sankai

Dear Partners,

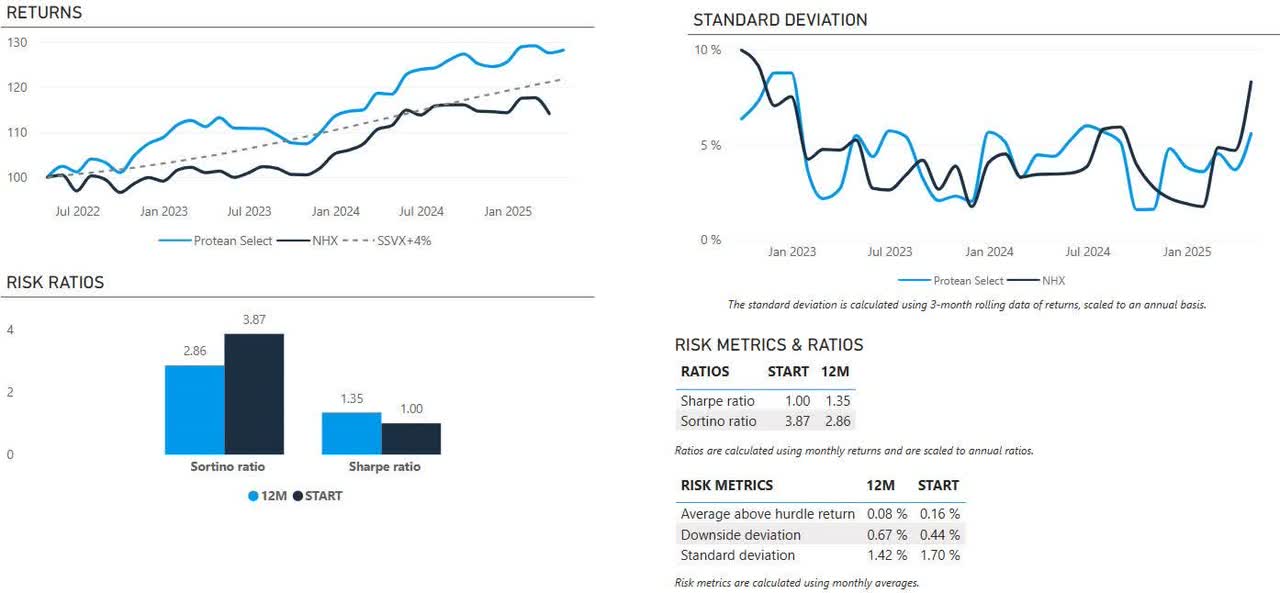

Happy birthday to Protean Select, turning three years old! We now have a 3-year track record. It is not without satisfaction we conclude that a 28.2% return with <6% volatility, yielding an 8.6% CAGR, has beaten the market handsomely with less than a third of the risk.

