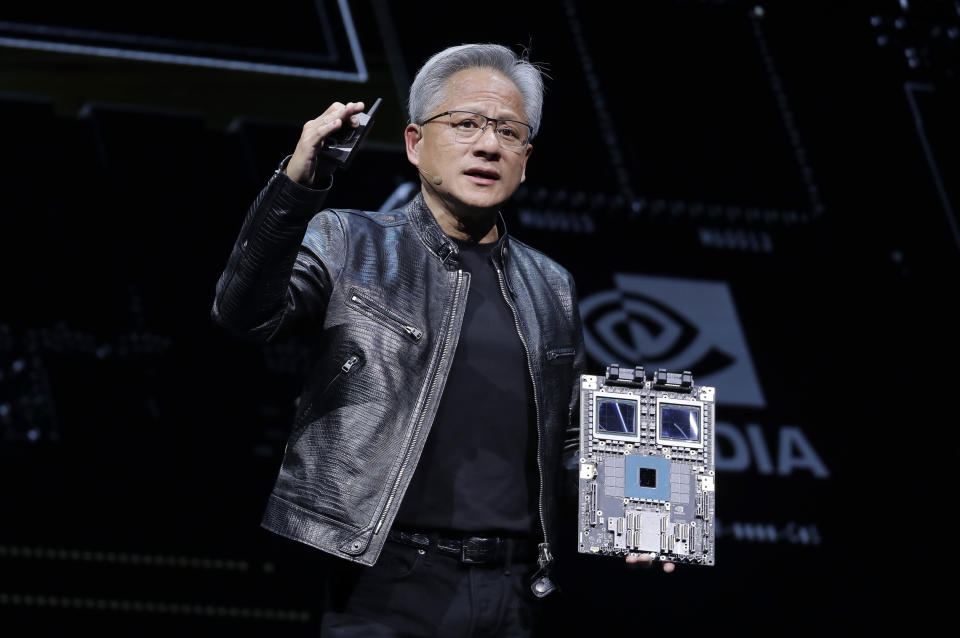

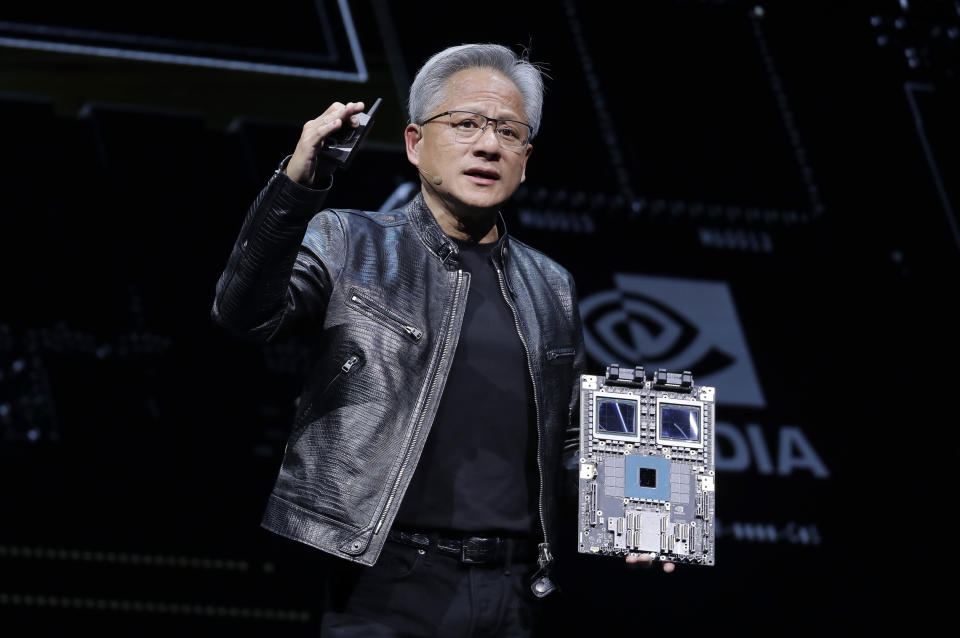

Nvidia stock (NVDA) popped more than 5% on Tuesday, reversing a three-day slide that erased roughly $430 billion of the AI chip giant’s market cap.

Shares had declined nearly 13% since Thursday as investors rotated out of the stock, which hit a record-high close exactly one week ago when it briefly surpassed Microsoft (MSFT) as the most valuable company in the world.

The chip heavyweight gave back that title as the three-day sell-off commenced.

“I think it’s way overblown. I don’t think people should be nervous about what’s happening with Nvidia,” Kenny Polcari, managing partner at Kace Capital Advisors, told Yahoo Finance on Tuesday.

“I would use this weakness as an opportunity,” he added, noting the timing of the decline.

“We’re at the end of the quarter, so it’s a quarter-marking period. You’ve got a lot of big assets that are trying to reshuffle and rebalance,” he said.

Polcari added he wouldn’t be surprised if the stock slid “another 5% or 8%.”

On Tuesday, Nvidia’s market cap climbed back to hover around the $3 trillion level, though it was still below the valuations of Microsoft or Apple (AAPL).

Nvidia has played a pivotal role in buoying the S&P 500 (^GSPC) and the Nasdaq (^IXIC) to repeated record highs in 2024.

The Santa Clara, Calif.-based company completed a 10-for-1 stock split on June 10.

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on X at @ines_ferre.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance