eAlisa

Here’s the truth about ETFs: there’s one for everything and plenty of “me-too” funds that don’t really differentiate by much other than issuer. As an example, there are tons of small-cap growth ETFs out there, and passive ones all largely behave the same with similar holdings are price drivers. The iShares Morningstar Small-Cap Growth ETF (NYSEARCA:ISCG), a fund that specifically targets small-capitalization U.S. equities exhibiting growth characteristics, is one of those “me-too” funds that doesn’t really differentiate itself by very much.

ISCG was launched on June 28, 2004, by BlackRock Fund Advisors. Its primary objective is to track the investment results of an index composed of small-capitalization U.S. equities that exhibit growth characteristics. To achieve this, ISCG indexes the Morningstar US Small Cap Broad Growth Extended Index (USD), using a representative sampling technique.

ISCG offers exposure to small public U.S. companies that are projected to grow at an above-average rate compared to the market. Therefore, it provides targeted access to a specific category of small-cap domestic stocks. Investors can use ISCG to diversify a U.S. stock allocation and tilt their portfolio towards growth stocks.

ISCG has accumulated net assets of around $559 million, making it a medium-sized ETF within the Small Cap Growth segment of the U.S. equity market. The fund’s expense ratio stands at 0.06%, making it one of the most cost-effective products in the ETF space. Other than that, it’s not much different from other small-cap growth ETFs.

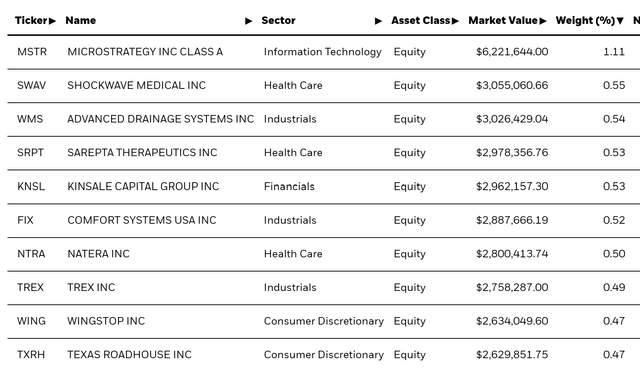

Top Holdings of ISCG

When investing in an ETF, it’s usually crucial to examine its top holdings as these stocks carry the most weight in the fund’s performance. When looking at ISCG, we see that no position holds more than 1.11% of the fund, meaning that the top 10 positions are not a significant driver of returns. Not uncommon to find in small-cap funds given the sheer number of companies in that market-cap range.

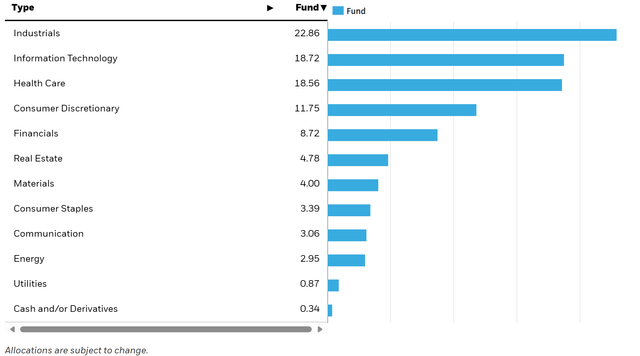

Sector Composition and Weightings

ISCG’s sector composition is diversified across various sectors. However, it leans heavily towards Industrials (22.86%), followed by Information Technology (18.72%), and Health Care (18.56%). Industrials have been quite strong in this run higher following Technology, so it makes sense to see this as a big component of the growth style.

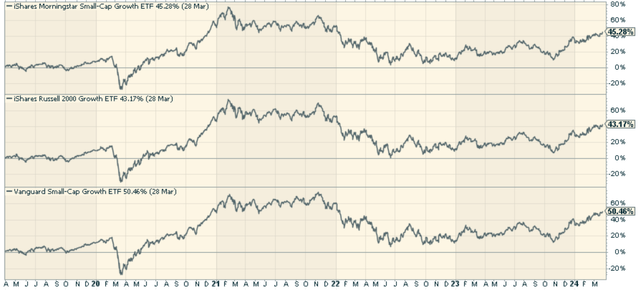

Peer Comparison

When choosing an ETF, it’s helpful to compare it with its peers in the same category. Two notable peers of ISCG are the iShares Russell 2000 Growth ETF (IWO) and the Vanguard Small-Cap Growth ETF (VBK). ISCG is smack in the middle performance wise of IWO and VBK. Much of this differential can be attributed to different sector allocations, but for the most part, the funds track similarly. VBK for example has Technology as its largest sector weight, not Industrials, which has given it an edge in this cycle.

Pros and Cons of Investing in ISCG

Investing in ISCG offers several advantages. First, it provides exposure to small public U.S. companies expected to grow at an above-average rate relative to the market. This can be particularly attractive during periods of economic expansion when small-cap stocks often outperform their large-cap counterparts.

Second, ISCG’s low expense ratio of 0.06% makes it a cost-effective choice for investors. This is a significant advantage as lower costs can translate into higher returns over the long term.

Third, ISCG offers a good level of diversification, with 1,000 individual holdings spread across various sectors. This can help to reduce company-specific risk.

However, investing in ISCG also carries certain risks. As it focuses on small-cap companies, it may be more volatile and potentially riskier than funds that invest in larger, more established companies. Also, because it targets growth stocks, it may be more sensitive to market fluctuations and economic downturns compared to value-oriented funds.

Should You Invest in ISCG?

Given the current economic climate and the potential for small-cap growth stocks to outperform in a booming economy, ISCG provides an attractive investment opportunity for investors looking to diversify their portfolio and tilt it towards growth stocks. My criticism isn’t around the fund – just that it’s another small-cap growth ETF that has no discernible edge. Any out or underperformance is more due to sector allocations and the cycle than anything else. If that doesn’t bother you, it’s a cheap way to get exposure.