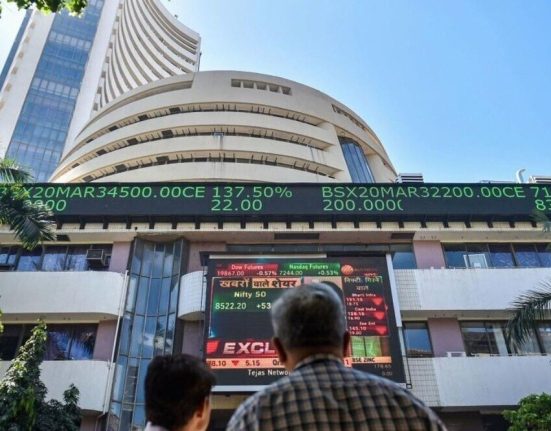

Indian benchmark indices settled sharply lower on Thursday, amid weekly F&O expiry, bucking the positive global cues. headline indices shrugged off the optimism of India-UK free trade deal. BSE Sensex tanked 542.47 points, or 0.66 per cent, to settle at 82,184.17, while NSE’s Nifty50 plunged 157.80 points, or 0.63 per cent, to close at 25,062.10 for the day.

Select buzzing stocks including Exide Industries, L&T Finance and Jindal Steel & Power likely to remain under the spotlight of traders for the session today. Here is what Vishnu Kant Upadhyay, AVP of Research & Advisory at Master Capital Services has to say about these stocks ahead of Friday’s trading session:

Jindal Steel & Power | Buy | Target Price: Rs 1,070-1,090 | Stop Loss: Rs 953

Jindal Steel & Power has registered a breakout from a multi-month consolidation, surpassing the psychological Rs 1,000 mark with a bullish wide-range candle supported by strong volumes, indicating accumulation. The price structure reflects a rounding bottom formation. It is trading well above the 20, 50, 100, and 200 day EMAs, showcasing solid trend alignment. RSI is trending near 68, reinforcing bullish momentum, while MACD has turned positive with a fresh crossover above the signal line. The stock is displaying strong relative strength compared to Nifty, signalling leadership and potential for further upside.

Exide Industries | Buy | Target Price: Rs 430-450 | Stop Loss: Rs 370

Share prices of Exide have moved above the key falling trendline resistance on the daily chart and exhibiting a constructive setup with the formation of higher highs and higher lows, indicating a developing uptrend. The stock is sustaining above the 20, 50, and 100 day EMAs, reflecting strengthening trend structure. Volume activity shows signs of accumulation with spikes on positive sessions. RSI is gradually rising above 55, while MACD is nearing a bullish crossover, suggesting improving momentum.

L&T Finance | Buy | Target Price: Rs 228-235 | Stop Loss: Rs 198

L&T Finance has resumed its uptrend after a successful retest of the breakout above its all time high at Rs 200, reaffirming bullish strength. The price action remains constructive, marked by higher highs and higher lows. The stock is well supported by all key moving averages 20, 50, 100, and 200 day EMAs, aligned positively. The breakout was backed by a volume surge, signalling strong buying interest. RSI is holding firmly above 65, and MACD maintains a bullish crossover, indicating sustained momentum and reinforcing the continuation of the upward trend.

Disclaimer: Business Today provides stock market news for informational purposes only and should not be construed as investment advice. Readers are encouraged to consult with a qualified financial advisor before making any investment decisions.