(Bloomberg) — European shares edged higher in thin trading after a European Central Bank official signaled policy makers could consider successive rate cuts starting next month. Futures on the Nasdaq 100 climbed 0.4% to a record high with US markets closed.

Most Read from Bloomberg

Carmakers and utilities led a modest advance in the Stoxx Europe 600 index. Turnover was less than half the 20-day average for the time of day, with UK and US markets closed for holidays. American equity futures advanced and a gauge of the dollar dipped.

The ECB shouldn’t rule out lowering borrowing costs at both its June and July meetings, Governing Council member Francois Villeroy de Galhau said, pushing back against fellow monetary officials who are uncomfortable at the idea of consecutive cuts. Chief Economist Philip Lane said earlier the central will have to keep policy restrictive through 2024, even after cutting interest rates next month.

An ECB rate cut in June has been widely telegraphed, but subsequent steps are less clear given uncertainty over wage growth and factors like the fighting in the Middle East. Data this week may show headline inflation in the euro region ticked up in May.

“European inflation is back,” though the May spike may be temporary, Credit Agricole SA strategists led by Jean-François Paren wrote in a note. “This does not call the June cut into question but adds risk of de-pricing additional cuts later.”

Among individual movers in Europe, EFG International AG rallied as much as 4.7% following a Bloomberg news report after the market close Friday that Julius Baer Group Ltd. is exploring a potential acquisition of its rival Swiss private bank. Julius Baer slipped 0.8%.

The MSCI Asia Pacific index posted its biggest gain since May 16, led by stock gauges in Hong Kong, China, and Japan.

A swath of inflation prints from Australia to Japan, the euro region and the US is due this week as traders finesse bets on the outlook for monetary policy. The Federal Reserve’s favorite measure of underlying inflation is due on Friday and is expected to show modest relief. Fed Chair Jerome Powell has stressed the need for more evidence that inflation is on a path to the 2% goal before easing policy.

John Williams, Lisa Cook, Neel Kashkari and Lorie Logan are among the US central bankers due to speak this week.

Read More: About the ‘T+1’ Rule Making US Stocks Settle in a Day: QuickTake

Trading of cash Treasuries was closed. The “T+1” rule that has the potential to cause trouble for overseas investors will come into effect when traders return from the long weekend — making US equities settle in one day rather than two.

Meanwhile, gold gained, while copper futures fell. Oil advanced after its biggest weekly loss in four, with the focus on an OPEC+ supply meeting on Sunday and US demand at the start of the summer driving season.

Some key events this week:

-

IMF holds discussions with Ukrainian authorities to review economic policies as the country seeks to unlock next tranche of $2.2 billion in aid, Monday

-

Cleveland Fed President Loretta Mester speaks at BOJ event in Tokyo; Minneapolis Fed President Neel Kashkari and ECB Governing Council member Klaas Knot address Barclays-CEPR International Monetary Policy forum, Tuesday

-

South African election, the most significant since the end of apartheid, Wednesday

-

Fed releases Beige Book economic survey, Wednesday

-

South Africa rate decision, US initial jobless claims, GDP, wholesale inventories, Thursday

-

New York Fed President John Williams speaks at the Economic Club of New York, Thursday

-

GDP data published for Canada, Eurozone, Turkey, Friday

-

Japan unemployment, Tokyo CPI, industrial production, retail sales, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.2% to the highest since May 21 as of 1:11 p.m. New York time

-

Nasdaq 100 futures rose 0.4% to a record high

-

Futures on the Dow Jones Industrial Average rose 0.2%

-

The MSCI World Index rose 0.2% to the highest since May 21

-

The MSCI Asia Pacific Index rose 1%,

-

The MSCI Emerging Markets Index rose 0.7%

-

The Stoxx Europe 600 rose 0.3%

-

Ibovespa Brasil Sao Paulo Stock Exchange Index rose 0.1%

-

S&P/BMV IPC fell 0.4%, falling for the sixth straight day, the longest losing streak since Jan. 4

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1% to the lowest since May 21

-

The euro rose 0.1% to $1.0858

-

The British pound rose 0.3% to the highest since March 20

-

The Japanese yen was little changed at 156.91 per dollar

-

The Mexican peso rose 0.2% to 16.6591

-

The Brazilian real was unchanged at 5.1684 per dollar

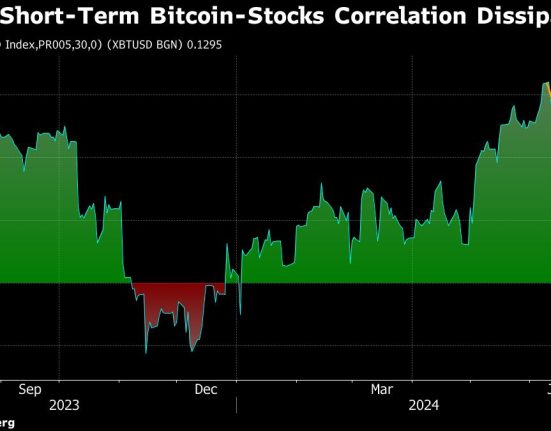

Cryptocurrencies

-

Bitcoin rose 2.3% to $70,259.35

-

Ether rose 2.1% to the highest since March 13

Bonds

-

The yield on 10-year Treasuries declined one basis point to 4.46%

-

Germany’s 10-year yield declined four basis points to 2.55%

-

Britain’s 10-year yield was little changed at 4.26%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Matthew Burgess, Catherine Bosley and Michael Msika.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.