The Supreme Court heard the case in April, and the ruling is expected to be delivered later this afternoon

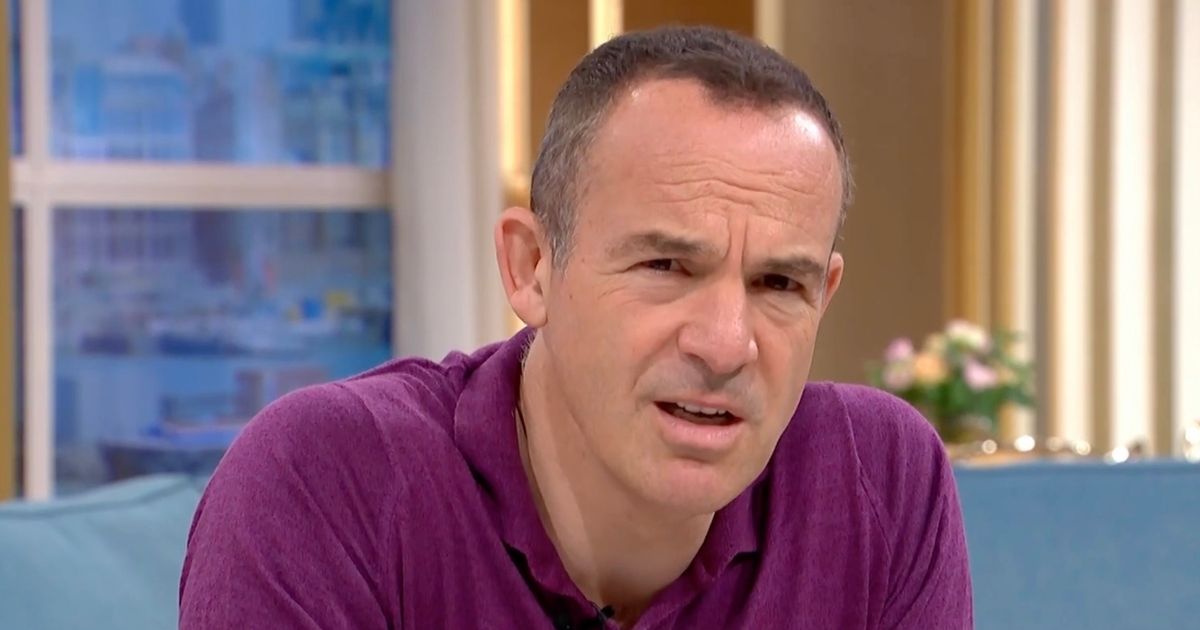

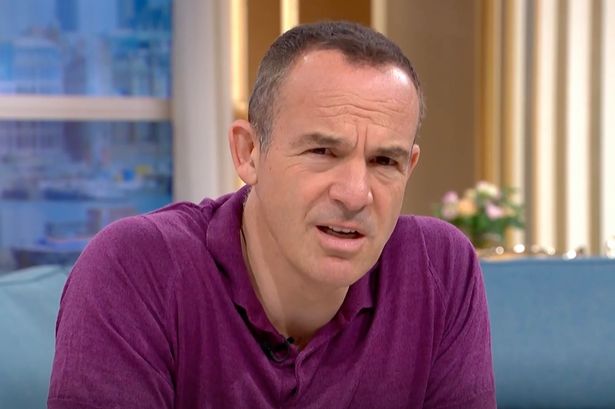

Martin Lewis has shared three possible outcomes for the Supreme Court’s judgement around hidden car finance commission claims.

Their ruling is expected around 4pm today and could pave the way for millions of motorists to claim compensation for motor finance mis-selling.

The Supreme Court heard the case in April, after car finance firms Close Brothers and Motonovo appealed against the Court of Appeal’s surprise ruling, made in October 2024, that all car finance agreements with hidden commission were unlawful.

Read more: Martin Lewis’ MSE ‘top’ 6% interest savings account with cashback on bills

In October, the Court of Appeal ruled that motor finance firms broke the law by not telling borrowers about broker commission terms. This decision could lead to £44 billion in compensation for millions of people.

Speaking to the BBC, Martin said: “So in summary, on Friday, one of three things is likely to happen. First, the Supreme Court upholds the Court of Appeal ruling on commission disclosure arrangements.

“To be honest, that shakes everything up in the air, there may be political intervention, we don’t know when. If not many people with car finance, virtually all of them will be due a payout but we don’t know the scale.

“Second option, the Supreme Court rejects the Court of Appeal ruling in part or in full, in which case discretionary commission arrangement cases will still go ahead via the regulator as they were planned to.

“They could even launch a system where people don’t have to apply to get their money back if they were mis-sold. It might just tell firms they have to pay out automatically.

“The third one is the Supreme Court comes out with something novel and we just haven’t even prepared for that one. That’s my unknown unknown.”

A Treasury spokesperson said they want a fair decision that gives consumers proper compensation for their losses.

They added: “We want to see a balanced judgment that delivers compensation proportionate to losses that consumers have suffered and allows the motor finance sector to continue supporting millions of motorists to own vehicles.

“It is now appropriate to let the appeals process run its course.”

Andy Agathangelou, founder of consumer advocacy group Transparency Task Force said: “This is at least the second time the Chancellor of the Exchequer has hoped to intervene, or should I say interfere, with the judicial process surrounding the car finance scandal.

“It’s not a good look for her, because she seems happy to in effect take money out of the pockets of innocent, harmed consumers, and put it in the pockets of banks and car finance companies that have broken the law.”