Synopsis

Earlier this month, the Securities and Exchange Board of India (Sebi) ordered the impounding of INR4,843 crore from US-based high-frequency trading firm Jane Street. The market regulator alleges that the firm manipulated index prices across 21 expiry sessions between August 2023 and May 2025, earning unlawful gains in the process. Over the years, Sebi has established a framework of Investor Protection and Education Funds (IPEFs) aimed at fulfilling this core mandate. These operate at multiple levels: within Sebi itself, through exchanges, and via depositories. At the exchange level, they are designed to compensate investors in case a trading member defaults and lacks sufficient assets to cover claims. Depositories are mandated to maintain similar protection funds. While these safety nets exist on paper, their ability to respond swiftly — especially in complex, large-scale manipulations involving foreign entities — remains untested.

Can victims of Jane Street scam be compensated by IPEFs? Sebi’s investor protection and education funds allow for restitution of ill-gotten gains to affected investors. However, in the case of the Jane Street index manipulation scandal, regulatory experts say compensation is far from guaranteed. With only an interim order in place, and multiple legal and procedural hurdles ahead, actual payouts may be a long and uncertain process. Did the likes

Uh-oh! This is an exclusive story available for selected readers only.

Worry not. You’re just a step away.

What’s Included with

![]() ETPrime Membership

ETPrime Membership

1Exclusive Insights That Matter

2Stay informed anytime, anywhere with ET ePaper

ePaper – Print View

Read the PDF version of ET newspaper. Download & access it offline anytime.

ePaper – Digital View

Read your daily newspaper in Digital View & get it delivered to your inbox everyday.

Wealth Edition

Manage your money efficiently with this weekly money management guide.

3Invest Wisely With Smart Market Tools & Investment Ideas

Investment Ideas

Grow your wealth with stock ideas & sectoral trends.

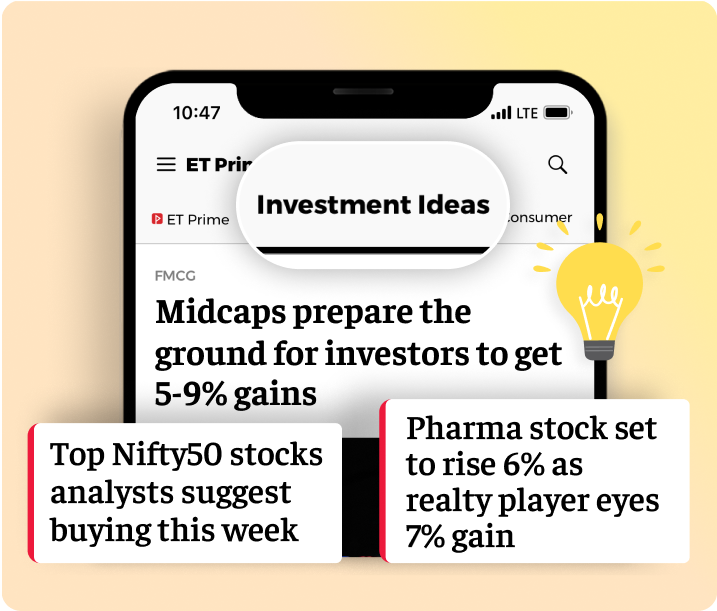

Stock Reports Plus

Buy low & sell high with access to Stock Score, Upside potential & more.

BigBull Porfolio

Get to know where the market bulls are investing to identify the right stocks.