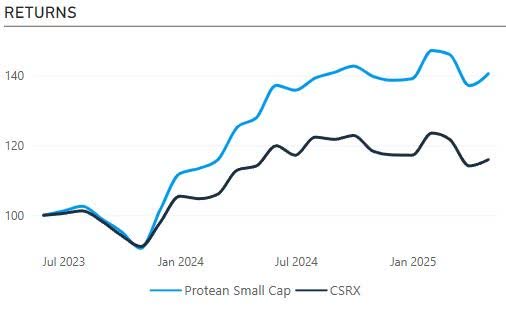

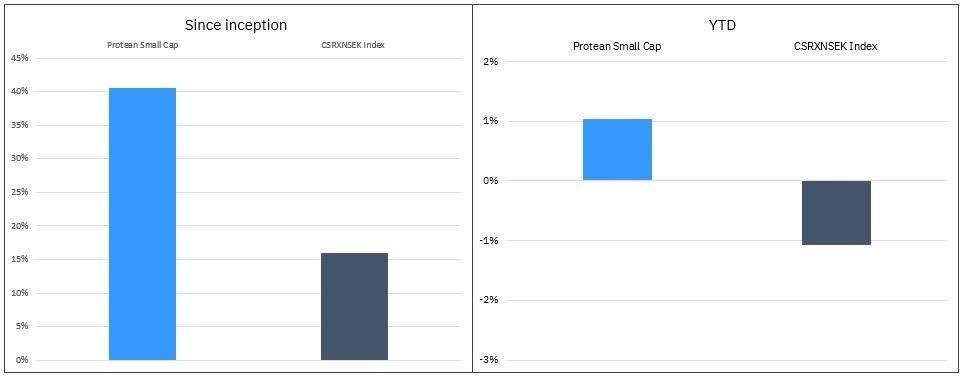

Protean Small Cap returned 2.5%, outperforming its index by 0.9%. Since launching in June 2023, it has gained 40.5%, which is 24.6% ahead of the Carnegie Nordic Small Cap Index.

The hedge fund Protean Select returned 0.5% in April, staying true to its objective of generating reasonable returns and avoiding large drawdowns. Year to date, the return is 2.1%.

Protean Aktiesparfond Norden, our new fund that combines the low fees of passive funds with the active fund’s chance of beating the market, ended up doing what it is supposed to do: returning 2.3% in its first month, 3.4%-points ahead of the index (VINX Nordic Cap SEK).

This month’s letter elaborates on how we acted during an eventful month and managed to end up ahead, how we think about the first three years as hedge fund managers and how we structure both our business and portfolio. And, as always, a handful of stock observations and commentary.

Thank you for being an investor!

// Team Protean

Protean Small Cap

– Car’s update for April

Protean Small Cap returned +2.5% in April. That is 0.9%-points ahead of the CSXRN (SEK) benchmark index for the month. This puts the fund 24.6% points ahead of our index (CSRXN SEK) since inception, and performance since start is slightly north of 40%. The fund now manages ca. SEK540m. Thank you for your trust.

April came to be a volatile month. Being a monthly traded fund means that we only update performance infrequently, but the fund fell as much as 9% intra-month before recovering sharply. We used the volatility to add to our stronger ideas, and the portfolio is somewhat more concentrated to our top ten positions than usual.

The fund benefited from its holdings in ITAB Shop Concept, Asmodee, Biotage (OTCPK:BITGF), Coor and Embracer (OTCPK:THQQF) while names such as Getinge (OTCPK:GNGBF), Lindex, Acast (OTCPK:ACASF) and Balco were notable detractors.

ITAB Shop Concept performed well during April, mainly helped by the release of pro forma 2024 numbers for the combined group following the large HMY acquisition. This demonstrated that the development of HMY had been better during 2024 than expected. A decent Q1 report also helped to derisk the case. While the overall direction (north) of the combined group’s margin trajectory remains clear, ITAB’s short-term margin levels are dependent on the mix within the group. Encouragingly, they secured a new order for their high margin gate solutions in the quarter.

Asmodee, the tabletop gaming spin-off from Embracer, was a strong performer for us. It has come to be one of our larger positions as we also added to the stake during the month. Sales momentum should be strong during the Jan-March quarter, as several of its distributed card games are performing well. We consider Asmodee to be an attractive combination of underlying organic growth, M&A possibilities as well as an undemanding valuation. As the shareholder list matures following the spin-off, we believe further performance could be expected.

A bid on Biotage helped us during the month, even though our investment in this Swedish med tech company didn’t bring what we had expected, and we end up with a loss. Biotage’s 2023 acquisition of Astrea became a bit of a disaster, as the earnings in Astrea collapsed after the deal was closed. Astrea also became a trojan horse for KKR, which sold it to Biotage, got paid in shares, and now acquires Biotage.

Apparently, Getinge was one of our main detractors during April. We struggle a bit to understand why when we recollect the month. Sure, there’s a worry about tariffs but nothing that sets it apart from the sector as such. The Q1 earnings met expectations, although whispering might have been higher given the negative share price development during the day. In any case, we continue to see good risk/reward in Getinge. A more sensible M&A strategy along the lines of ‘buy quality and cry once’ is starting to work in their favor.

Some of the other losers during the month are – unfortunately – more easily explained. The Nordic fashion retailer Lindex had one of their worst quarters in recent history. Logistics was said to be the main culprit according to management and given that Lindex is moving to a new warehouse we can sympathize with that. The share remains attractively valued, and earnings momentum is likely to be regained during H2.

