[WASHINGTON] Treasury Secretary Scott Bessent said he’s working with US legislators on outbound investment rules for China that would make clear what’s allowed and what’s not.

“We talked about the importance of establishing a either red light or green light, and not having a yellow zone, for outbound investment,” Bessent said on Wednesday (May 7), referring to a discussion with two House representatives.

“The outbound investment security programme is an important national security tool in our effort to restrict the PRC from exploiting the benefits of US investment,” he said, referring to the People’s Republic of China.

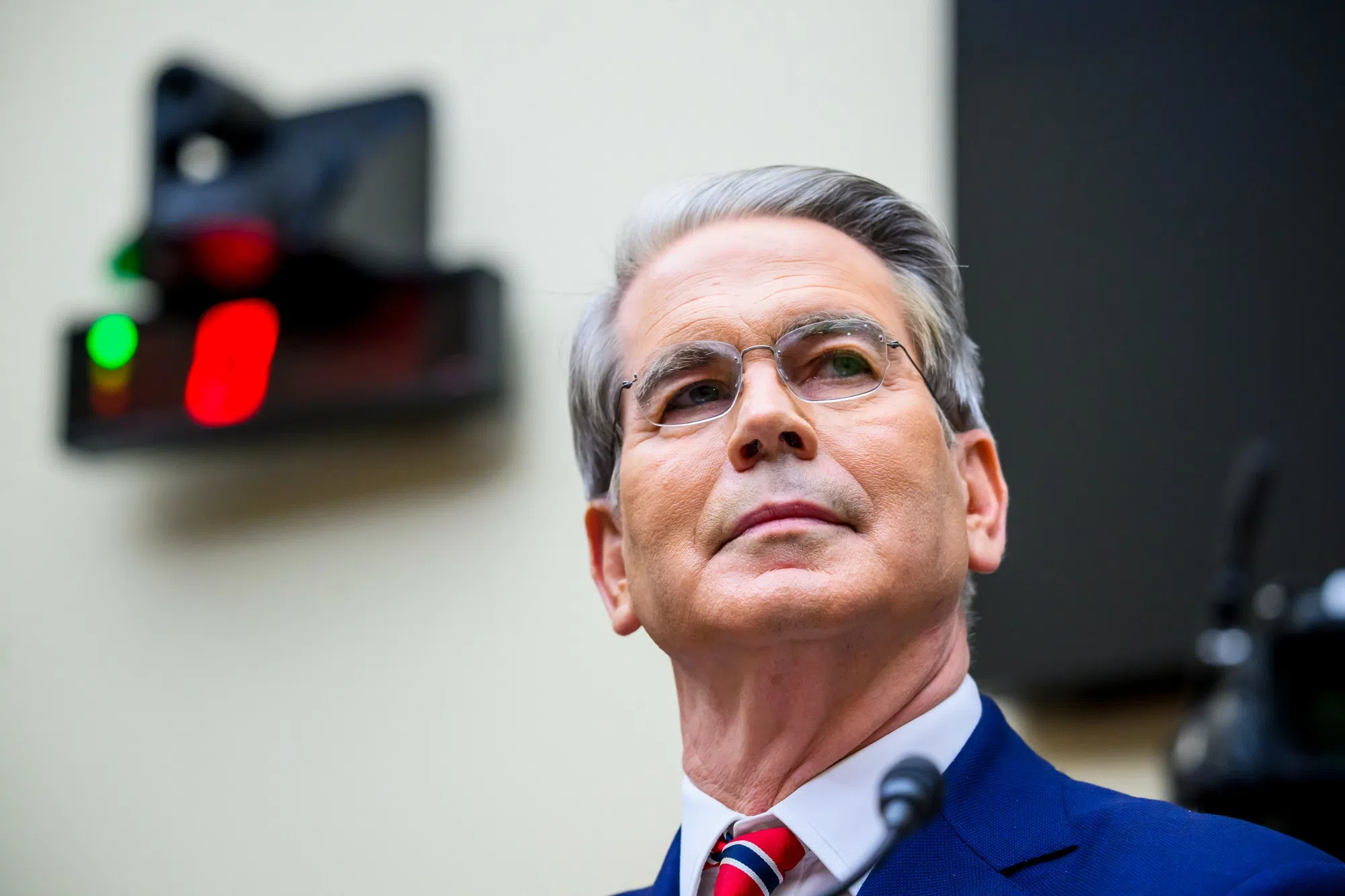

Bessent was answering questions at a House Financial Services Committee hearing. The topic of potential restrictions on American capital heading to China also came up in a separate House hearing Tuesday, when the Treasury chief advised that congressional legislation should leave flexibility in implementation, allowing the rules to be “durable”. He also said the issue is “nuanced”.

The Trump administration is already working on beefing up guidance on outbound investment established by the Biden administration.

“We are trying to ensure that the investment community is aware and familiar with the programme,” Bessent said on Wednesday. “We appreciate the interest from Congress. And while legislation will be important and helpful, we would like a bit more time” to inform any bill, he said.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

New tool

While the Committee on Foreign Investment in the US, or CFIUS, has long had the ability to investigate, and nix, foreign interests from acquiring American assets, in recent years there have been calls in Washington to restrict outbound flows for some purposes.

“It is a new national security tool that we restrict the PRC from exploiting the benefits” of American money, Bessent said.

The Treasury secretary was also asked about proposed legislation to put conditions on allowing China’s yuan to make up a larger weight of the basket of currencies used to set the value of the International Monetary Fund’s so-called Special Drawing Rights. The fund in 2015 approved the yuan to join that basket, offering it newfound status as a global reserve currency.

“I look forward to working with Congress on this issue on whether additional legislation is needed to address the Chinese practices – or whether it could be done through trade negotiations,” Bessent said. BLOOMBERG