STOCKBRIDGE, Ga. (Atlanta News First) – Properly teaching financial literacy often means starting young.

“Different world these days with the internet,” said Ryan Behrens to a group of elementary school students inside a back room at the Stockbridge branch of Delta Community Credit Union.

He’s spent the past couple of weeks teaching kids across metro Atlanta for DCCU’s Cool Cash Money Camp.

“Saving is just setting aside money now, so we can use it in the future,” he explained, walking kids through the math of saving for future goals and expenditures.

While most people would not associate finance with 8-to-10-year-olds, the kids here are eager to learn.

Harmony Latour wants to save up for her mom’s birthday gift.

“Her birthday is this weekend, so I want to get her a birthday gift before she goes out of town,” Latour said.

Others wanted to save for something more extravagant.

“I would like to save my money for a trip to go to Paris,” said Margerie Lebron, who already has the European excursion in her sights.

“Right now, I have $2,059,” she said, explaining she’s about two-thirds of the way to her goal. She’d like to find a way to get there faster.

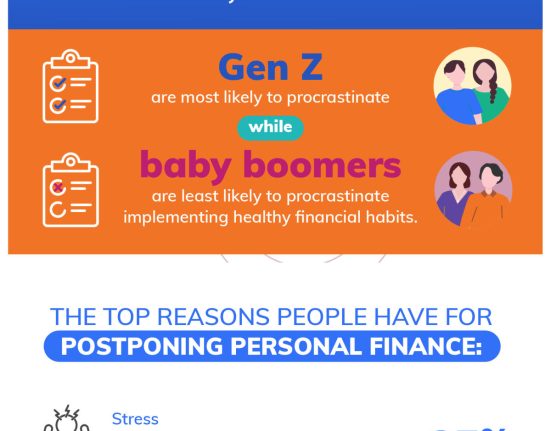

The numbers paint a bleak picture of American finances and show why programs like these at DCCU are needed.

“It’s important for them to understand what it means to make important financial decisions,” said Jai Rogers, DCCU’s vice president of business & community development.

The Financial Educators Council estimates that the average American loses $1,506 per year to financial illiteracy, which includes credit card fees, overspending and overdrafting bank accounts. It’s also estimated that close to 40% of Americans don’t fully understand how these things can hurt their credit scores and long-term financial goals.

“This is what we do all year long,” Rogers added.

The class is only a couple of hours long, but when the kids leave, they’ll have a better grasp of their financial future, even if they haven’t chosen a future just yet.

“I want to be a lot of things, but I don’t know which one to pick,” Amariah Jordan said.

Copyright 2024 WANF. All rights reserved.