Tobacco companies used to be among the darlings of the stock market. With growing cash flows each and every year, they made long-term shareholders a lot of money. But that has changed in recent years.

Over the last 10 years, British American Tobacco (NYSE: BTI) — one of the largest tobacco/nicotine companies in the world — has produced a total return of negative 6%, while the S&P 500 is up 231%. This includes the robust dividend payments it distributes to shareholders every quarter.

Today, its dividend yield has risen to just under 10%. With technology stocks pushing to new all-time highs, this forgotten tobacco giant looks increasingly undervalued. Is British American Tobacco an income investor’s dream right now?

The smokeable business is declining, but cash flows are strong

British American Tobacco owns some of the longest-standing global cigarette brands. These include Dunhill, Newport, and Camel. While these brands have maintained market share within the cigarette sector for decades, the overall rate of smoking is declining around the globe, which is affecting shipment volumes. To counteract the impact of those volume declines on its financials, British American Tobacco has consistently raised the prices on packs of cigarettes.

You can see the results of that strategy in the company’s consolidated financials. British American Tobacco’s revenue is actually up 5.7% over the last five years, despite the declining use of cigarettes worldwide. Over the next five years, the company expects to generate over $50 billion in free cash flow. For a company with a market cap of just $68 billion, this shows the potential discounted valuation British American Tobacco trades at right now.

But these price hikes can’t drive cash flow forever, right? Eventually, most people are going to stop smoking cigarettes. That’s where its new technology products come in.

Growth can come from new nicotine products

Almost everyone is aware of the health harms caused by cigarette smoking. So is the executive team at British American Tobacco. That is why they have been working to build and buy other nicotine products to replace cigarettes among the adult population. These include nicotine pouches, e-vapor, and heat-not-burn cigarette devices. These products may have fewer harmful health effects compared to cigarettes.

Shareholders should benefit, too. The company’s “new categories” segment grew revenue by 21% on an organic constant currency basis in 2023 and should hit $5 billion in annual revenue soon. Of course, since this is a global company, this may be affected by foreign currency exchange rates. This segment finally reached profitability last year, driving a positive contribution profit for British American Tobacco for the first time ever.

Over the next 10 years and beyond, these new products could drive volume growth for the company and hopefully make up for the eventual profit declines that will arrive in the cigarette business.

Is the dividend sustainable?

Volume growth from new products is great. But income investors care about one thing above all else: dividend payments. At today’s share prices, British American Tobacco has a dividend yield approaching 10%. This makes it one of the highest-yielding stocks in the world, which may make some investors skeptical about the payout’s sustainability.

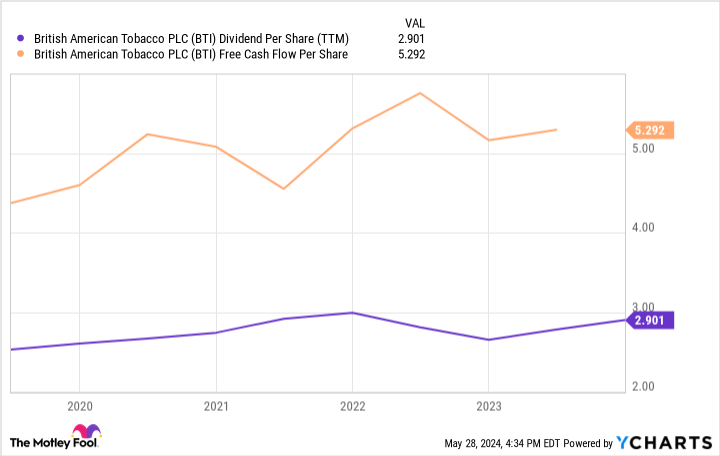

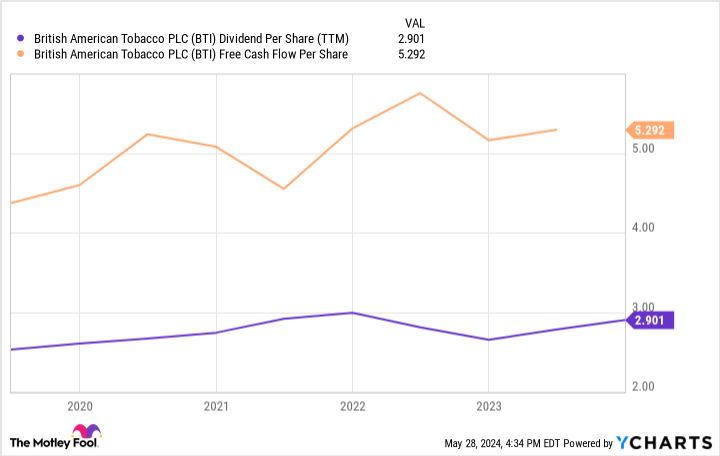

When you look at the numbers, it is clear that British American Tobacco actually has plenty of room to maintain its dividend payments at their current level, and will likely be able to grow them in the coming years. Its free cash flow — which is what companies deploy to cover their dividends — was $5.30 per share over the last 12 months. Its dividend is currently just $2.90 per share.

Even if the cigarette business does worse than expected over the next few years, British American Tobacco has plenty of room to maintain its current dividend payout, so income investors can rest easy owning this cash-generating nicotine giant.

Should you invest $1,000 in British American Tobacco right now?

Before you buy stock in British American Tobacco, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and British American Tobacco wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

Forget Buying a Rental Property: Passive Investors Should Buy This Spectacular Dividend Stock Yielding Close to 10% Instead was originally published by The Motley Fool