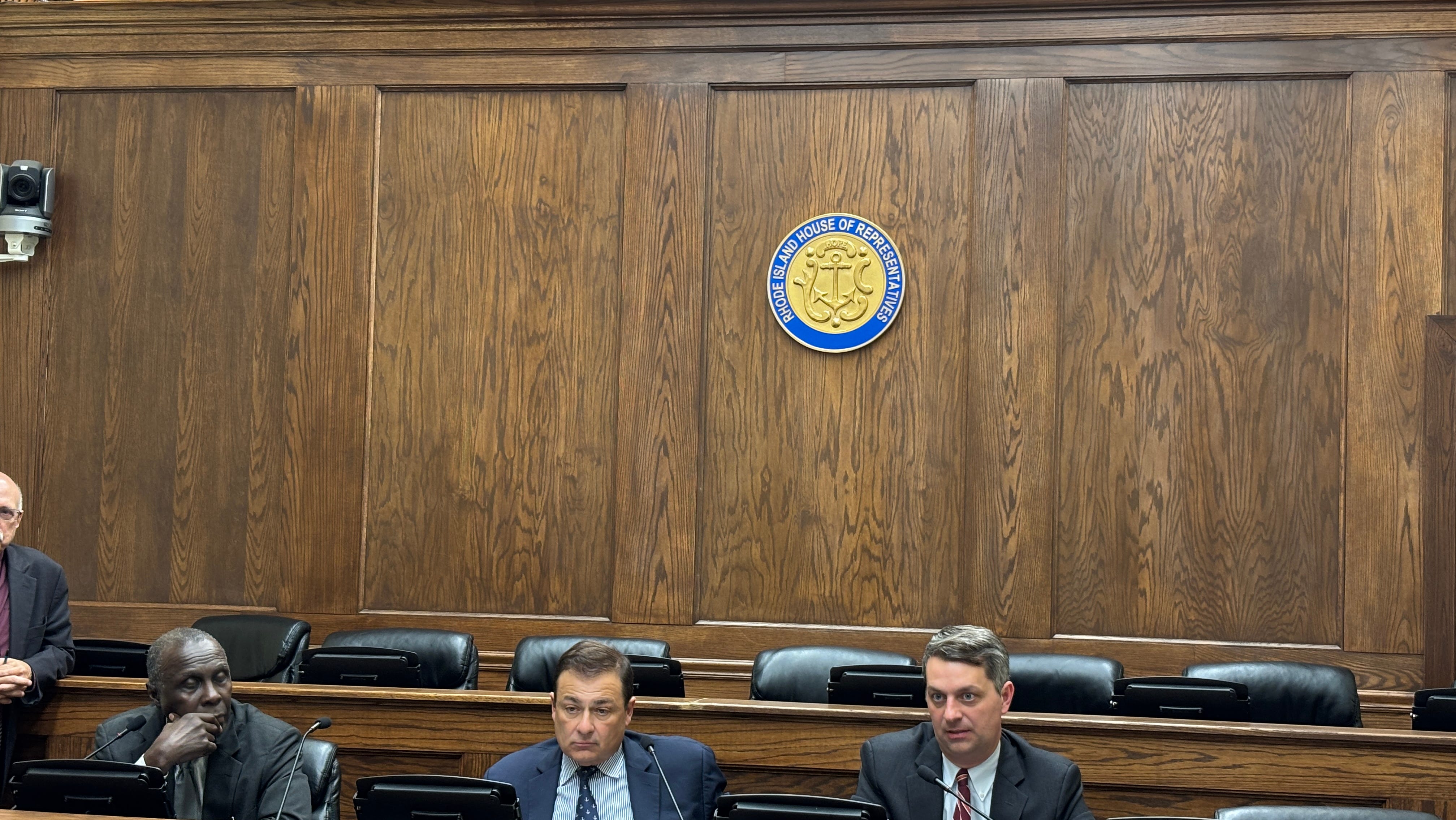

House Speaker Shekarchi describes priorities in new $14.3B RI budget

House Speaker K. Joseph Shekarchi describes the priorities in new $14.3B state budget

- Rhode Island House Democrats proposed a $14.3 billion budget that increases health care funding without raising income taxes on the wealthy.

- The budget includes a tax on second homes valued over $1 million and a 3-cent-per-gallon hike in the gas tax to send more money to RIPTA.

- The proposal rejects some of Gov. Dan McKee’s suggestions, such as a digital advertising tax, but adopts others, such as new fees on electric vehicles and short-term rentals.

- Funding increases are allocated for education, services for unhoused Rhode Islanders, and the construction of a new Washington Bridge.

PROVIDENCE – Rhode Island House Democrats have unveiled a new $14.3 billion state budget that seeks to bolster the finances of primary care doctors, hospitals and nursing homes without raising income taxes on the wealthy.

The proposed tax and spending plan for the year starting July 1 would raise Medicaid reimbursement rates to inject, including federal dollars, $45 million into primary care, $38 million into hospitals and $12 million into nursing homes. Funding for primary care practices would come in part from a new health insurance fee estimated to generate $30 million per year.

Although it spares the well-heeled an income tax hike, the House budget resurrects a tax proposed a decade ago on second homes worth more than $1 million, branded the “Taylor Swift tax” after the Watch Hill vacation home of the famous pop star.

