Turning $10,000 into $1 million from a single investment requires a 100-times return on your initial investment. This is an incredible stock performance, but very few companies have actually delivered this level of returns for shareholders. These companies are rare and need to be situated in a growing industry with a widely used product.

One stock that some investors think could have that potential is AI powerhouse Palantir (PLTR 3.36%). Palantir provides AI-powered data analytics software that is rapidly growing and checks the two boxes established beforehand. Is it possible for Palantir to transform $10,000 into $1 million? Let’s find out.

Image source: Getty Images.

Palantir’s growth has been impressive

Palantir’s software is quite complex but can easily be summed up as data in and insights out. Between those two points, a lot of AI processing occurs, and that AI processing is what sets Palantir apart from many other AI-powered data analytics platforms.

Palantir started catering to government entities and quickly grew a strong reputation for being an incredibly useful platform. In fact, it’s rumored (but never confirmed) that Palantir helped track down Osama Bin Laden’s final hiding place. Palantir recognized the usefulness of its platform outside of government applications and began marketing it to the consumer side around the time of its IPO.

That business has performed remarkably well, especially in the U.S., where demand for AI applications is massive and growing. Palantir’s financial results, which have been fantastic, reflect this.

In Q1, Palantir’s overall revenue rose 39% year over year, which is impressive in its own right. But the results become even more impressive when you peel back the curtain.

In the U.S. commercial sector, revenue rose 71% year over year to $255 million. Even the U.S. government’s spending rose above the average, with revenue increasing 45% to $373 million. Clearly, foreign governments and businesses aren’t adopting AI as rapidly as the U.S., but if they begin to, Palantir’s growth could go even higher.

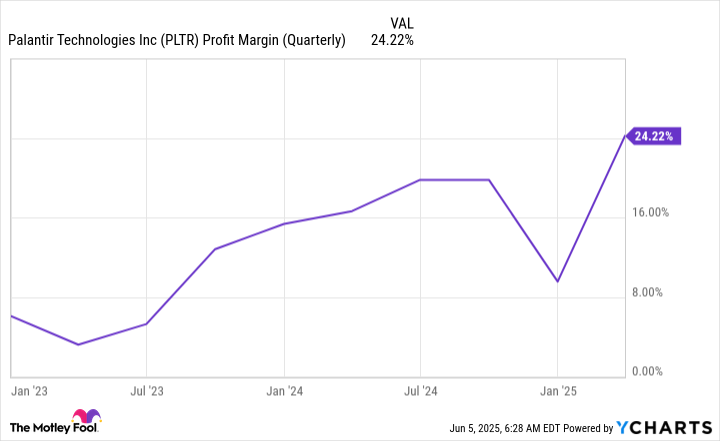

Another bonus with Palantir is that it’s actually profitable, unlike some high-flying software companies. In Q1, Palantir posted its best profit margin to date, and there’s still plenty of room to expand its margins over time.

PLTR Profit Margin (Quarterly) data by YCharts

These are all impressive results, but do they add up to a company that can transform $10,000 into $1 million?

Palantir’s stock is in dangerous territory

Currently, Palantir’s market cap is just over $300 billion. So, for Palantir to deliver 100-times returns, it would need to be a $30 trillion company. Considering that the largest companies in the world are valued at around $3.5 trillion, I’d say the chance of Palantir delivering a 100-time return from these levels is almost zero.

Palantir is already too large of a business to have those returns. But what can investors expect moving forward?

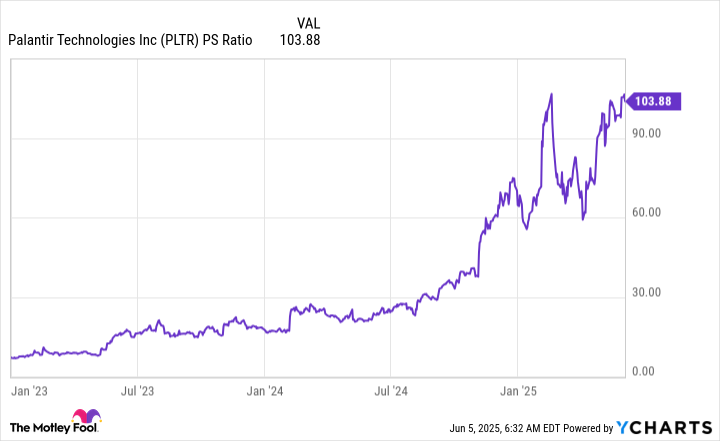

Well, here’s where things get a bit tricky. Palantir already has a ton of growth priced into its stock. At 104 times sales, it is one of the most expensive stocks in the market and among the most expensive that investors have ever seen.

PLTR PS Ratio data by YCharts

Companies priced at this level rarely work out, and if I were an investor, I’d be worried more about losing money than gaining money right now. Most software companies trade between 10 and 20 times sales. However, Palantir is an above-average software company due to its rapid growth and strong execution.

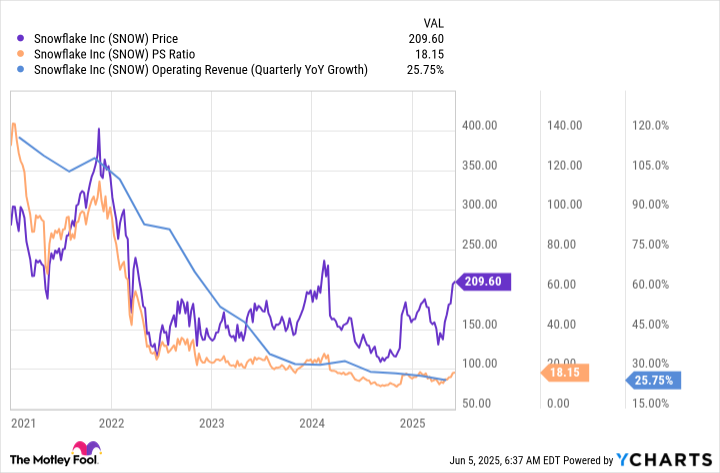

Take a look at another highflier and see how it worked out for them:

Snowflake (NYSE: SNOW) traded at more than 100 times its sales and had sales growth of over 100%, yet the stock is significantly down from its previous levels. This could happen to Palantir, and the effects could be even worse due to how much slower Palantir is growing than Snowflake.

As a result, I think investors should be cautious about investing in Palantir. It’s a highly valued company that could be prone to a sharp drop should growth slow.