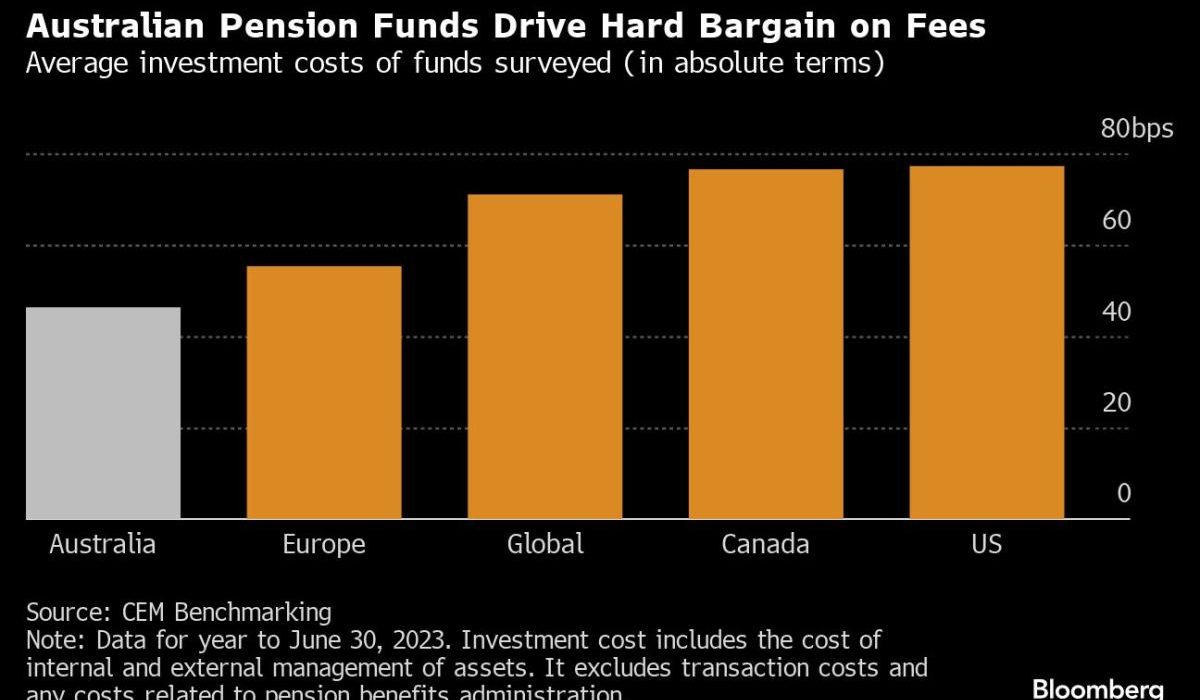

(Bloomberg) — Australia’s booming A$3.7 trillion ($2.5 trillion) pensions industry is proving a tough negotiator on asset management fees, as data reveals the funds often pay significantly less than others.

Most Read from Bloomberg

A survey of 11 pensions revealed they paid almost 12 basis points — or about a fifth — less than their global peers in investment costs in the year through June 2023, according to analysis firm CEM Benchmarking. That saved those funds a combined A$1.1 billion, as pensions come under increasing pressure to cut charges for their members in the country’s highly competitive market.

“They have become tough negotiators,” Mike Heale, CEM’s Toronto-based head of business development, said in an interview. “Some managers now are not very keen on being in Australia or quoting on Australian business because you know that there’s fee compression.”

The report surveyed a group of unnamed pensions with a median total assets under management of A$72 billion, and compared the cohort with global peers. It showed that Australian funds paid an average investment cost of 43.6 basis points, compared with 55.5 basis points by global funds, when accounting for scale and asset mix. The discount was far larger on an absolute basis.

The fee discount is widest when it comes to real assets. Australian funds are paying far lower fees than global peers for some real estate and infrastructure investments, according to the report. They’re also on average paying less across fixed income, private equity, private credit and hedge fund assets.

Even Larry Fink’s Favorite Pension Plan Has Retirees Worried

Asset managers are feeling the pinch as pensions increasingly take investment functions in-house, or opt for flat-fee structures for the funds they have farmed out to third-party managers. Australian firm First Sentier Investors last month said it would close investment funds with a total of A$14 billion and return the money to investors, citing a retreat from low-margin business.

At the same time, regulatory scrutiny of pension funds has ramped up as the industry rakes in record inflows from Australian workers of more than A$2 billion a week. The industry is now subject to an annual performance test designed to weed out poor performing funds and lower fees for members.

Still, Heale cautioned about pension funds squeezing costs too far, saying it could be problematic if the compression led to an exodus of active managers from the Australian market.

“This should not be a race to the bottom in terms of costs,” he said. “If lowest cost was the only thing that mattered, then everybody would invest passively at the lowest possible cost.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.