The budget would inject $15 million into the Rhode Island Public Transit Authority, the same amount of money lawmakers added to the statewide bus system a year ago but less than half of the $33 million the agency says it needs to plug a budget hole and avoid service cuts.

The extra RIPTA funding will come from a 3-cent-per-gallon hike in the gas tax slated to go into effect July 1 and tweaks to the formula that distributes transportation funds. A 1-cent-per-gallon increase in the gas tax is already set to go into effect in July.

How does the House budget differ from the governor’s spending plan?

The budget, a rewrite of the $14.2 billion tax and spending plan Gov. Dan McKee proposed in January, was quickly passed on an 11-3 vote by the House Finance Committee on June 10, setting it up for a vote before the full House on June 17.

“All our colleagues have heard, the Senate has heard and we decided that we needed to take action now,” House Speaker K. Joseph Shekarchi told reporters about the money for primary care. “We’ve heard that our reimbursement rates are low, and that’s the primary cause of the health care shortage. We wanted to address that immediately.”

Senate President Valarie Lawson in an email applauded budget investments in healthcare, RIPTA and child care, suggesting it won’t have much trouble passing that chamber.

As expected, the House abandoned several of McKee’s proposals, including a 50-cent hike in the cigarette tax, buying an office building from Citizens Bank in East Providence and a tax on digital advertising that the governor hoped would pull in $9.5 million next year and $23.5 million annually by 2030.

But the House budget agreed with the governor on other proposals, including a new fee on electric vehicles and charging the state’s 5% hotel tax to short-term rentals of whole homes on sites such as Airbnb.

Other budget highlights include:

- Truck tolls. The House accepted McKee’s plan to turn on the legal-again tolls on tractor trailers in the first half of 2026 and collect an estimated $10 million in state revenue.

- Washington Bridge: $22 million in state dollars to match federal funds to build a new westbound Washington Bridge.

- Education: The House proposal would spend $16.5 million more on education than McKee proposed and $59 million more than the current-year budget.

- Homelessness: An increase in the real estate conveyance tax on properties worth more than $800,000 and part of the hotel tax collections from whole-home rentals will go to services for unhoused Rhode Islanders.

- Airbnb: Extends the 5% state hotel tax to whole-house rentals, something lawmakers rejected last year but McKee’s budget expects will generate $4.7 million per year.

- DMV: A $1 hike in the Division of Motor Vehicles “technology fee” to $3.50 per transaction.

- Superman Building: The House budget included a provision, already passed as a standalone bill in the Senate, that would exempt the owner of the vacant Industrial Trust Tower in Providence from sales tax on construction materials while claiming a maximum in other state incentives.

- Parking: The state’s 7% sales tax would be charged to parking, generating $3.2 million per year.

- Nicotine pouches: The tax applied to the wholesale cost of tobacco products would be expanded to synthetic nicotine pouches such as Zyn, generating $12 million per year.

Millionaires tax

Longtime advocates of increasing taxes on Rhode Island’s highest-earning residents hoped the budget pressure facing the state this year would convince top lawmakers that the time was now right to do it. They proposed a 3% surcharge on income above $625,000, which was estimated to generate $190 million in annual revenue.

And as lawmakers waited for the final details of the budget to be hammered out on June 10, the Working Families Party camped outside the State House with a box truck showing illuminated messages of support for a tax hike, such as, “Save Rhode Island. Tax the Rich.”

But Shekarchi told reporters that lawmakers decided against a tax hike, at least until the state knows whether Congress is going to pass a tax cut bill that could slash Medicaid funding and shift more costs to states.

“We don’t know what’s going to happen in Washington,” Shekarchi said. “We don’t know what changes are going to be made in the federal tax code. We felt comfortable enough to do the non-owner-occupied taxes over a million dollars at this time, and we will revisit that issue when we have more clarity from Washington.”

But Working Families Political Director Zack Mezera said what’s happening is more reason to tax make the “1% pay their fair share,” not an excuse.

“Today’s budget shows that state leadership would rather raise gas taxes for working families than increase taxes on millionaires,” Mezera wrote in a news release. “As President Trump and his allies advance destructive cuts that could cause over 240,000 Rhode Islanders to lose Medicaid and hundreds of educators and care workers to lose their jobs, we need bold action to raise revenue now – otherwise working people and small businesses will be paying the price for years.”

RIPTA

With $15 million from the budget to fill a $33 million projected shortfall, it looks as though RIPTA is going to need to scale back what it does, but Shekarchi said it would not necessarily mean large layoffs or route cuts.

“I think they need to look at everything,” he said. “Maybe it’s smaller buses, maybe it’s addressing the ride schedule, maybe it’s a slight fare increase, maybe it’s looking at management positions. That’s why we mandated, when we gave them $15 million last year, they do an efficiency study and find out the solutions.”

Despite the prospect of having to make painful cuts this summer, RIPTA CEO Christopher Durand said the bus system is “grateful” for the additional permanent state revenue.

“The agency has long needed a consistent funding stream to allow us to better support getting Rhode Islanders to work, school and healthcare,” he said in an email. “The last time the agency saw a permanent change in its funding structure was over ten years ago; this is a needed improvement, which we are thankful for.”