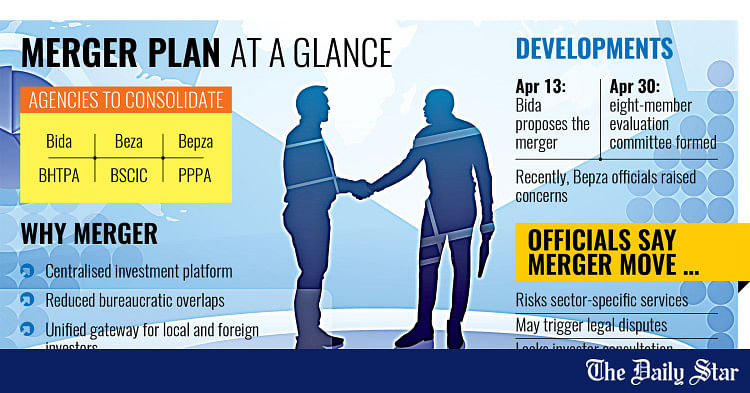

The Chief Adviser’s Office has recently formed an eight-member committee to assess the proposed merger of several investment-related agencies under the single umbrella of the Bangladesh Investment Development Authority (Bida).

By cutting red tape and boosting business confidence, the consolidation will streamline services for both foreign and domestic investors, said officials.

The agencies being considered for merger are the Bangladesh Economic Zones Authority (Beza), the Bangladesh Export Processing Zones Authority (Bepza), the Bangladesh Hi-Tech Park Authority (BHTPA), the Bangladesh Small and Cottage Industries Corporation (BSCIC), and the Public-Private Partnership Authority (PPPA), alongside Bida itself.

The move follows a recommendation made at a meeting of Bida’s governing board on April 13, attended by Chief Adviser Muhammad Yunus.

In line with that recommendation, the Chief Adviser’s Office issued a gazette notification on April 30, announcing the formation of the assessment committee.

This review panel is led by Industries Adviser Adilur Rahman Khan, with Bida and Beza’s Executive Chairman Ashik Chowdhury acting as member secretary.

Other members include Commerce Adviser Sk Bashir Uddin, International Affairs Envoy to the Chief Adviser Lutfey Siddiqi, Bangladesh Bank Governor Ahsan H Mansur, Principal Secretary to the Chief Adviser M Siraz Uddin Miah, Senior Secretary of the public administration ministry Md Mokhles Ur Rahman, and Finance Secretary Md Khairuzzaman Mozumder.

According to the gazette, the committee will examine all aspects of Bida’s proposal and provide its opinion on the feasibility and implications of merging the six institutions.

Fears over loss of sector-specific focus

The plan has stirred unease among stakeholders, who said that folding all the agencies into one may water down their specialised mandates and weaken investor services.

At present, these investment promotion agencies (IPAs) run under different laws and serve specific sectors such as export zones, hi-tech parks, and economic zones.

Each has its own regulatory framework, incentive schemes, and investor base — elements that require tailored strategies.

A blanket merger could strip the agencies of their niche strengths, according to an internal assessment by Bepza.

The agencies also alleged that the merger decision was made without enough consultation, especially with investors already in business in Export Processing Zones (EPZs).

“As direct stakeholders, investors deserve to be informed and allowed to assess the potential opportunities and risks,” said a Bepza official, preferring anonymity.

The internal Bepza assessment notes that each IPA has legally binding agreements with investors based on its own operational rules. A sudden restructuring could cause legal disputes and even lead to international arbitration, possibly damaging Bangladesh’s reputation as an investment destination.

A single centralised body may also slow down rather than speed up business processes, leading to bureaucratic delays that contradict the fast-track provisions built into the original laws governing these agencies.

‘Promising on paper, but will it work?’

Economists, too, have voiced mixed reactions over the merger move.

Selim Raihan, an economics professor at Dhaka University and the executive director of local think tank South Asian Network on Economic Modeling (Sanem), said the idea has merit, but its effectiveness will depend on the execution.

“In our country, numerous initiatives are taken, but they often fail to deliver due to a lack of coordination, bureaucratic complexities, and inefficiency,” said the economist.

According to him, the merger itself is not necessarily problematic.

“What is crucial is building an effective organisation that can deliver services efficiently and on time,” he added.

Taskeen Ahmed, president of the Dhaka Chamber of Commerce and Industry (DCCI), said that the government’s decision to merge multiple investment agencies into a single authority holds significant promise for attracting more foreign direct investments (FDIs).

“This move could streamline services, reduce bureaucratic red tape, and foster a more investor-friendly environment,” said Ahmed.

He further said that a unified body would enhance inter-agency coordination and policy consistency, ultimately lowering the cost of doing business in Bangladesh.