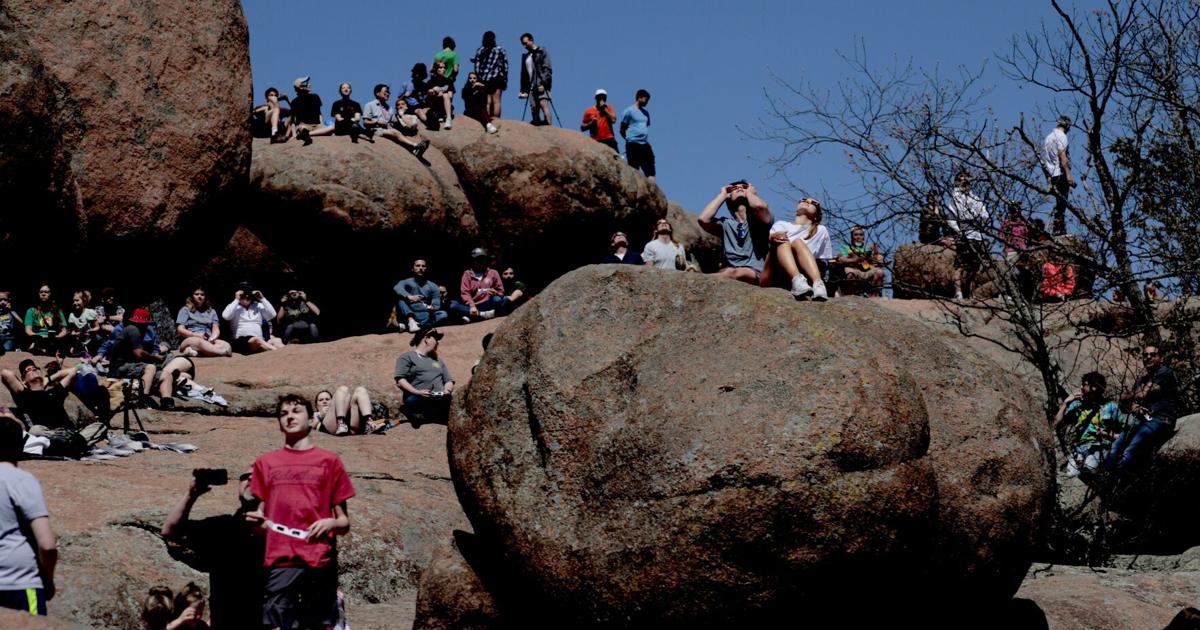

Crowd of people watch the solar eclipse on boulders on Monday, April 8, 2024, at Elephant Rocks State Park in Belleview, Missouri. With sunny skies, the enjoyed two minutes and 18 seconds of totality. Photo by Laurie Skrivan, lskrivan@post-dispatch.com

JEFFERSON CITY — A sales tax voters first approved over 40 years ago to fund Missouri state parks, as well as soil and water conservation efforts, has a high-profile supporter.

Gov. Mike Kehoe, a Republican, told the Post-Dispatch recently he favors renewal of the one-tenth-of-one-cent Parks, Soils and Water Sales Tax. A 10-year renewal of the tax will be on the ballot next year.

The tax generated roughly $136.7 million in fiscal 2024, according to state figures.

Half of the revenue generated from the sales tax goes to state parks while half is directed to soil and water conservation.

The sales tax money flowing to state parks, an average of $10 a year per Missourian, makes up about three-fourths of the park system budget, according to the agency.

“Gov. Kehoe supports the renewal of the Parks, Soils and Waters Sales Tax,” Gabrielle Picard, spokesperson for Kehoe, said in an email.

People are also reading…

Kehoe’s support for extending the parks, soils and water sales tax comes as he has advocated for rolling back the state income tax. He also is expected to sign legislation in the coming days doing away with the state capital gains tax.

Missouri state parks currently don’t charge admission fees.

But if voters choose not to renew the tax next year, that could increase pressure to charge admission.

“Governor Kehoe is proud that Missouri is one of just a few states to not charge for admission into our state parks,” Picard said.

Missouri State Parks attracted approximately 19.8 million visitors last year, down from about 20.3 million visitors the year before.

First approved in 1984, Missouri voters last renewed the Parks, Soils and Water sales tax in 2016, with nearly 80% of voters at the time favoring a 10-year extension.

Missouri’s overall state sales tax is 4.225%, which excludes local sales taxes.

The 4.225% rate generates revenue for several different funds: a 3% tax is dedicated to general revenue, with an additional 1% tax for education, a .125% tax for conservation, and the .1% tax for parks, soil and water.