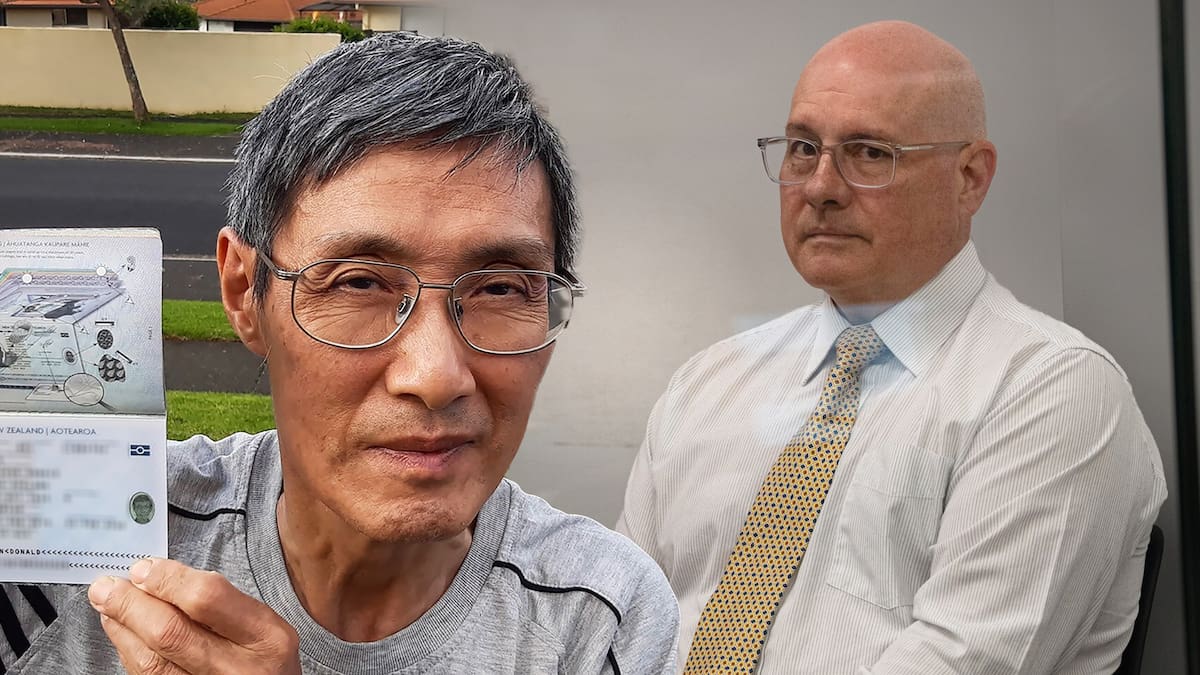

Victim Steven Fan, whose $1m retirement savings were never recovered, is appalled by the delay. He questions whether FMA staff failed to act sooner because they were on Christmas holiday.

“Something like a scam is urgent, isn’t it?

“I do question that. It is a bit slow. The horse is out the gate already.”

The FMA is defending its response. It says it must be satisfied that concerns about potential scams are genuine before issuing a warning, which involves “gathering information from complainants and working closely with partner agencies”.

In December 2022, a Wellington man was about to send $300,000 to an outfit calling itself Magnitude Financial to invest in high-interest bonds with the Commonwealth Bank of Australia.

But after checking the company’s website and prospectus documents, he still had a nagging feeling, so forwarded the material to his Wellington financial adviser.

The adviser immediately smelled a rat.

The 9% interest rate was “not reasonable” at the time, the adviser told the Herald.

Though Magnitude Financial was a legitimate company in Australia, the firm was not a registered financial service provider in New Zealand.

And unusually, the investment appeared to be in South African dollars.

“From my perspective, that was enough for me to say, ‘I don’t think this is legitimate. I’ve got my suspicions and I’m going to flag it straight to the FMA’.”

On December 19, 2022, the adviser phoned FMA staff and alerted them to the potential scam. He also forwarded relevant correspondence and emails from the fraudsters.

But it would be another 36 days until a public scam warning appeared on the FMA’s website on January 24, 2023 — recommending “caution if dealing with this entity”.

The FMA has confirmed it received “multiple complaints” about the potential scam, the first on December 8 — 47 days before the public warning was sent.

‘I feel let down’

That warning came too late for Fan.

He had been contacted by a so-called Magnitude Financial broker in December 2022 and convinced to invest.

He made an initial $1m payment that month with assistance from TSB staff, but cancelled the payment days later because the supposed bond purchase wasn’t jointly registered in his wife’s name.

He made a second $1m transfer on January 13, 2023.

Fan now believes his money might not have been lost if the watchdog had issued an earlier alert, putting him and his bank on notice of the scam.

While the period included the Christmas break, Fan said scammers don’t take holidays, and the agency tasked with monitoring for scams and keeping investors safe should act immediately on potential threats.

“I feel let down. It should be more efficient. I’m sure they could do things faster.”

The financial adviser who first blew the whistle did not want to comment on the FMA response.

“They said they would look into it. I don’t know how long those investigations take. We’d reported it through the official channels. It’s up to them to process it from there.”

‘Scammers don’t sleep’

Another victim, Anthony Lipanovic, lost $950,000 to the scam, though he sent his money two days after the FMA warning with assistance from ASB.

Both men’s money was deposited into the Westpac account of Auckland businessman Carel Viljoen, who was last month found guilty of money laundering.

Speaking generally, Viljoen’s lawyer, senior barrister Matthew Goodwin, said the holiday period was likely a “soft target” for scammers because people were often on vacation with limited email access.

The case should be a “wake up call” for the regulator, as “scammers don’t sleep”.

Consumer NZ chief Jon Duffy said the FMA needed to act urgently in response to potential threats to warn victims and banks.

“I’m surprised the FMA didn’t act more quickly than it did.”

Massey University banking expert Claire Matthews said delayed response times could mean investors had already been fleeced and criminals moved on to their next scam by the time a warning was issued.

In a statement, the FMA said initial complaints about Magnitude Financial questioned the company’s legitimacy “rather than reporting financial loss”.

“Before issuing a warning, the FMA must establish a reasonable basis for its concerns.”

While most FMA staff took leave over Christmas, a small team was available to address urgent matters.

The FMA published several warnings in December 2022 and January 2023.

“The FMA has increased the capacity of its scam response team and evolved its approach to scams over the last few years as the issue has grown.”

The FMA now sends its warnings directly to banks “to improve visibility and response”.

Lane Nichols is Auckland Desk Editor and a senior journalist for the New Zealand Herald with more than 20 years’ experience in the industry.

Sign up to The Daily H, a free newsletter curated by our editors and delivered straight to your inbox every weekday.