Analysis: What makes Irish nursing homes so attractive to global investors and how have they achieved such rapid growth?

By Nicholas O’Neill, UCD

Investment funds have made a striking entry into Ireland’s nursing home sector, expanding at a remarkable pace. Today, just 10 investment funds hold one-third of all nursing home beds in the state — a dramatic shift from 2017 when their presence was virtually non-existent.

Their growing dominance raises two important questions: How have these financial players managed such rapid growth? And what makes Irish nursing homes so attractive to global investors?

The funds in question are private equity firms and real-estate investment trusts (known as REITs). Private equity raises capital to buy businesses, aiming to resell them for profit within a few years. REITs are financial landlords: they buy or finance buildings, collect rent, and pass returns on to shareholders. In short, private equity and REITs use nursing homes as an asset to extract wealth.

Privatisation

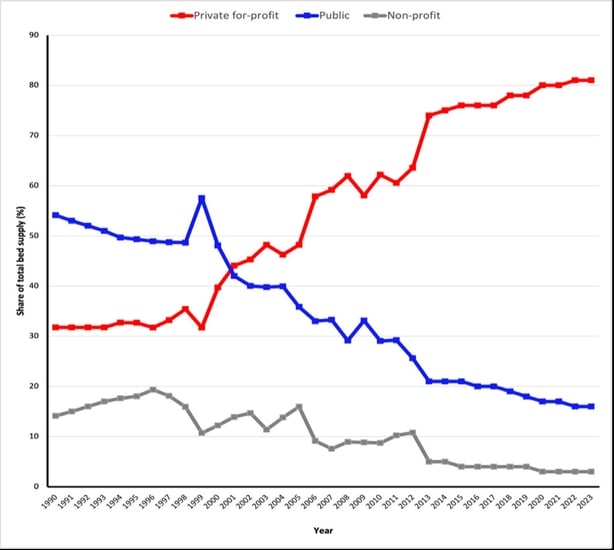

The Health Information and Quality Authority (HIQA) and the Economic and Social Research Institute (ESRI) have highlighted the shift towards a market model of care, dominated by private for-profit provision. Back in 1990, public nursing homes provided more than half of all beds in the country. By 2023, that share had plummeted to just 16%. Over the same period, private for-profit providers skyrocketed from 32% to a dominant 81% (see graph below).

This places Ireland alongside England as the most privatised nursing home systems in Europe — both with over 80% of beds privately provided. By contrast, even third-place Spain has under 50% in private hands. This dominance has created fertile ground for global investment funds. Without an established market already in place, there would have been little for them to invest in.

A financial strategy for growth

Once investment funds enter a sector, they use specific financial strategies to grow fast. The most important is called the OpCo/PropCo model. It splits ownership into two parts: one company runs the service (the operating company, or OpCo), while another owns the building (the property company, or PropCo).

In the nursing home sector, this often means a private equity firm owns the operator, while a REIT owns the real estate. The operator pays rent to the property owner — and both return profits to investors.

We need your consent to load this rte-player contentWe use rte-player to manage extra content that can set cookies on your device and collect data about your activity. Please review their details and accept them to load the content.Manage Preferences

From RTÉ News, HIQA report highlights closure of many smaller, local nursing homes

Why are Irish nursing homes so attractive?

There are five main reasons investment funds are flocking to Ireland’s care sector:

First, Ireland’s ageing population ensures long-term demand. By 2051, the over-65 population is set to double to 1.6 million, with the over-80s (primary users of nursing homes) rising by 271%. Yet bed supply already lags behind. The HSE estimates an additional 10,000 beds will be needed by 2031.

Given government policy has long favoured private for-profit provision, investment funds assume most of this growing demand will be met by private operators. As the director of one such fund put it: “If the government aren’t going to deliver it, it creates the opportunity… The demographics isn’t going to change and government policies don’t change radically when you’ve got Fianna Fáil, Fine Gael in power since the dawn of time in our state. I’d say that’s probably what attracted them [investment funds], to be honest with you.” (Interview with author)

Second, a fragmented market. Ireland traditionally had a lot of small, independent care home operators. Investment funds see this as a chance to consolidate — buying up smaller providers to create large, more profitable chains.

Third, Ireland offers risk diversification. For global investors, Irish nursing homes are one piece of a broader strategy. A fund might also invest in hospitals, student housing or clinics across different countries — spreading risk across sectors and regions.

We need your consent to load this rte-player contentWe use rte-player to manage extra content that can set cookies on your device and collect data about your activity. Please review their details and accept them to load the content.Manage Preferences

From RTÉ News, Nursing Homes Ireland says 77 nursing homes have closed since 2018 due to rising operational costs

Fourth, government funding provides guaranteed income. Although privately run, nursing homes receive most of their income through the Fair Deal scheme. Between 2017 and 2022, the share of this public funding going to the ten largest providers (all owned by investment funds) nearly doubled — from 14% to 27% of overall government expenditure.

Fifth, regulation. At first glance, it might seem odd that profit-driven investors would favour regulation. HIQA ensures private homes meet basic standards, reducing the risk of scandals like France’s Orpea case, which caused major reputational and financial damage.

Why does any of this matter?

So what if nursing homes are owned by global investment funds instead of the state or a local family business? Well, research from multiple countries suggests that private for-profit ownership — especially by investment funds — often results in worse care outcomes than public or non-profit alternatives. Issues include precarious staffing conditions, cost cutting, and an emphasis on maintaining profit margins.

In Ireland, HIQA has warned that growing investment fund involvement and market consolidation pose major risks to the sector’s long-term sustainability. This raises deeper questions about how we value care. As Sally Rooney recently asked about the housing crisis: “How much of our housing stock should ideally be concentrated in the hands of private landlords”? The same applies here: How much of our care infrastructure should be owned by profit-driven investment funds?

Dr Nicholas O’Neill is a Postdoctoral Researcher at the Geary Institute for Public Policy at UCD. He is a former Research Ireland awardee.

Follow RTÉ Brainstorm on WhatsApp and Instagram for more stories and updates

The views expressed here are those of the author and do not represent or reflect the views of RTÉ