business. Entrepreneurs work long hours, which is necessary to efficiently employ the capital available. Depending on the industry of the business, buildings are needed, as well as a wide variety of physical capital. A dishwasher is critical for a restaurant but not for a construction firm. The quality of the equipment and management impact the productivity of the employees, which directly affects unit labor costs. And labor costs are, for most firms, the largest item in the P&L.

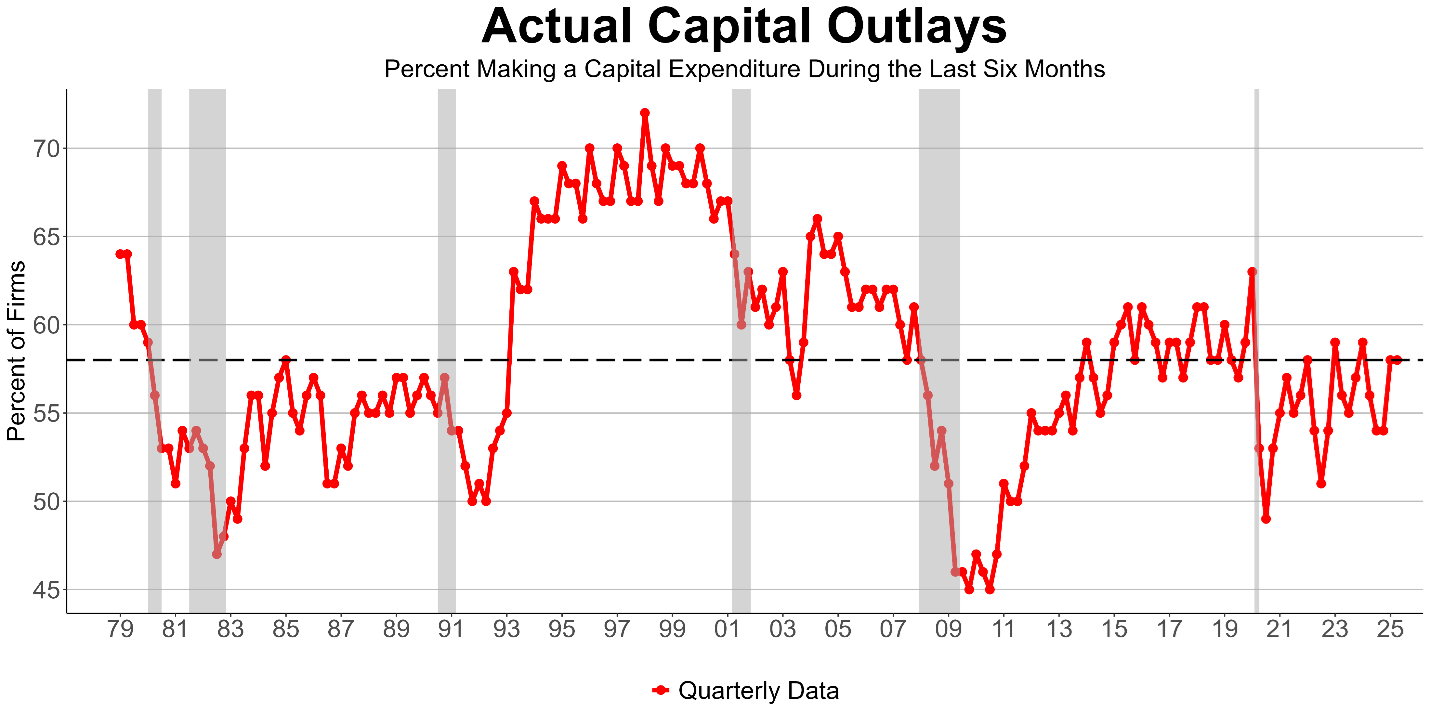

It’s hard to discern any trend in capital spending; the 2008 recession clearly tanked investment spending, as have all recessions. Clearly, the fear associated with Y2K drove the highest levels of investment spending in the last 50 years, which fell sharply after we all saw what actually happened (which was not much). Investment spending picked up around 2016 but hit a wall with Covid, and has been subdued since.

Actual Capital Outlays. NFIB Small Business Economic Trends. April 2025.

Reporting on their most recent outlays, there appears to be little variation between 2019 and 2025 in the type of specific investments in capital equipment. Most expenditures are paid for in the purchase period, not financed. Vehicles and equipment dominated the shopping list, although taken together, facilities expenditures were almost as frequent as vehicle purchases.

Capital Expenditures. NFIB Small Business Economic Trends.

There was a lot of inflation at the end of the 2019-2025 period. However, there is not much evidence of it in the size of expenditures, other than a shift from outlays below $10k to the $10k-$50k category. They buy what they need to run their business and figure out ways to absorb higher costs. Apparently, most small business borrowing is for cash flow management, not for the financing of major equipment and facilities purchases.

Expenditure Spending. NFIB Small Business Economic Trends.

Employees get paid by the hour of work provided, delivering variable amounts of value. Owners are compensated in the bottom line of the P&L. Owners don’t “punch a clock,” they just work. They are the most valuable asset of the firm. Their focus too often is diverted by mandated compliance activities of dubious value. Their investment of time is critical to the success of the firm, and regulators should avoid unnecessarily diverting their attention from their main job – building a successful business.