Which companies are regulated?

Most prominent investment platforms in Singapore are. This includes companies such as Endowus, StashAway and Chocolate Finance.

A Financial Institutions Directory can be used to find out whether a company is regulated or licensed by MAS, though the need for a license depends on a firm’s business model.

MAS also maintains an Investor Alert List. It’s not exhaustive, but includes companies and people who may have been wrongly perceived as being licensed, authorised or regulated.

What does it mean to be licensed?

Companies licensed by MAS are likely to be in better financial shape, said Professor Sumit Agarwal of the National University of Singapore’s business school.

They are also less likely to collapse, and consumers don’t have to worry as much if the company does go under, he added.

“It gives … the consumer confidence that, look, there is some regulatory oversight for the company,” said the professor of finance, economics and real estate.

How are investments with such firms protected?

For firms with a capital markets services license for fund management, MAS requires their customers’ funds to be separated from the company’s monies.

Customers’ funds must be placed under independent custody.

And the company is required to put in place a risk management framework as well as provide clear and transparent disclosures on the terms of its services.

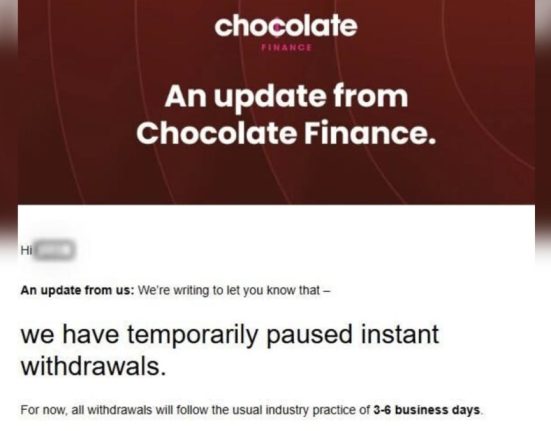

In the case of Chocolate Finance, customers’ monies are held in “segregated, ringfenced accounts” with the company and Allfunds, a fund distribution platform.