(Bloomberg) — European stocks fell and bond yields rose after the latest price data from the UK cast doubt on hopes that prices pressures have been vanquished.

Most Read from Bloomberg

The pan-European Stoxx 600 gauge slipped 0.4% and Britain’s FTSE 100 shed 0.3% after data showed UK inflation slowed less than expected last month, raising questions about when the Bank of England can start cutting interest rates. The pound strengthened and gilts plunged, sending the two-year yield about 12 basis points higher.

Bond yields across Europe rose, while US Treasury borrowing costs also ticked up.

The figures reinforced concerns that inflation pressures globally remain sticky, preventing central banks from easing policy as early as currently anticipated. Earlier on Wednesday, the Reserve Bank of New Zealand kept interest rates unchanged and signaled policy will stay tight for longer, while Federal Reserve Governor Christopher Waller said on Tuesday he needs to see several more good inflation numbers to begin interest-rate cuts.

“Both the RBNZ and the UK inflation data highlight the fraught nature of the current juncture, with investors struggling to gauge both the timing and extent of long-awaited central bank easing cycles,” Rabobank’s head of rates strategy, Richard McGuire, said in a note.

US equity futures were little changed after the S&P 500 hit yet another record high Tuesday, with artificial intelligence bellwether Nvidia Corp. due to report its results after market close. It’s projected to report a 243% gain in revenue, according to Wall Street estimates, but a 90% year-to-date share rally means it could struggle to match sky-high expectations.

Among individual movers in premarket trading, Lululemon Athletica Inc. dropped as much as 4% after announcing organizational changes, while Tesla Inc. slid after disclosing European sales fell to a 15-month low in April.

In Europe, shares in Anglo American Plc weakened. as investors waited to see if rival BHP Group Ltd. would launch its takeover bid to create a global copper behemoth. BHP has a deadline of 5 p.m. London time to announce a firm intention to make an offer. Among other prominent stock movers, Marks & Spencer Group Plc jumped to the highest since November 2018 after issuing better-than-expected results and a robust outlook.

Energy stocks lost ground as Brent crude futures dropped for the third straight day.

Gold, silver and copper also eased after hitting record highs, though the recent price surge for metals and grains has renewed inflation fears, with Bloomberg’s spot commodity index holding near a 16-month peak.

Traders have dialed down expectatons for Fed interest rate cuts this year, currently seeing around 40 basis points of rate cuts in 2024, versus the 50 basis-point reduction priced last week. Minutes of the last Fed policy meeting, due later Wednesday, could offer further clues on rate-setters’ thinking.

Key events this week:

-

US existing home sales, Wednesday

-

Fed minutes, Wednesday

-

Nvidia earnings, Wednesday

-

Eurozone S&P Global services and manufacturing PMIs, consumer confidence, Thursday

-

G-7 finance meeting, May 23-25

-

US new home sales, initial jobless claims, Thursday

-

Fed’s Raphael Bostic speaks, Thursday

-

US durable goods, consumer sentiment, Friday

-

Fed’s Christopher Waller speaks, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 fell 0.4% as of 10:18 a.m. London time

-

S&P 500 futures fell 0.1%

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average were little changed

-

The MSCI Asia Pacific Index fell 0.2%

-

The MSCI Emerging Markets Index rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0844

-

The Japanese yen fell 0.2% to 156.48 per dollar

-

The offshore yuan was little changed at 7.2486 per dollar

-

The British pound rose 0.1% to $1.2722

Cryptocurrencies

-

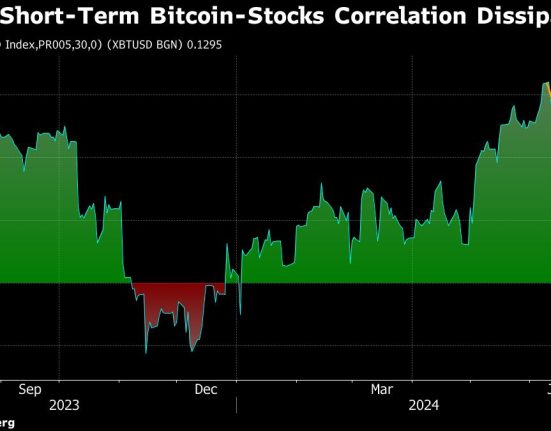

Bitcoin rose 0.4% to $69,968.91

-

Ether was little changed at $3,748.2

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 4.44%

-

Germany’s 10-year yield advanced three basis points to 2.53%

-

Britain’s 10-year yield advanced nine basis points to 4.22%

Commodities

-

Brent crude fell 1.3% to $81.77 a barrel

-

Spot gold fell 0.2% to $2,416.91 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.