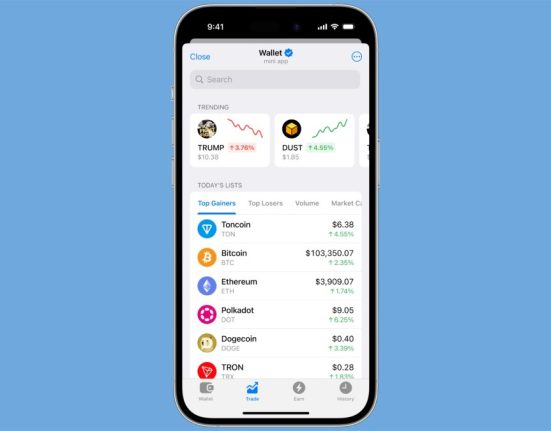

Bitcoin sank Wednesday before the US Federal Reserve’s interest rate call, and after a mixed launch in Hong Kong of investment products tracking the world’s top cryptocurrency and rival ether.

At about 1450 GMT, bitcoin slid 4.26 percent to $57,315, having earlier plumbed a more than two-month low at $56,527.

The US central bank is forecast to keep rates on hold after a regular policy meeting later Wednesday, but accompanying statements could hint at when cuts may begin or not.

“Bitcoin prices have fallen back to their lowest level since February today,” Tickmill analyst James Harte told AFP.

“Fears of a hawkish shift from the Fed are amplifying the selling with traders bracing for a firmer dollar on the back of the (decision) tonight,” which would make cryptocurrencies less attractive to hold.

Advertisement – Scroll to Continue

Markets have pushed back expectations for when the Fed will start cutting interest rates in light of elevated US inflation.

Those hopes had previously helped bitcoin blaze a record-breaking trail.

“Expectations of forthcoming Fed easing had been a key driver behind the rally earlier in the year,” noted Harte.

Advertisement – Scroll to Continue

Bitcoin’s record run in 2024 was also propelled by moves toward greater accessibility via exchange-traded funds (ETFs), which enable the wider public to invest without having to hold the cryptocurrency directly.

The United States in January gave the green light to ETFs pegged to bitcoin’s spot price.

That injected optimism into the market and also helped push bitcoin to fresh heights.

Advertisement – Scroll to Continue

Bitcoin thus rocketed in March to an all-time record peak of $73,797 before pulling back.

However, Hong Kong’s first spot bitcoin and ether ETFs, launched on Tuesday, received a lukewarm reception.

Hong Kong’s pioneering crypto ETFs on the city’s bourse include six funds issued by three managers — Bosera Funds, China Asset Management (Hong Kong) Limited and Harvest Global Investments.

Advertisement – Scroll to Continue

“The first day of funds being listed saw just $10 million in inflows” in Hong Kong, said Harte.

“With demand for spot bitcoin ETFs in the US having dried up over the last month, traders are sensing risks of a deeper pullback here.”

Added to the picture, this year’s record bitcoin rally was also supported by the anticipation of a so-called “halving” which took place last month.

The event halved the reward for operating bitcoin, a much-anticipated step designed to limit production and boost the popular virtual unit.

lul/rfj/cw