We sold our final stake in RaySearch (OTCPK:RSLBF) during the month. It has been a very strong performer for us since inception, gaining almost 270% since we added it in the 70s during June 2023. Valuation has changed, and recent FX developments will hold back the underlying earnings improvement in the coming quarters.

A new position is Ratos (OTCPK:RTOBF). This Swedish holding company is loved by few, which we can understand. It has struggled over the last couple of years, with a lack of clear strategic direction. A couple of blow-ups in the portfolio have stolen all the attention, which means that the positive development in holdings such as HL Display has gone unnoticed.

Protean Small Cap vs Index since inception

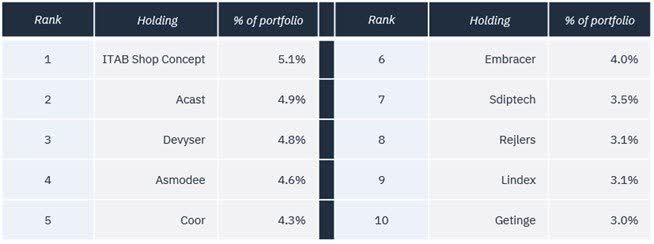

The ten largest positions in Protean Small Cap as we enter May:

Protean Select

– Pontus’ update for April

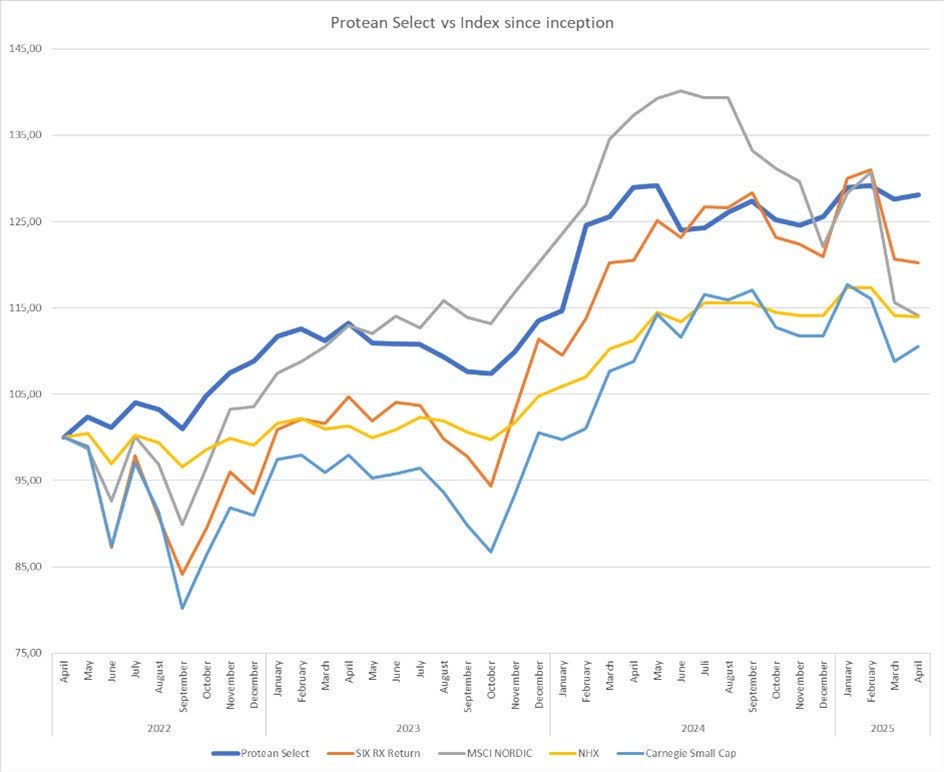

*We illustrate our performance by showing a comparison with the NHX Equities index. This is an index constructed from the performance of 54 Nordic hedge funds focusing on equity strategies. NHX is published after our Partner Letter, so updates with one-month lag in the chart above. We aim to have positive returns regardless of the market, but no return is created in a vacuum, and a net-long strategy will correlate. Our hurdle rate is 6.3275% annualized (4% + 90-day Swedish T-bills). All figures are net of fees and ratios in the above charts are calculated using monthly returns.