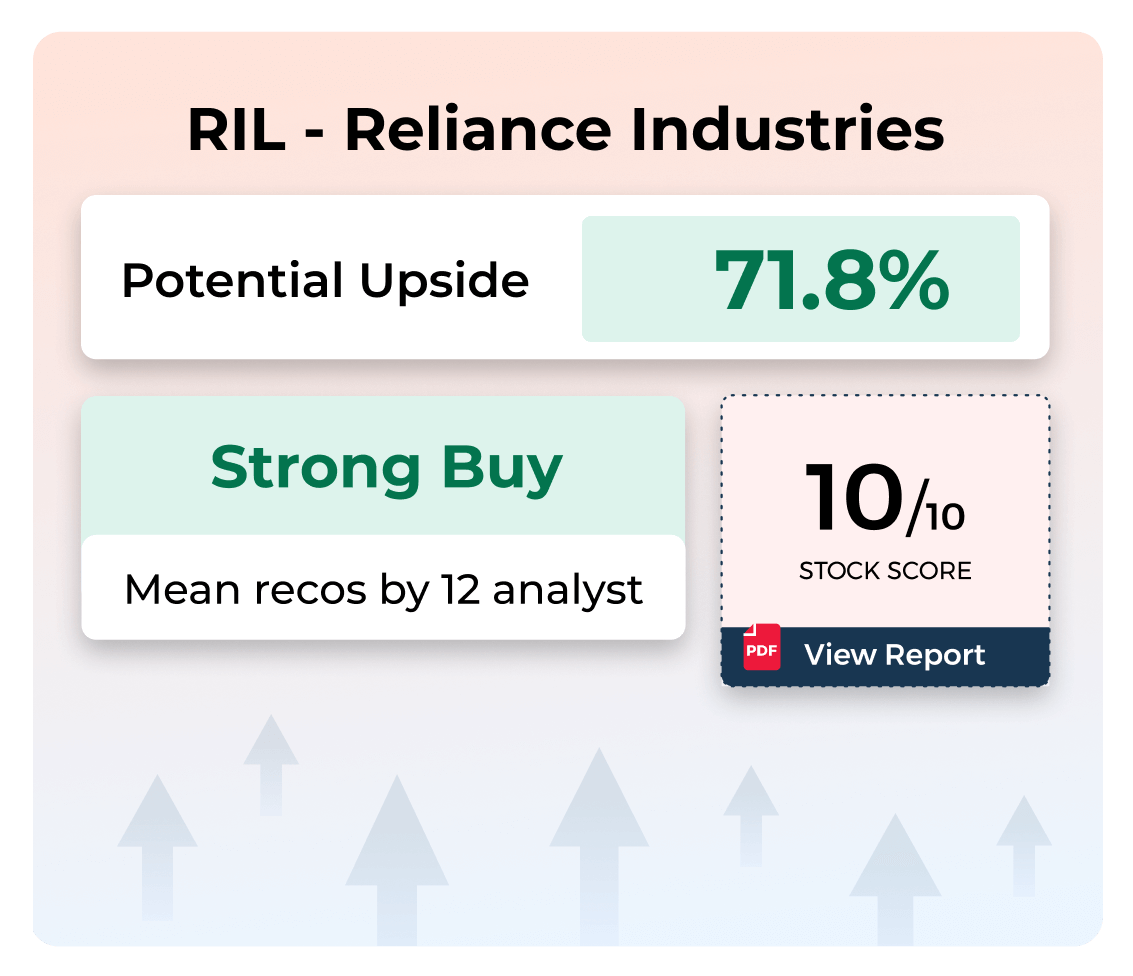

Stock Analyzer

Check the score based on the company’s fundamentals, solvency, growth, risk & ownership to decide the right stocks.

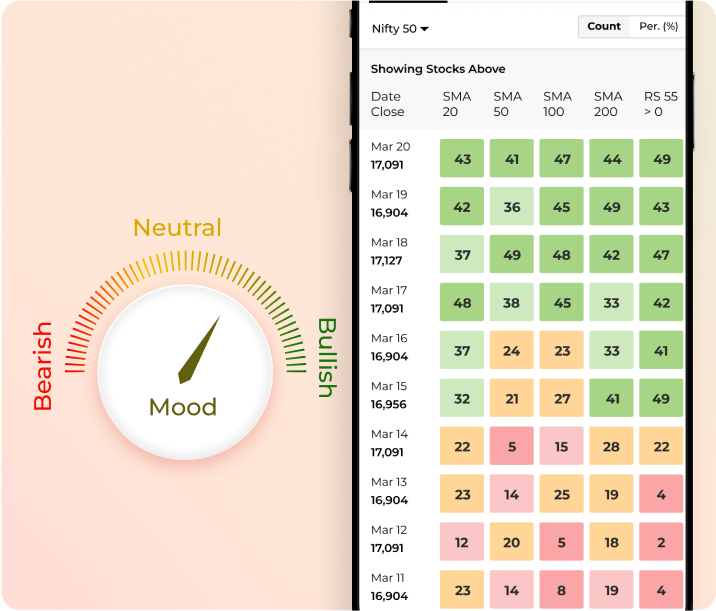

Market Mood

Analyze the market sentiments & identify the trend reversal for strategic decisions.

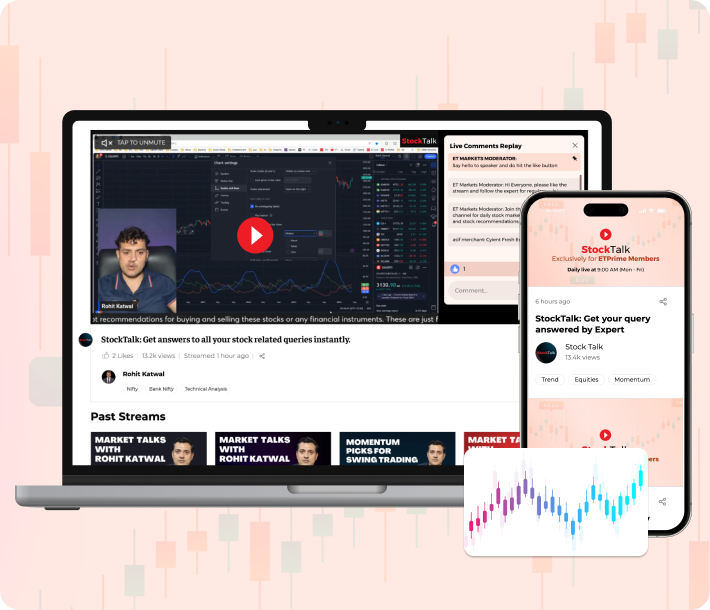

Stock Talk Live at 9 AM Daily

Ask your stock queries & get assured replies by ET appointed, SEBI registered experts.

4Times Of India Subscription (1 Year)

TOI ePaper

Read the PDF version of TOI newspaper. Download & access it offline anytime.

Deep Explainers

Explore the In-depth explanation of complex topics for everyday life decisions.

Health+ Stories

Get fitter with daily health insights committed to your well-being.

Personal Finance+ Stories

Manage your wealth better with in-depth insights & updates on finance.

New York Times Exclusives

Stay globally informed with exclusive story from New York Times.

5Enjoy Complimentary Subscriptions From Top Brands

TimesPrime Subscription

Access 20+ premium subscriptions like Spotify, Uber One & more.

Docubay Subscription

Stream new documentaries from all across the world every day.