April summary

Protean Select returned 0.5% in April, leaving the fund up 2.1% year to date. Suffice to say that markets experienced above-average volatility during the month. A testament is the endless supply of breathless commentary from strategists in my inbox, on how this was the “biggest intra-month draw-down and recovery in history”.

We celebrate our third anniversary this month-end. Since its inception in May 2022, the fund has generated a return of 28.2%, with 6% volatility. That equates to a 3-year compounded average growth (CAGR) of 8.6%.

Top contributors in April were Kojamo (OTCPK:KOJAF), Biotage and ITAB. Notable detractors were Nordea (OTCQX:NRDBY), EQT and Getinge.

We exit April with 32% beta-adjusted net long exposure and 113% gross exposure (adjusted for cash and cash equivalents). Note, however, we have a combined position of 8% in Fortnox (OTCPK:FNOXF) and Biotage, both under bid, and therefore, they do not correlate with the general market. This means an adjusted net exposure is more in the vicinity of 24%, than the reported 32% above. The portfolio remains diversified, with no single position >5% of assets.

That was fun, let’s not do it again

At one point, the MSCI Nordic Index, made up of the largest and most liquid companies in the region, was down 13%. Yet it closed the month “only” 2.3% down.

Net exposure averaged 21% for the month but varied a lot. At market lows, it was only 4% (in fact, the beta-adjusted net was -4% at that point).

In hindsight, it’s easy to say, “Shouldn’t you have had the highest net exposure when markets were down 13%?” Yes, but that’s not how we operate. We are not trying to be heroes when markets are flirting with the left tails.

Just like the Fed, we have a dual mandate:

1. Generate acceptable returns.

2. Protect capital.

There is still a real and non-zero chance the status of the USD gets called into question, and with it several fundamentals of the financial world order. The tariff shenanigans from the US Administration could yet have a substantial and sustained negative impact on global growth and trade dynamics. This is not reflected in current asset prices in my view.

The consequence of the two above variables, in addition to a geopolitical landscape that is close to incomprehensible, is that we are unwilling to take a gamble that “Of course Trump will blink, and markets will come roaring back.”

How we acted during April

We were already cautiously positioned going into the month (following a very murky March, remember), short many US-exposed cyclical companies, long domestic value like Axfood (OTCPK:AXFOF), Kojamo, Intea and Financials. We were also well hedged via baskets and futures. To cover some of the upside risk, we implemented a call-spread on the OMX index. It has the benefit of being a structure with a pre-defined cost (approximately 20bps of the fund’s capital) but being a position that grows if markets start trending upwards.

A feature of macro- and flow driven markets is all stocks are treated similarly, almost regardless of the company’s fundamental exposures. This can be exploited by a fundamentally oriented and risk-averse investor. A part of our strategy is to own several small and mid-caps for a long period of time. We think of them as our potential multi-baggers, and this bucket in the fund has generated the bulk of our performance over the past three years. During April, we not only held on to these positions but added to them at attractive levels. Examples include Devyser, Acast, Asmodee, ITAB and Truecaller (OTCPK:TRUBF).

This is a prime example of exactly what we are trying to achieve: protect the portfolio from big drawdowns, while keeping the upside optionality from long-term and fundamentally driven long positions intact.

You can also do some nimble trading in the turbulence: we bought a block of discount retailer Rusta at SEK 62.3 (yes, below all the closing prices for the month). On April 30, Rusta closed at SEK 78 (we have since sold the position).

Some of the dumb stuff

Naturally, we did some silly things as well. No month is complete without at least a few facepalms. When the US 10-y interest rate was on a tear and fears were that the whole US debt structure could spiral out of control, which would trigger systemic financial risk, we trimmed longs in the Nordic banks and instead added short positions. This proved to be exactly the wrong thing to do, and at exactly the wrong time. We adjusted the positions towards the end of the month and ended up net making money on our long position in Nordea but losing money in banks on aggregate due to the very costly shorts.

We also covered our long-held short in white goods manufacturer Electrolux (OTCPK:ELUXY), thinking they would possibly be a net beneficiary of the tariffs, since cheap Asian imports have been causing price pressure and taking share for a long time. The quarterly results for Elux are a black box, however, and this ill-timed cover meant we missed out on the 20% drop. They may still see a net positive effect from tariffs, alas, just not in Q1.

Reacting to change

When Trump announced the 90-day delay to the “reciprocal” tariffs, we covered the bulk of our US exposed single-stock shorts (Assa being but one example) and trimmed some of the big relative winners (like Axfood). Towards the end of the month, the index call-spread started contributing, as did some of our bargain purchases in small- and midcaps.

Here is an (unaudited) visual representation of how the April day-by-day performance played out, contrasted with the MSCI Nordic Index, for reference:

Does what it says on the package

The illustration above shows how we believe and hope our fund will behave. We manage to participate only marginally on the downside, and adapt to capture some of the upside, ending up in a better place to continue compounding our capital.

Printing a positive return for the month where most indices are down is always pleasing, but it won’t always be the case. We’ll have our share of terrible months, too.

Outlook

We’re skeptical to the recent bounce. The tariff impact is yet to be felt in the real world. Just because the policy pendulum has swung in a non-stupid direction in the past two weeks, what’s to say it won’t swing back? This is not an environment in which to swing for the fences, and we remain only cautiously optimistic.

Protean Aktiesparfond Norden

– Richard Bråse

Aktiesparfonden is a Nordic long-only fund aiming to generate above-market returns over the long term by active investing in value-creating companies and charging a low fee. A fee that is reduced further as the fund grows, sharing the scale advantages with investors.

Aktiesparfonden returned 2.3% in its inaugural month. It beat its benchmark, VINX Nordic Cap, by 3.4% points.

Our communication for Aktiesparfonden is in currently only in Swedish, and a longer update can be found at www.aktiesparfonden.se by clicking the headline “Anslagstavla”.

The fund now manages >400m SEK.

Thank you for your long-term perspective and trust in our process.

Richard

Third Anniversary

When we started Protean Funds, we promised each other and our investors that “unless we have generated a competitive risk-adjusted return after three years, we will close down and do something useful instead”.

It’s been a wild three years. The Ukraine war, rampant inflation, and the collapse of the COVID growth stock bubble of 2022. The bid for Swedish Match. The higher-for-longer scare and escalating tensions in the Middle East of 2023. The 2025 tariff chaos, and just the general nonsense of the second Trump administration. The +170% rise of Novo Nordisk to become the biggest company in Europe, followed by its 60%+ fall. Etc.

How do we stack up?

Let’s have a look at index-level returns since our launch on May 2nd 2022.

The large-cap MSCI Nordic index has returned 14% over three years, a CAGR of

only 4.5%. The Carnegie Nordic Small Cap Index has returned 11% for the period, generating a meager 3.4% CAGR. The broad and dividends re-invested Swedish SIX RX Index has returned 20%, for a decent CAGR of 6.3%. The NHX Index, probably the most relevant index, since it’s all Nordic equity-focused hedge funds, is up 14%, yielding a CAGR of 4.5%.

Compared, our Protean Select has done well. It returned 28.2% net of fees. That’s a CAGR of 8.6%.

While the fund doesn’t compare itself to an index, this outcome is an argument for why a hedge fund can defend a place in a portfolio: it seems possible to receive an above-market return, but with less than a third of the volatility. At least for this specific three-year-period. What the next three years look like nobody knows. We will for sure underperform the market in a massive rally, but limited drawdowns in down or volatile markets allow for more powerful long-term compounding.

Quality of returns

The construction of both our business and Protean Select’s portfolio reflects our learnings from observing how hedge funds fail.

1. A diversified portfolio. Only in the rarest of circumstances has a position been >5% of the portfolio (SWMA is a notable exception). Concentration can lead to spectacular results when you are right, but to ruin if (when) you are wrong. Since arrogance and overconfidence are required personality traits for anyone looking to run a hedge fund and thinking they can beat the market, concentration risk is a real risk, and we have seen many examples. It is particularly painful on the short side, as a rising short becomes a bigger and bigger problem (a long position that goes down becomes a smaller and smaller problem all by itself – unless you keep adding to it!). There are funds out there where some trades bear the hallmarks of a “Heads I win, tails I move back in with my parents”-risk profile. I love my mother, but at 46, I’d rather run a diversified book!

2. A modest gross exposure. Over the three years, it has averaged around 125%. This can be thought of as leverage, and a higher gross leads to bigger swings in returns, both on the upside and downside. In fairness, we probably should have been running a higher gross exposure. But truth be told, for a new fund, staying in the game and not blowing up is more important than optimizing 100% for performance. It is possible the next three years will see a slightly higher gross exposure, now that we are starting to get the hang of it and have hopefully built some credibility.

3. No existential blow-ups. This is partly a result of the diversification, but also of the attention we pay to liquidity. It is appealing to build substantial stakes in high-conviction micro-caps. But getting out when realizing things are turning south is far more difficult and liquidity compounds the problem. Of course, we have had stocks spectacularly go against us, but thanks to risk controls and careful sizing, the impact has never been close to existential.

4. The fee model is competitive. The traditional 2/20-model is antiquated. With interest rates above zero (market neutral) hedge funds are capturing 3-4% return just from cash holdings. If you charge a 1%+ fixed fee, and then 20% on any positive absolute return on top of that, you just need to raise as much money as possible and try not to have negative returns, to make a killing on fees.

We charge an 1.2% fixed fee (plus transaction costs, which are above average since we are very active), and a performance fee only if we beat a) our highest ever NAV and b) our hurdle. The hurdle is 4% plus the 3-month government interest rate (currently 2.2%), and it accumulates on top of the high-water mark. This is a tough hurdle for a diversified, low-gross, low-net fund to beat. In fact, in the past 1.5 years we have only charged a performance fee one month (and it was 0.09%), despite posting acceptable returns. This is as it should be. We should only get a performance fee for outstanding results, not acceptable ones.

More funds should have an accumulating cash hurdle above the risk-free rate. It is fair.

What’s ahead for Protean Select?

Predictions are hard. Particularly about the future. But three years is the magic number to achieve for that elusive financial industry Holy Grail called Track Record. We now have a 3-year one. And a decent one at that. Of the Nordic long-short funds we internally track and compare ourselves with, only one has a marginally better return for the past three years, but generated with more than twice our standard deviation, and several multiples of our net exposure.

If one is allowed to dream, we will be able to attract enough investors willing to partner with us for the long term in our quest for reasonable returns with reasonable risk, to be able to close the fund at 200m USD.

We stick to our guns that small is beautiful – our belief that it’s easier to generate returns via active management with a smaller fund than a large one.

The Protean Select strategy currently manages approximately 80m USD in the commingled fund, which means there is still room for new investors.

Hopefully, we deserve some attention in the coming three years. But make no mistakes: returns come first on the list; asset growth last.

If we don’t get a single new investor, we will still be happy. Because we’re allowed to do what we love. Every day.

Argue about stocks. Be wrong. Be right. Survive. Paint our picture of the world expressed through a portfolio. Hopefully generate ok returns.

Come what may.

The monthly reminder

We optimize for performance, not for convenience, size, or marketing.

You can withdraw money only quarterly (monthly in Small Cap).

We tell you very little about our holdings.

Our strategy is tricky to describe as we aim to be versatile.

A hedge fund can lose money even if markets are up.

We charge a performance fee if we do well.

You do not get a discount if you have a larger sum to invest.

We do not have a long track record.

Aktiesparfonden’s reminder

We aim to generate above index returns over 3-5 years, but there are no guarantees.

The fund is daily traded, but that doesn’t mean you should.

To beat the index, you need to deviate from the index. This means taking uncomfortable positions.

Be aware that the fund can underperform the index during periods. Sometimes, long periods.

We lower the fee as the fund grows. The first 10 basis point cut comes at 10bn SEK in AuM.

Thank you for being an investor.

Pontus Dackmo

CEO & Investment Manager

Protean Funds Scandinavia AB

DISCLAIMER: Investments in a fund can both increase and decrease in value. You are not guaranteed preservation of invested capital.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.